Who can take early retirement

When considering the possibility of granting the right to early retirement benefits to employees of labor treatment dispensaries, it should be borne in mind that these dispensaries do not belong to institutions executing criminal penalties, since they provide labor treatment to persons who are not convicted. Therefore, the right to early assignment of an old-age labor pension in accordance with subparagraph. 17 they don't have.1.

All workers permanently and directly engaged in work with convicts (regardless of the name of the profession).

Decor

First of all, you will need to prepare a whole package of documents:

- Civil ID or any other document to confirm your identity.

- Documents that serve as evidence for work in specific enterprises or positions. They often use work books, or various types of employment agreements and contracts.

- Information regarding average monthly earnings until 2002. Some use statements from their personal account at the Pension Fund. Or a certificate is requested from employers.

- Confirmation of non-insurance periods. This is time that is equal to the insurance period, but is not included in it.

- Additional documents with information on education, disabled family members, and so on.

Most often, the payer’s personal account with the Pension Fund already contains all the necessary information. A complete set of documentation is required only if the pensioner does not agree with the information and expresses the intention to supplement it independently.

You can use several methods to transfer documents:

- Personal Account on the Pension Fund website. Here the application is filled out electronically. But you still have to go to the department to hand over the originals.

- MFC. A convenient solution from a territorial point of view; employees will always advise you on paperwork and any errors present. The disadvantage is that it may take longer.

- With the participation of a trusted person. A relevant option if a citizen is often undergoing treatment or on business trips abroad.

The pension fund is given approximately 10 days to review all papers. If there are missing papers, the pensioner is given three months to correct existing deficiencies. Submission date – the day on which the last document was submitted.

From the date of acceptance of the application, payments will be assigned.

The Pension Fund can accept applications as early as a month before a citizen reaches the appropriate age. But it is recommended to start the application process earlier. Indeed, some supporting certificates may require more time.

Important! In the PFR Personal Account you can always see whether information regarding the pension itself and work activity is displayed correctly.

Official website of the authorities of the Moscow Region - Selenginsky district

According to subparagraph 17, paragraph 1, article 27 of the Federal Law “On Labor Pensions in the Russian Federation of December 17, 2001 No. 173, the right to early labor pension is provided for workers, managers and employees of institutions executing criminal penalties in the form of imprisonment, the right to early labor pension is established old-age pension, which is assigned to men upon reaching 55, and women upon reaching 50, if they have been employed in work with convicts for at least 15 and 10 years, respectively, and have an insurance period of at least 25 and 20 years, respectively.

However, employees of these organizations and institutions do not enjoy the right to early assignment of a labor pension, since they are not employees of institutions that execute criminal penalties.

The right to early assignment of an old-age labor pension according to the List approved by Decree of the Government of the Russian Federation of February 3, 1994 N 85, is enjoyed by workers and employees of institutions executing punishments, employed in work with convicts constantly and directly during the full working day, i.e. at least 80% of working time. Some enterprises that are not institutions executing criminal punishments may use the labor of convicts.

Employees of such enterprises do not enjoy the right to early pension provision. When considering the possibility of granting the right to early retirement benefits to employees of labor treatment dispensaries, it should be borne in mind that these dispensaries do not belong to institutions executing criminal penalties, since they provide labor treatment to persons who are not convicted. Therefore, the right to early assignment of an old-age labor pension in accordance with subparagraph. 17 of the commented article they do not have.

Payment amounts and how they are calculated

When calculating pension payments, two components are used:

- Fixed or basic amount from the government.

- Sum insured. Determined by how much employers paid for the employee.

The fixed size is multiplied with various coefficients, including regional ones, to determine the result. It is important to consider the number of points a person has accumulated along with the value of one.

When calculating payments, it is important to pay attention to the following several points:

- If at some point in time a citizen was at the labor exchange, for which he received benefits, this period is not taken into account.

- The period before and after childbirth is also not taken into account.

- Part-time work in two or more companies is also not subject to accounting.

The northern pension is 30-50% higher than the usual one.

All about early retirement pensions

The conditions for assigning an early retirement pension to citizens employed in work with convicts as workers and employees of institutions executing criminal penalties in the form of imprisonment are as follows:

All workers permanently and directly engaged in work with convicts.

Punishment in the form of imprisonment is carried out in a colony-settlement, educational colony, medical correctional institution, correctional colony of general, strict or special regime or prison. Do they have the right to long visits with those sentenced to imprisonment? You can find out how to do this in the sections “How to save and increase money” and “Financial life planning”, and also learn from my books. If you have any questions, ask me, I will try to answer them. Medical workers constantly and directly involved in working with convicts: The representative of the defendant PKU IK-19 GUFSIN of Russia for the Sverdlovsk region did not agree with the plaintiff’s claims, since the plaintiff’s job responsibilities did not include direct work with convicts; during the controversial periods of work, job descriptions for drivers were not compiled. The representative of the defendant PKU IK-26 of the Federal Penitentiary Service of Russia for the Sverdlovsk Region also did not agree with the plaintiff’s claims, since there were no documents confirming the plaintiff’s constant and direct employment with convicts in the institution. In accordance with the List, which consists of 4 sections, the following have the right to early retirement, subject to constant and direct employment at work with convicts: This List is exhaustive and is not subject to broad interpretation, i.e., it is those managers and specialists who enjoy the right to early retirement , whose positions are expressly provided for in the List. For example, periods of work in the positions of “technological engineer” and “technical technician” cannot be included in the length of service giving the right to early retirement, since only “engineers and “technicians” are included in the specified List.

The penal system may include enterprises specially created to support the activities of the penal system, research, design, educational and other institutions. Employees of these organizations and institutions do not enjoy the right to early retirement, since they are not employees of institutions executing criminal penalties. The main condition for granting early retirement to these workers is their constant full-time employment working with convicts. In this case, the nature of the work they perform does not matter. Analysis of the above norms allows us to directly state that persons working in institutions for the execution of punishment in the form of imprisonment in the position of “accountant” have the right to early retirement in accordance with Article 28 of the Federal Law “On Labor Pensions in the Russian Federation”.

So why are they denied the issuance of a “preferential certificate?” In pursuance of this norm, the Government of the Russian Federation adopted the Resolution “On the lists of jobs, professions, positions, specialties and institutions, taking into account which an old-age labor pension is assigned early in accordance with Article 28 of the Federal Law “On labor pensions in the Russian Federation”, (“Collection of Legislation of the Russian Federation”, 04.11.2002, N 44, Art. 4393, “Rossiyskaya Gazeta”, N 212, 06.11.2002). The right of teaching staff to early assignment of an old-age labor pension is currently provided for by Federal Law No. 173-FZ of December 17, 2001 “On Labor Pensions in the Russian Federation.” Decree of the Government of the Russian Federation dated October 29, 2002 No. 781 approved: The list of positions and institutions in which work is counted as length of service for an early pedagogical pension, and the Rules for calculating periods of work giving the right to an early pedagogical pension. It must be borne in mind that by order of the Minister of Education of the USSR and the Minister of Internal Affairs of the USSR dated February 20, 1976 No. 23/45, it was determined that for the education of convicts in the education system, evening (shift) secondary schools were created, the activities of which were regulated by the Regulations on evening ( shift) secondary school.

By virtue of Art. 19 of the Law “On Labor Pensions in the Russian Federation”, a labor pension (part of the labor pension) is assigned from the date of application for the specified pension (for the specified part of the labor pension), except for the cases provided for in paragraph 4 of this article, but in all cases not earlier than the day the right to the specified pension (the specified part of the pension) arises. Thus, the argument of the cassation appeal that the debtor of the head of the laboratory is not provided for by the above List is the basis for refusing to include the disputed period of work of the plaintiff from 04/18/1989 to 09/30/2000 in the special length of service for the early assignment of an old-age pension in connection with employment at work with convicts is not.

On establishing the length of service coefficient

Decision Comments Russian Federation Decision dated May 08, 2012 In case No. 2-1145/2012 Adopted by the Vorkuta City Court of the Komi Republic

- Vorkuta City Court of the Komi Republic

- as part of the presiding judge Mitskevich E.V.,

- with the secretary of the court session Petukhova E.V.,

- having considered in open court in the city of Vorkuta on April 25, 2012 the case of Kononenkov’s claim ... against the State Institution - the Administration of the Pension Fund of the Russian Federation in Vorkuta of the Komi Republic for establishing the length of service coefficient +++

Installed:

- Kononenkov A.N. filed a lawsuit against the defendant to establish a length of service coefficient for calculating the pension in the amount of +++ from the moment the pension was assigned.

- In support of the claim, he indicated that he had been the recipient of an old-age pension since June 10, 2010. The pension was assigned in accordance with paragraph 2 of Article 27 of Federal Law No. 173-FZ of December 17, 2001 “On Labor Pensions in the Russian Federation.” When establishing a pension, the defendant converted the plaintiff’s pension rights acquired as of January 1, 2002, while the length of service coefficient, as calculated by the Pension Fund, which served as the basis for calculating the pension, was 0.61. The plaintiff does not agree with this length of service coefficient. The length of service coefficient depends directly on the number of years worked in the jobs listed, in this case, in List No. 2. The length of service coefficient for 12 years and 6 months worked at work in harmful and dangerous conditions should be 0.55. For each full year of overtime in harmful and dangerous working conditions, the experience coefficient increases by 0.01, but not more than 0.20 in total. The defendant indicates that the plaintiff’s special experience is 18 years 8 months 27 days, the experience coefficient is 0.61. However, the defendant unlawfully does not count the plaintiff’s work as a gas welder at the Kolchuginsky plant named after S. Ordzhonikidze in the period from July 27, 1978 to July 6, 1979 into the special length of service that gives the right to a preferential pension. and from 08/11/1981 to 02/12/1982 In addition, the defendant unlawfully did not count the period of service in the Soviet army from July 10, 1979 to May 31, 1981 as the preferential length of service. At the time of work at the Kolchuginsky plant named after S. Ordzhonikidze and conscription service in the Soviet army, the current legal regulation provided for the possibility of credit such activities during a special period of service, and further changes in legislation cannot serve as a basis for infringing on the rights of the plaintiff in the field of pension provision. Taking into account the indicated periods, the plaintiff’s special experience is 22 years 5 months and 29 days, therefore the experience coefficient is not 0.61, but +++

- The plaintiff and defendant, duly notified of the time and place of the trial, did not take part in the court hearing.

- The plaintiff requested that the case be considered in his absence; the defendant did not notify the court of the reasons for the failure of his representative to appear.

- In accordance with Article 167 of the Civil Procedure Code of the Russian Federation, the case was considered in the absence of the plaintiff and defendant.

- Having examined the case materials, the materials of the pension case +++, the court comes to the following.

- In accordance with paragraph 2, paragraph 1 of Art. 27 of the Federal Law “On Labor Pensions in the Russian Federation”, an old-age labor pension is assigned before reaching the age established by Article 7 of this Federal Law (for men 60 years old), to men upon reaching the age of 55 years, if they have worked in jobs with difficult working conditions, respectively at least 12 years 6 months and have an insurance period of at least 25 years.

- In accordance with paragraph 2 of Art. 28.1 of the said law, to persons who have worked for at least 15 calendar years in the regions of the Far North or at least 20 calendar years in equivalent areas and have the necessary for the early assignment of an old-age labor pension provided for in subparagraphs 1 - 10 and 16 - 18 of paragraph 1 of the article 27 of this Federal Law, the insurance period and length of service in the relevant types of work, the age established for the early assignment of the specified pension is reduced by five years.

- Thus, a man has the right to a pension upon reaching 50 years of age if he has a total experience of at least 25 years, experience in the Far North of at least 15 years, and special experience of at least 12 years 6 months.

- The court found that the plaintiff, born ***, with ***, is the recipient of an old-age labor pension in accordance with paragraph 2, paragraph 1, article 27 and paragraph 2, article 28.1 of the Federal Law of December 17, 2001. No. 173-FZ “On labor pensions in the Russian Federation.”

- According to the materials of the pension file as of June 10, 2010. The plaintiff’s length of service to determine the right to a pension was: general work experience ***, work experience in the RKS - ***, special experience with difficult working conditions according to List No. 2 - ***. Experience for determining pension capital as of 01/01/2002. amounted to: general work experience ***, work experience in RKS - ***, special experience with difficult working conditions according to List No. 2 - ***.

- In accordance with paragraph 2 of Article 27 of the Federal Law “On Labor Pensions in the Russian Federation”, lists of relevant works, industries, professions, positions, specialties and institutions, taking into account which the labor pension provided for in paragraph 1 of this article is assigned, rules for calculating periods of work and assignments of labor pensions, if necessary, are approved by the Government of the Russian Federation.

- Decree of the Government of the Russian Federation dated July 18, 2002 N 537 established that in case of early assignment of an old-age labor pension, the lists of industries, works, professions and positions approved by the Cabinet of Ministers of the USSR, the Council of Ministers of the RSFSR and the Government of the Russian Federation are used.

- At the same time, subparagraph “b” of paragraph 1 of this Resolution establishes that the specified Lists are applied in the following order:

- in case of early assignment of an old-age labor pension to workers employed in jobs with difficult working conditions, - List No. 2 of industries, jobs, professions, positions and indicators with harmful and difficult working conditions, approved by Resolution of the Cabinet of Ministers of the USSR of January 26, 1991 No. 10 .

- The time of work performed before January 1, 1992, provided for by List No. 2 of industries, workshops, professions and positions, work in which gives the right to a state pension on preferential terms and in preferential amounts, approved by Resolution of the Council of Ministers of the USSR of August 22, 1956 No. 1173 (with subsequent additions), is counted towards the length of service giving the right to early assignment of an old-age pension, along with the work provided for in the List specified in paragraph one of this subclause.

- Resolution of the Council of Ministers of the USSR dated August 22, 1956 N 1173 approved Lists No. 1 and No. 2; in accordance with Section XXXII “General Professions” of List No. 2, electric welders and their assistants, gas welders and their assistants, and argon atomic-hydrogen welding welders had the right to a preferential pension.

- In accordance with the Rules for calculating and confirming the insurance period for establishing labor pensions, approved by the Decree of the Government of the Russian Federation of July 24, 2002. No. 555, the main document confirming the periods of work under an employment contract is the work book.

- At the same time, according to clause 5 of the List of documents necessary to establish a labor pension..., approved by the Resolution of the Ministry of Labor of Russia and the Pension Fund of the Russian Federation dated February 27, 2002. No. 16/19 pa, to the application of a citizen who applied for an old-age labor pension in accordance with Articles 27 and 28 of the Law of December 17, 2001, if necessary, in addition to the documents provided for in paragraph 1 of this List, must Documents confirming work experience in the relevant types of work must be attached.

- In accordance with the Rules for calculating periods of work giving the right to early assignment of a labor pension..., approved by the Decree of the Government of the Russian Federation of July 11, 2002. No. 516, the right to a pension due to special working conditions is available to employees who are constantly engaged in performing work provided for in the Lists for a full working day. Periods of temporary disability and annual paid leave, including additional ones, are included in the special length of service.

- In making a request to establish a length of service coefficient of 0.64, the plaintiff indicates that the incorrect establishment of the length of service coefficient was caused by the fact that the defendant did not include periods of work from July 27, 1978 into the plaintiff’s special length of service. to 07/06/1979 and from 08/11/1981 to 02/12/1982

- From the work book of A.N. Kononenkov. It follows that on July 27, 1978, the plaintiff was hired for the position /// at the Kolchuginsky plant named after S. Ordzhonikidze. On July 31, 1978, he was transferred to the position of ///. On July 6, 1979, he was dismissed due to conscription into the Soviet Army. 08/11/1981 rehired /// at the Kolchuginsky plant named after S. Ordzhonikidze, where he worked in the specified position until 02/12/1982.

- In turn, according to a certificate from Kolchugtsvetmet CJSC dated June 23, 2010, clarifying the special nature of the work for the assignment of a preferential pension, A.N. Kononenkov actually worked at the Kolchugino Non-Ferrous Metals Processing Plant named after S. Ordzhonikidze in the Capital Construction Department from *** to *** and from 02/12/1982 to 05/10/1984 by profession ///, engaged in cutting and manual welding , which corresponds to List No. 2, section XXXIII, profession code 23200000-19756 and from 07/31/1978 to 07/06/1979, from 08/11/1981 to 02/11/1982 by profession ///, which corresponds to the List No. 2, section XXXII, Directory 1956. The work was performed during a full working day, a full working week, without administrative leaves, downtime and distractions to other work.

- The above certificate is available in the pension file materials. As follows from the materials of the pension case, namely the table of the plaintiff’s work activity, periods of work from July 27, 1978. to 07/06/1979 and from 08/11/1981 to 02/12/1982 included by the defendant in the length of service under List No. 2. Taking into account the indicated periods, the plaintiff’s special experience under List No. 2, as noted above, amounted to *** for determining the right to a pension; to determine pension capital (as of 01/01/2002) - ***

- Thus, the plaintiff’s arguments that the periods of labor activity from July 27, 1978. to 07/06/1979 and from 08/11/1981 to 02/12/1982 were not included by the defendant in the special experience under List No. 2 and were not confirmed.

- In accordance with the military ID, the plaintiff served in the USSR Armed Forces from July 10, 1979 to May 26, 1981.

- According to the plaintiff’s work activity table, the specified period of conscription military service is included by the defendant in his total length of service.

- From the materials of the pension case it follows that the period of military service was immediately preceded by the period of work of the plaintiff from July 31, 1979. to 07/06/1979, and was immediately followed by the period of work of the plaintiff from 08/11/1981 to 02/11/1982 as ///, which were included by the defendant in the length of service under List No. 2.

- At the same time, it was established that the period of military service upon conscription was not included in the special length of service of the plaintiff UPFR in the city of Vorkuta.

- Provisions of Part 2 of Article 6, Part 4 of Article 15, Part 1 of Article 17, Articles 18, 19 and Part 1 of Art. 55 of the Constitution of the Russian Federation presuppose legal certainty and the associated predictability of legislative policy in the field of pension provision, necessary so that participants in relevant legal relations can reasonably foresee the consequences of their behavior and be confident that the right acquired by them on the basis of current legislation will be respected by the authorities and will be implemented.

- The Constitutional Court of the Russian Federation in Resolution No. 2-P of January 29, 2004, with reference to Resolution No. 8-P of May 24, 2001 and Determination No. 320-O of November 5, 2002, indicated that in relation to citizens who acquired pension rights before the introduction of new legal regulation, previously acquired rights to a pension are retained in accordance with the conditions and norms of the legislation of the Russian Federation in force at the time of acquisition of the right.

- In accordance with paragraphs. “k” clause 109 of the Regulations on the procedure for assigning and paying pensions, approved by Resolution of the Council of Ministers of the USSR of August 3, 1972 N 590, service in the Armed Forces of the USSR is also counted towards the length of service, while, when appointed on preferential terms or in preferential pensions for old age and disability for workers and employees who worked in underground work, in work with hazardous working conditions and in hot shops and in other work with difficult working conditions, the periods specified in subparagraphs “k” and “l” are equalized by choice applying for a pension either for work that preceded this period, or for work that followed the end of this period.

- Thus, for the period of the plaintiff’s service in the Armed Forces of the USSR (from July 10, 1979 to May 26, 1981), the current legal regulation provided for the possibility of counting such activities into work experience, and further changes in legislation cannot serve as a basis for infringing on his rights in the field pension provision.

- Accordingly, the above-mentioned period of service of the plaintiff is subject to inclusion in the length of service in his specialty during the early assignment of an old-age labor pension, regardless of the time of his application for a pension and the time his right to do so arose.

- A different interpretation and application of pension legislation would entail a restriction of the constitutional right to social security, which cannot be justified by the goals specified in Part 3 of Article 55 of the Constitution of the Russian Federation, for the sake of which the federal law allows for the restriction of the rights and freedoms of man and citizen.

- Under such circumstances, the period of service by the plaintiff in the Armed Forces of the USSR is subject to counting towards the length of service according to List No. 2, which gives the right to an early retirement pension in accordance with paragraph 2, paragraph 1, Article 27 of the Federal Law “On Labor Pensions in the Russian Federation” .

- Taking into account the period of service in the army, the plaintiff’s experience in List No. 2 for determining the right to a pension was: *** (experience in the relevant types of work according to the materials of the pension file) + ***, and the experience in the relevant types of work for determining the pension capital (on ***) will be: 18 years, 08 months, 27 days (experience in the relevant types of work according to the pension file) + *** = ***.

- According to clause 3 of Article 30 of the Federal Law of December 17, 2001 No. 173-FZ “On Labor Pensions in the Russian Federation,” the estimated size of the labor pension is determined (in the case of choosing an insured person) using the following formula:

- RP = SK x ZR / ZP x SZP, where

- RP - the estimated size of the labor pension;

- SK is the length of service coefficient, which for insured persons:

- from among men with a total work experience of at least 25 years, and from among women with a total work experience of at least 20 years, it is 0.55 and increases by 0.01 for each full year of total work experience in excess of the specified duration, but not more than 0.20;

- of the number of persons with insurance experience and (or) experience in the relevant types of work that are required for the early assignment of an old-age labor pension (Articles 27 - 28 of this Federal Law), is 0.55 with a duration of total work experience equal to the duration of the insurance period , specified in Articles 27 - 28 of this Federal Law, required for the early assignment of an old-age labor pension, and increases by 0.01 for each full year of total work experience in excess of the duration of such work experience, but not more than by 0.20.

- By virtue of clause 9 of the specified article of the Federal Law of December 17, 2001 No. 173-FZ, the conversion (transformation) of pension rights into the estimated pension capital of the insured persons specified in paragraph 1 of Article 27 of this Federal Law, including persons in respect of whom when assigning an early labor old-age pension, the provisions of Article 28.1 of this Federal Law are applied, and the insured persons specified in Article 27.1 of this Federal Law may be granted at their choice in the manner established by paragraph 3 of this article, using instead of the total length of service (existing and full) experience in the relevant types of work (existing and full).

- Guided by the above provisions of Federal Law No. 173-FZ of December 17, 2001, the court found that when converting the plaintiff’s pension rights, based on the duration of his special service, established at the court hearing, taking into account military service on conscription, equal to ***, which exceeds the required special service for granting a pension of 12 years 6 months. for 8 full years, the experience coefficient will be +++ (0.55 + 0.01 x +++).

- In turn, from the materials of the pension case it is clear that the conversion of the plaintiff’s pension rights was carried out by the defendant from a special length of service equal to ***, using a length of service coefficient of 0.61.

- In such circumstances, the court considers claims to impose an obligation on the defendant to establish the length of service coefficient for a special length of service to be satisfied in the amount of establishing a length of service coefficient equal to +++, since an understatement of the length of service coefficient entails an understatement of the amount of the pension assigned and paid to the plaintiff. At the same time, the court does not see any grounds for establishing the plaintiff’s experience coefficient for special experience +++.

- In accordance with Article 103 of the Code of Civil Procedure of the Russian Federation, a state fee in the amount of 200 rubles is subject to recovery from the defendant.

- Based on the above and guided by Art. 194-199 Code of Civil Procedure of the Russian Federation,

Decided:

- To oblige the State Institution - the Office of the Pension Fund of the Russian Federation in Vorkuta to establish for Kononenkov... an experience coefficient for calculating a pension in the amount of +++ from 06/10/2010.

- To collect from the State Institution - the Office of the Pension Fund of the Russian Federation in the city of Vorkuta a state fee to the budget of the municipal formation of the urban district "Vorkuta" in the amount of 200 rubles 00 kopecks.

- Refuse to satisfy Alexey Nikolaevich Kononenkov’s request to establish a length of service coefficient of +++.

- The decision can be appealed within a month to the Supreme Court of the Komi Republic through the Vorkuta City Court.

- Judge E.V. Mitskevich

>The length of service coefficient for preferential pensioners

Case No. not determined

having considered in open court a civil case based on the claim of FULL NAME1 against the State institution - the Department of the Pension Fund of the Russian Federation on the inclusion of periods of work in special work experience and recognition of the right to early retirement pension,

Include periods of work FULL NAME1 with convicts in Institutions KM-401/1 and M-200/1 with DD. MM. YYYY according to DD. MM. YYYY and with DD. MM. YYYY according to DD. MM. YYYY in his special work experience.

Having heard the parties, witnesses, and examined the case materials, the court comes to the following conclusion:

. Corrective labor colonies No. 1, 2, and 3 were located in the villages of Keba, Bolshaya Shchelya, and Zubovo. The right to early retirement when working with convicts? In the village of Ust-Chulasa and in the village there were shift sites from the colony ITK-1, where convicts serving their sentences worked in the main production - logging and rafting, including on mechanisms and machines, as well as in work supporting the main production, in various economic work, construction, maintenance work on the departmental housing stock of the institution. Recognize the right of Full Name 1 to an early retirement pension with DD. MM. YYYY, as having sufficient work experience in special working conditions and insurance experience.

Northern pension

A special northern pension is assigned to Russians who worked in regions with the appropriate status. The amount of such remuneration is larger than regular payments. Preferential conditions are due to the fact that the work of such persons is associated with certain obstacles.

For 2020, the payment for such citizens was almost 5,400 rubles . Each region in this direction sets its own separate coefficient. The basic pension is multiplied by it. The amount of remuneration awarded to a particular citizen depends on this.

The main thing is that the citizen himself is registered in the territory of the region that has the appropriate status.

Decree of the Government of the Russian Federation of October 29, 2002

By Decree of the Government of the Russian Federation of May 26, 2009 Who has the right to long visits with convicts? N 449 this resolution has been amended

Rules for calculating periods of work giving the right to early assignment of an old-age labor pension to persons who carried out medical and other activities to protect public health in health care institutions, in accordance with subparagraph 20 of paragraph 1 of Article 27 of the Federal Law “On Labor Pensions in the Russian Federation.”

In accordance with Article 27 of the Federal Law “On Labor Pensions in the Russian Federation”, the Government of the Russian Federation decides: b) persons who were employed in work with convicted persons as workers and employees of institutions of the Ministry of Justice of the Russian Federation, executing criminal penalties in the form of imprisonment, - a list of jobs, professions and positions of employees of institutions executing criminal punishments in the form of imprisonment, working with convicts, approved by Decree of the Government of the Russian Federation of February 3, 1994 No. 85 (Collected Acts of the President and Government of the Russian Federation, 1994, No. 7 , Art. 509; Collection of Legislation of the Russian Federation, 1996, No. 36, Art. 4240); list of positions and institutions in which work is counted towards length of service, giving the right to early assignment of an old-age labor pension to persons who carried out medical and other activities protection of public health in healthcare institutions, in accordance with subparagraph 20 of paragraph 1 of Article 27 of the Federal Law “On Labor Pensions in the Russian Federation”;

Are there any benefits and additional benefits?

Here are just a few examples of benefits available to this category of citizens:

- After three years of service, it is possible to purchase housing at the expense of the Ministry of Defense.

- Availability of several cash bonuses.

- Application of tax deductions, exemption from certain types of fees.

- Free travel and services in medical institutions.

Seafarers are entitled to remuneration only if they perform their duties in the proper manner. Usually such citizens are exempt from property and transport taxes.

Preferential pension due to harmfulness

- when working according to List 1 - for every 1 full year of work for women and men;

- when working according to List 2 hazardous professions - for each:

- 2.5 years of hazardous work for men;

- 2 years of special experience - for women.

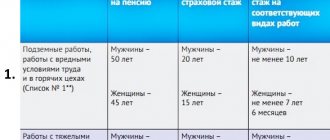

List 1 of professions that give the right to early retirement includes positions related to underground work, hot shops, and hazardous working conditions . To determine the right to a preferential pension, a list of works and positions approved by legislative acts is used:

- having at least half of the established special experience (see table above);

- availability in full of the required amount of general insurance experience and IPC .

List No. 1 for periods of working activity from January 1, 1992 includes 24 types of industries , each of which identifies professions in which work allows early retirement. Let us give as an example some of them in the table below: If the harmful experience indicated in the table was not completed in full, then you can count on a reduction in the generally established retirement age in proportion to the accumulated special experience.

Pension based on active service - what documents confirm active service upon retirement?

Every citizen who falls into the professional/social category established by the law of the Russian Federation receives the right to early retirement. A prerequisite for obtaining such a right is compliance with the general requirements for seniority.

The package of documents to confirm your seniority includes:

- Employment record book with all necessary information – original + photocopy (employment contract).

- Additional information (which was not indicated in the work book) determining the right to early retirement: certificates clarifying the special working conditions and their nature in a particular institution or organization/enterprise - for the entire period of work from all places of work.

- Russian passport + photocopy.

- SNILS + photocopy.

- For women: marriage certificate + copy.

- For men: military ID + copy.

- Certificate of birth of children + copies.

- A document on the average salary for any 5 years of activity.

- TIN.

- Other documents/certificates confirming the harmfulness of the work (certificates from medical institutions about disability, etc.).

If there are children aged 18-23 who are undergoing full-time education:

- Document on income for the last 3 months.

- Document on the amount of the scholarship.

- A document confirming that the child is a dependent.

- Study document.

Detailed information on the list of required documents can be obtained from your territorial Pension Fund office.

The decision to refuse/establish an early pension is made by the Pension Fund after a complete and objective review of the package of documents.

It is recommended to contact the Pension Fund at your place of residence 1 year (maximum 4 months) before the immediate emergence of the right to early retirement, so that Pension Fund specialists have the opportunity to request (if necessary) clarifying certificates from former places of work and from archives, and the future pensioner has the opportunity to calmly collect all documents.

The right to early retirement when working with convicts

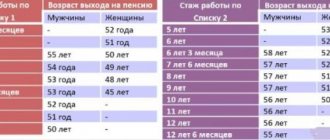

Let's give all kinds of examples in the table and indicate how many years citizens will be able to take out early retirement pensions in 2020, under what conditions.

Work on vessels of the marine fleet of the fishing industry for the extraction, processing of fish and seafood, acceptance of finished products in the fishery, as well as on certain types of vessels of the sea, river fleet and fishing industry fleet.

Citizens who want to apply for an early pension will have to contact the Pension Fund in advance, when the retirement age has not yet reached the established limits. Citizens working with convicts as workers, as well as employees of institutions executing criminal penalties in the form of imprisonment.

Military pensioners can apply for a pension before reaching the required age.

How is seniority considered - how to get bonuses for work based on seniority?

Work experience includes those periods of work that were performed regularly and for a full working day, taking into account the payment of insurance contributions to the Pension Fund for all periods. Also, the length of service will include periods of annual/additional leave + periods of receiving social insurance benefits for periods of temporary disability. So, early retirement is due...

- Women over 45 years old. Reasons: work in hazardous working conditions, underground work, in hot shops. The duration of the insurance period is from 15 years, harmful - from 7.5 years.

- Men over 50 years old. Reasons: work in hazardous working conditions, underground work, in hot shops. The duration of the insurance period is from 20 years, harmful - from 10 years.

- Men over 55 years old. Reasons: working under difficult working conditions. The period of harmful work experience is from 12.5 years, the insurance period is from 25 years.

- Women over 50 years old. Reasons: working under difficult working conditions. The period of harmful work experience is from 10 years, the insurance period is from 20 years.

- Women over 50 years old. Reasons: work in agriculture and other sectors of the economy as tractor drivers. The period of harmful work experience is from 15 years, the insurance period is from 20 years.

- Women over 50 years old. Reasons: work in the textile industry with increased intensity and severity. The period of harmful work experience is from 20 years, the insurance period is from 20 years.

- Women over 50 years old. Reasons: activity as workers of locomotive crews and other workers in the system of organizing transportation and traffic safety in railway transport and the subway + as drivers of freight transport in mines, mines and quarries. The period of harmful work experience is from 10 years, the insurance period is from 20 years.

- Men over 55 years old. Reasons: activity as workers of locomotive crews and other workers in the system of organizing transportation and traffic safety in railway transport and the subway + as drivers of freight transport in mines, mines and quarries. The period of harmful work experience is from 12.6 years, the insurance period is from 25 years.

- Women/men from 50-55 years old. Reasons: work in the Far North. The period of harmful experience is from 15 years.

- Men over 55 years old. Reasons: activities in geological exploration, forest management, hydrographic and other work as part of brigades, detachments and expeditions. The period of harmful work experience is from 12.5 years, the insurance period is from 25 years.

- Women over 50 years old. Reasons: activities in geological exploration, forest management, hydrographic and other work as part of brigades, detachments and expeditions. The period of harmful work experience is from 10 years, the insurance period is from 20 years.

- Men over 55 years old. Reasons: work in timber rafting/logging. The period of harmful work experience is from 12.5 years, the insurance period is from 25 years.

- Women over 50 years old. Reasons: work on rafting/logging operations. The period of harmful work experience is from 10 years, the insurance period is from 20 years.

- Men over 55 years old. Reason: work as crew mechanics in port loading and unloading operations. The period of harmful work experience is from 20 years, the insurance period is from 25 years.

- Women over 50 years old. Reasons: work as crew mechanics at port loading and unloading operations. The period of harmful work experience is from 15 years, the insurance period is from 20 years.

- Men over 55 years old. Reasons: work as a crew member on various vessels (sea and river fleets, fishing industry fleets). The period of harmful work experience is from 12.5 years, the insurance period is from 25 years.

- Women over 50 years old. Reasons: work as a crew member on various vessels (sea and river fleets, fishing industry fleets). The period of harmful work experience is from 10 years, the insurance period is from 20 years.

Things to consider:

- The preferential length of service always includes all periods of temporary disability and main/additional vacations.

- When working (harmful) at several enterprises, periods of harmful work experience can be summed up if the work was related to types of activity that give such a right.

- In case of hazardous work carried out during part-time working days/weeks, the length of service is calculated based on the time actually worked (not according to the calendar), taking into account archival documents (statements).

- When working on a rotational basis, the time of “between shifts” rest + probationary period + time spent on retraining or professional training is usually taken into account.

To accurately calculate preferential length of service and determine the harmfulness of work, you should contact the Pension Fund at your place of registration with a set of necessary documents.

Early retirement, pension disputes: advice from a lawyer

Please note: if the special service period is more than half of the required period, the retirement age will be calculated proportionally. So, in order for a man to retire at 50, he must have 10 years of experience in a special activity; if he has worked only 5 years, retirement age will not come earlier than 55 years.

Important: you can protect your right to preferential pension benefits in court.

- mining;

- ore processing;

- metallurgy production;

- chemical,

- coke and mixed production;

- nuclear industry and energy.

However, this list is not exhaustive. There are other categories that find themselves in a difficult social situation. Work in flight test personnel with direct employment in flight tests (research) of experimental and serial aviation, aerospace, aeronautical and parachute equipment. At least 25 years in rural areas and urban settlements. At least 30 years in cities, rural areas and urban-type settlements or only in cities

What is hot work experience and what does it include - an overview of professions with hot work experience

Harmful or “hot” experience is considered to be continuous experience in a “harmful” profession defined by law or “northern” experience.

Citizens who have worked before the deadline have the right to become pensioners...

- In the regions of the Far North.

- In certain underground operations.

- In hot shops (metallurgy, etc.).

- With harmful or difficult working conditions.

- Tractor drivers in agriculture (for women) and other economic sectors.

- In the textile industry, subject to increased severity and intensity (for female employees).

- As subway and railway transport workers.

- In geological exploration, forest management and other works.

- At timber rafting and logging.

- At port unloading works.

- In crews on various vessels.

- On flight crews.

- As rescuers when working in one of the emergency rescue, fire services or the Ministry of Emergency Situations.

- As employees in correctional institutions.

- In children's and school institutions.

- In health care institutions of the country.

- As drivers of public regular transport.

- On theater stages or in theatrical and entertainment organizations.

Preferential conditions for early retirement are defined by Article 27 of Federal Law No. 173 dated 12/17/01. All professions/positions that fall under the concept of “harmful” are listed in 2 corresponding lists.

List 1 (the most hazardous professions and jobs) includes:

- Any type of work underground (tunneling, work in mines/mines, etc.).

- Work in particularly difficult and harmful conditions (production of ammunition and electrical equipment, oil refining, etc.).

- Work in hot shops (glassmaking, metallurgy, ceramics production, etc.).

- Etc.

Men who worked in professions from List 1 retire at the age of 50, provided they have at least 10 years of “harmful” work experience and 20 years of insurance service. Women retire at 45 years old with an insurance period of 15 years and a “harmful” period of 7.5 years. If employed in particularly hazardous work (from List 1) less than half of the annual norm, a pension is assigned in accordance with List 2.

List 2 includes:

- Mining works.

- Harmful and difficult working conditions (food and light industry, production of medicines and hardware, oil and gas production, etc.).

- Transport professions.

- Etc.

Men who worked in professions from the 2nd List retire at 55 years old with an insurance period of 25 years and “harmful” service of 12.5 years. Women retire at the age of 50 with an insurance period of 20 years and a “harmful” period of 10 years.

The conditions for early retirement will depend on the insurance and special length of service, working conditions and gender. The age range for early retirement is 40-55 years.

You can study Lists 1 and 2 in detail in the official document: Resolution of the Cabinet of Ministers of the USSR dated January 26, 1991 No. 10 “On approval of lists of production, work, professions, positions and indicators giving the right to preferential pension provision” (as amended on July 23 , August 9, October 2, 1991).

From what year is early retirement possible: list of who is eligible, conditions, length of service, documents

The required insurance period will gradually increase: from 6 years in 2020. up to 15 years by 2024 And the individual pension coefficient will grow by 2.4 points annually until it reaches 30.

- women who have raised more than 5 children, parents and guardians of disabled people from childhood.

- the right to early retirement belongs to disabled people: due to military injury, with pituitary dwarfism, and having the first group of vision.

- citizens permanently residing or working in the Far North and equivalent regions, persons employed in underground and mining industries, doctors in rural areas, etc.

Articles 30,31 and 32 of Federal Law No. 400 provide guaranteed assignment of a labor pension to citizens whose work experience includes the following periods.

- standard retirement age (65 years for men, 63 years for women);

- age limit of disabled people (70 – men, 68 – women),

- age level of certain categories (medical workers, teachers, theater workers, workers of the Far North, etc.).

Then the payment of the early pension stops and is resumed only after the dismissal or closure of the individual entrepreneur or legal entity. Therefore, it is worth deciding in advance on the choice (pension or salary) that gives the greatest income. A citizen must independently notify Pension Fund branches about all changes (including the age required for receiving an old-age insurance pension).

Read other articles on the site:

- Issues of qualification of crimes in criminal law and judicial practice

- Warned about liability for knowingly false denunciation under Article 306 of the Criminal Code of the Russian Federation

- Circumstances mitigating a person’s guilt in committing a tax offense

- What is guilt as a sign of a crime in criminal law

- How to get a long date with a convicted common-law wife

Dear colleagues, I wish each of us to hold high the title of lawyer, unswervingly adhering to the principles of impartiality and objectivity!

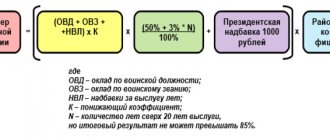

Pension calculation formula

Calculating a pension requires taking into account many factors, for example: difficult working conditions, number of years worked, qualifications, level of remuneration, raising children and much more. The current calculation formula was adopted in 2020 and is as follows:

Where:

SP - the amount of the insurance pension in rubles;

PV is a fixed payment, set by the state every year. In 2020 The size of the PV is 5334.19 rubles;

Kfv is a coefficient that increases the fixed payment in cases where a pensioner continues to work after reaching retirement age. Can vary from 1.056 if processed for 1 year, to 2.11 if processed for 10 years;

IPC - individual pension coefficient. The indicator in conditional points takes into account insurance deductions and existing experience with official employment. Calculated for each pensioner personally;

STB is the cost of one IPC point in rubles, established and indexed by the state annually, STB in 2020. equal to 87.24 rubles;

Kipk is a coefficient that increases the IPC for working pensioners; it can reach 2.32 if the processing experience is 10 years.

If we analyze the above formula, we can see that its size will depend, first of all, on the value of the IPC. This indicator takes into account many individual characteristics of the work activity of each citizen, such as:

- Number of years worked.

- Received wages and additional remunerations for labor from which insurance premiums were transferred.

- In cases of parental leave, the coefficient depends on the number of children. For the first child, 1.8 points are added per year, for the second - 3.6, for the third, fourth - 5.4 points.

- The time spent in military service is taken into account in the IPC at the rate of 1.8 points per year.

- The IPC takes into account care for the disabled and people over 80 years of age. This time is estimated at 1.8 points per year.

The size of the IPC also plays a role in the time of retirement. In 2020, the minimum value is set at 16.2 points with 10 years of experience. In the period until 2025, the minimum size will reach 30 points.

You can find out the value of the IPC:

- on the website of the Pension Fund of the Russian Federation in your personal account;

- at the PF office at your place of residence;

- on the unified portal of State Services when ordering information about the status of a personal account, taking into account the history.

The second way to increase your pension is to work after retirement age. This also applies to those who have the right to early retirement or receive a pension after completing the required length of service. Increasing factors can significantly increase the size of pension payments.

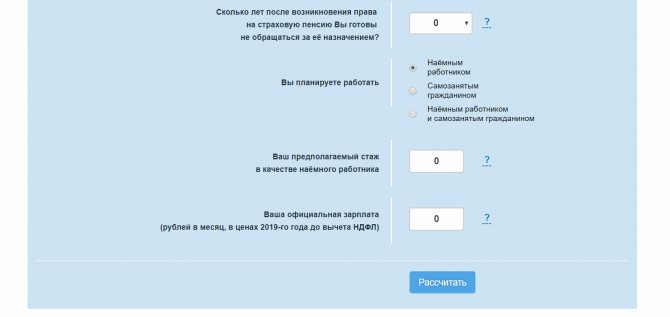

To make it easier to calculate the amount of your insurance pension, a pension calculator has been installed on the website of the Russian Pension Fund. Using it online, you can determine the approximate size of your pension by entering data on your existing experience, salary level, and the presence of additional factors influencing the amount of payments.

Popular tags

Committing a crime Composition of a crime Article of the Criminal Code car administrative initiation civil money activity document complaint law statement health property execution supervision punishment sample application release grounds liability refusal to submit police receiving order resolution right preliminary termination involvement causing harm production prosecutor's office prosecutor process decision witness investigation deadlines judicial condition petition storage

advocatus54.ru

Let's assume that she worked all 22 years in difficult working conditions (List No. 2). Her insurance experience is 22 years. To qualify for an early pension, women must work in difficult conditions for at least 10 years and have at least 20 years of insurance coverage.

If we count the SC from the total length of service, then: SC = 0.55 + 0.01 X (22 - 20) = 0.57, where: 0.55 is the coefficient for the total accumulated total length of service; 0.01 - percentage for working beyond the full length of service; 22 - total length of service of the employee; 20 is the required total length of service to grant a woman a preferential pension.

If we count the SC from preferential experience, then: SC = 0.55 + ODP X (22-10) = 0.67, where: 22 - special experience; 10 - the preferential length of service required for a woman to receive an early pension according to List No. 2.

As can be seen from the example, the insurance company based on preferential length of service is more profitable.

However, I would like to remind you that the pension capital is then calculated for work before 2002. Info But the rule also applies here: if half of the length of service has been worked out, the pension will also be granted early. According to the law, periods of work according to Lists No. 1 and 2, which took place in the region of the Far North or an area equated to the Far North before January 1, 2002, are counted in a special way: 1 year of such work is counted as 1 year 6 months.

SC - length of service coefficient, which for insured persons (except for disabled people with a disability of the first degree) is 55% and increases by 0.01 for each full year of total work experience, but not more than 20%.

Important: For a woman with 20 years of experience, 55% is established, for 21 years - 56%, for 22 years - 57%.

For 40 years and more – 75% (since the limit is no more than 75%). The ratio of the average monthly earnings of the insured person to the average monthly salary in the Russian Federation (ZR/ZP) is taken into account in an amount not exceeding 1.2. Instruction 1 It is important to note that these coefficients are applied based on the actual place of work and do not depend on the location of the organization in which the employee is employed.

2 The regional coefficient cannot set the maximum limit for an employee’s salary; it does not form a salary.