Military personnel, as well as employees of law enforcement agencies, according to the Law of the Russian Federation, have the opportunity to receive pension payments earlier than the general retirement age. In addition, employees of this category are entitled to additional benefits for pensioners of the Ministry of Internal Affairs and social incentives. But, taking into account that the benefit is awarded individually to each applicant, and not on the basis of universal amounts, we have to understand the peculiarities of maintaining retired employees of the Ministry of Internal Affairs. In particular, it remains to be clarified how many salaries are paid to police officers upon retirement.

Legislative regulation of the issue

The procedure for retirement of military personnel and police officers is regulated, first of all, by the norms of the Labor Code of the Russian Federation of December 30, 2001 N 197-FZ (as amended on December 31, 2017). Namely, Article 140 of the mentioned Draft Law, which stipulates the need for proper financial compensation for all officially employed persons upon dismissal. But, given that service in the police is associated with special working conditions, payments upon retirement in the Ministry of Internal Affairs are regulated by departmental documents and orders.

The main regulatory legal act of Russia, which obliges the payment of monetary allowances to the military and police, is Order of the Ministry of Internal Affairs of Russia dated December 31, 2013 No. 65 “On approval of the procedure for providing monetary allowances to employees of the internal affairs bodies of the Russian Federation.” The document sets out the procedure and conditions for providing cash benefits to civilian and certified employees of law enforcement agencies, including payments to employees of the Ministry of Internal Affairs upon retirement.

How to receive payments to pensioners of the Ministry of Internal Affairs?

The algorithm for providing preferences guaranteed by the state has a similar algorithm of actions.

Any privilege requires a citizen to formulate a personal statement, collect documents and contact the structure through which the benefit is assigned.

For various additional payments, the beneficiary will need a passport, SNILS, pension certificate and documents on the basis of which social support measures are assigned.

- Benefits for diabetics.

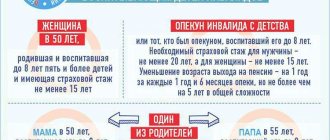

Government programs are aimed at supporting people with serious illnesses. Among them are patients with diabetes mellitus. The specificity of the disease is such that patients constantly need supportive treatment. Not all patients know what benefits diabetics are entitled to in 2020. Let's take a closer look at them. - The right to early assignment of pension: labor and insurance.

Legislation regulates the norms for the transition from work to pension benefits. There are categories of citizens whose work differs from others. It is carried out in difficult or harmful conditions for health, or these people have other social privileges. Z No. 400 “On insurance pensions” in articles 30-32 contains a description of the rules that give the right to early retirement. - Monthly financial support.

Residents of Russia are often offered a variety of incentives. Among them are additional monthly financial support. The benefit is issued by the Pension Fund upon presentation of papers proving the right to it. What are the features of applying for benefits? - Benefits for labor veterans in Moscow.

In the capital region, there is an expanded list of benefits for labor veterans, which allows them to move freely around the city and beyond. At the same time, it is a mistake to think that this status is assigned only to pensioners; according to the new laws, anyone can receive a certificate. What benefits does a labor veteran have in Moscow and Moscow Region, and the conditions for applying for them in 2020 are described in detail in the article. - Payment to pensioners in Moscow over 65 years of age: 2000 and 4000 rubles;

how to register; Saint Petersburg. In connection with the coronavirus pandemic and the growing number of infected people in Moscow, the capital's authorities have introduced a number of restrictive measures aimed at preventing the further spread of COVID -19. First of all, they affected Russians over 65 years of age, who, due to their age, are in a special risk group. In particular, certain payments to pensioners in Moscow were guaranteed. Next, we will look at how you can receive the amounts due. - Benefits for disabled pensioners in 2020.

The procedure for establishing disability is indicated in Government Decree No. 247 of 04/07/2008. The right to receive a social pension is established in Law No. 166-FZ of December 15, 2001. Measures of state support for citizens are regulated by regulatory legal act No. 178-FZ of July 17, 1999.

What payments are due upon dismissal to police officers?

Order of the Ministry of Internal Affairs of Russia dated December 31, 2013 No. 65 “On approval of the procedure for providing monetary compensation to employees of internal affairs bodies of the Russian Federation” also fixes what payments a police officer is entitled to upon retirement. Typically, all types of benefits and their amounts depend on the circumstances of dismissal, as well as the length of service. Thus, below is an exhaustive list of monetary benefits that may be provided upon termination of an employment contract:

- vacation compensation (days of unused rest for all years of service in a particular unit must be paid in full, including vacation for the current calendar year);

- lump sum payment upon termination of the contract (calculated in salaries and depending on length of service);

- monthly benefits to those dismissed who are deprived of pension payments (such compensation is accrued within one year and depends on the size of the employee’s salary).

As for uncertified personnel, they are entitled to a different set of material benefits. These include:

- wages proportional to days worked;

- compensation allowance for accumulated days of vacation;

- additional bonuses if the employee performed his duties in an exemplary manner.

A pensioner of the Ministry of Internal Affairs received disability after retirement

For each year of service that exceeds 20 years, 3 percent is added. But the total premium cannot exceed 85%. With mixed experience, the bonus will be equal to 1% and will be accrued for each year after 25 years of experience.

Loss of a breadwinner This type of pension can be obtained if a family is deprived of a breadwinner - an employee of the Ministry of Internal Affairs died while performing his duties or went missing.

Disabled family members can receive such a pension. These include:

- children under 18 years of age, and in the case of training, this age is extended to 23 years of age;

- disabled people;

- parents of an employee who are at retirement age;

- a relative who took care of the children, brothers or grandchildren of the deceased employee.

But such a pension must be issued within three months from the date of dismissal of the deceased.

Disability after retirement

And in this case, the employee’s length of service will not be taken into account - she will be appointed regardless of other factors.

Documents that need to be collected To receive a service pension, you should collect the following package of papers: Application It is filled out in accordance with the established template, and the document form can be obtained from the personnel service, the Ministry of Internal Affairs or downloaded from the official website of the Ministry of Internal Affairs Pay slip It is taken from the accounting department in a military unit Cash certificate Also located in the accounting department, but you only need to take the counterfoil from it If there are grounds for receiving any benefits It is also worth adding these papers Form for the processing of personal data This document is also filled out independently and using a general form If a pensioner of the Ministry of Internal Affairs leaves for a well-deserved rest under an insurance pension in connection with reaching retirement age, then an application according to the established form should be submitted to the Pension Fund of the Russian Federation.

Benefits for pensioners of the Ministry of Internal Affairs in 2020: registration procedure and conditions of appointment

Important To do this, a citizen must:

- officially get a job or register as an individual entrepreneur;

- register in the Pension Fund system and choose a pension tariff: insurance, or insurance + savings. Make sure that your employer makes timely contributions to your personal account in the pension insurance system. The status of your personal account can be monitored through the State Services portal after completing full registration indicating SNILS;

- achieve a minimum insurance ratio;

- upon reaching retirement age, contact the territorial branch of the Pension Fund of the Russian Federation with an application for the accrual of old-age insurance benefits;

- indicate a convenient way to receive payments.

It is worth noting that the pension benefit through the Pension Fund and the state pension through the Ministry of Internal Affairs are not mutually exclusive.

Registration of pensions for employees in the Ministry of Internal Affairs in 2020

Retirement for employees of the Ministry of Internal Affairs usually occurs earlier than for ordinary people. After all, work in law enforcement agencies is potentially dangerous and is associated with high risks for both health and human life. Therefore, after 25 years of work experience, if at least 12.5 years of work took place in the Ministry of Internal Affairs, a person has the right to retire.

But it is necessary to understand how pensions are being processed for employees at the Ministry of Internal Affairs in 2020. As in any other profession, the Ministry of Internal Affairs has its own nuances and pitfalls, which relate to the very size of pension payments depending on awards, length of service and rank.

And that is why, if a person wants to have a decent and calm old age, he needs to worry about proper retirement in advance.

Pension of the Ministry of Internal Affairs. length of service for calculating pensions. pension amount

Important information It should be understood that, unlike most other people, an employee of the Ministry of Internal Affairs of retirement age can receive an increasing pension, but only if he has served for more than 20 years.

Therefore, if a law enforcement officer works an additional ten years, he will receive a 3% increase for each year, but if the length of service is mixed, that is, the person did not constantly work in the police, then for each extra year he can count on a 1% increase.

Key points In order to feel calm and not worry when applying for a pension, you need to familiarize yourself with the basic concepts that are present in the field.

Thus, length of service implies retirement earlier than the generally accepted age. Usually they leave after reaching a certain length of service. And this feature is typical for workers in hazardous industries or departments associated with heavy stress and risk.

Pension of employees of the Ministry of Internal Affairs (police)

But several more documents are attached to it: Passport It should have a FMS mark indicating the presence of registration Labor book In replacement of this document, you can provide any other one that can confirm the employee’s length of service Certificate of pension insurance - Certificate of income for the last five years - If the employee has dependent family members It is worth providing a certificate confirming this If there are titles and awards It is necessary to collect evidence to confirm this fact Based on the fact that the package of documents is quite large, you should make sure that all of them are prepared in advance. Features of calculating payments In order to calculate the size of the pension payment, it is worth taking into account a number of features.

Pension of employees of the Ministry of Internal Affairs: conditions, calculation, news

Attention Amount from January 1, 2020 On January 1, 2020, insurance pensions were indexed, as a result of which monthly payments were increased by 3.7%. The minimum pension in 2018, including federal monthly payments, was set at the level of the subsistence pension minimum for each region of the country.

Calculation procedure When calculating insurance pensions, the following factors are taken into account: MP minimum pension (4982.9 rubles in 2020) SIPC cost of an insurance point in rubles at the time of pension assignment (81.49 rubles in 2020) IPC individual coefficient (sum of points) SP monthly insurance pension In 2020, to receive an old-age pension, you must meet the mandatory minimum: 9 years of work experience and 13.8 insurance points.

What pension is due to employees of the Ministry of Internal Affairs in 2020?

Federal Law, and a pension for long service (for disability), provided for by the Law of the Russian Federation of February 12, 1993 N 4468-I “On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, control bodies trafficking in narcotic drugs and psychotropic substances, institutions and bodies of the penal system, and their families" (hereinafter referred to as the Law of the Russian Federation "On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, traffic control bodies narcotic drugs and psychotropic substances, institutions and bodies of the penal system, and their families"); 4) widows of military personnel who died during conscription as a result of military trauma and who did not remarry.

The Pension Fund assigned only 1,400 rubles.

Hello. Unfortunately no. Federal Law of December 15, 2001 N 166-FZ “On State Pension Provision in the Russian Federation” (as amended and supplemented) Article 3. The right to a pension in accordance with this Federal Law 2.

Citizens who simultaneously have the right to various pensions in accordance with the legislation of the Russian Federation are assigned one pension of their choice, unless otherwise provided by federal law. 3.

The right to simultaneously receive two pensions is granted to: 1) citizens who have become disabled as a result of a military injury.

They may establish a disability pension provided for in subparagraph 1 of paragraph 2 (using paragraph 3 and paragraph 5) of Article 15 of this Federal Law, and an old-age insurance pension; 2) participants of the Great Patriotic War.

Source: https://territoria-prava.ru/pensioner-mvd-poluchil-invalidnost-posle-vyhoda-na-pensiyu/

Dismissal from the Ministry of Internal Affairs due to health reasons

Termination of a contract for health reasons makes it possible to receive not pension payments, but coverage for limited or total disability . The following circumstances must be present:

- registration of dismissal from the state due to injury;

- acquisition of health disorders in the next three months after termination of the contract;

- the presence of a cause-and-effect relationship between the disorder and service in the Ministry of Internal Affairs.

A pensioner also has the right to financial assistance for disability if the injury received became the basis for assigning a disability group. A disability will be recognized as being related to military service or work in law enforcement agencies in the following situations:

- mutilation;

- chronic and incurable diseases;

- contusion;

- injuries.

Considering that payments to military personnel upon dismissal for health reasons in 2020 begin to be processed as soon as possible after the termination of the contract, we must begin collecting and submitting documents as soon as possible. Otherwise, the procedure for changing the type of financial assistance will take a long time.

Disability of an employee of the Ministry of Internal Affairs: when assigned, amount of payments and how to register disability

Grounds for obtaining disability by an employee of the Ministry of Internal Affairs

Who has the right to apply for disability?

What disability group can be assigned to an employee of the Ministry of Internal Affairs?

What payments from the Ministry of Internal Affairs for disability are entitled to employees?

Payments from the Ministry of Internal Affairs for disability in 2020

Documentation of disability and benefits

Amount of disability pension of the Ministry of Internal Affairs

Disability can affect everyone, regardless of age or social status. The state guarantees provision and benefits for this category of people.

But unlike ordinary citizens, the disability of an employee of the Ministry of Internal Affairs differs both in the amount of payments and the grounds and procedure for receiving it.

Not every situation requires registration of this status, and in order to register disability, legal advice from professionals may often be required.

Grounds for obtaining disability by an employee of the Ministry of Internal Affairs

Assignment of disability occurs on specific grounds. The main one is the inability to carry out activities in the authorities due to lost ability to work. Also, the injury must be received while performing service at the workplace in the authorities, but not in other circumstances.

Who has the right to apply for disability?

Both employees in the law enforcement agencies and those dismissed can apply for status. It is also possible to apply for disability to a pensioner of the Ministry of Internal Affairs. In the last 2 cases, it is possible to apply for benefits if the disability occurred no later than 3 months after the end of service, or as a result of an exacerbation of injuries received while working in the Ministry of Internal Affairs.

Regardless of age, disability is assigned to an employee of the Ministry of Internal Affairs:

- serving employees who were wounded, sick, or concussed during combat operations at airfields, defensive structures, and front-line areas

- employees who received injuries or illnesses while in public protection units, battalions

- citizens who were called up for training camps, testing exercises and received injuries during the performance of tasks and duties.

Situations arise when, during the examination, an assumption is made that challenges the receipt of a group in the service. The law states that if, after rechecking, the group increases, the employee must be paid the difference in the amount of the disability group.

Register now and get a free consultation from Specialists

What disability group can be assigned to an employee of the Ministry of Internal Affairs?

When undergoing a medical examination, doctors determine the level of disability due to circumstances during service. The commission also determines groups, terms of assistance and medical rehabilitation.

Disability groups are divided into 3 categories:

- Group 1: employees who have completely lost their ability to work and independent life. Such persons require constant care from relatives or representatives of social services.

- Category 2: persons cannot work or engage in self-care due to health reasons. For such people, partial care and service by others is important.

- Group 3: citizens who have partially lost their ability to work and can work under normal conditions.

Important:

if the cause of disability is an injury received during service, then a disability pension is assigned to employees of the Ministry of Internal Affairs regardless of the total length of service and length of service.

Register now and get a free consultation from Specialists

What payments from the Ministry of Internal Affairs for disability are entitled to employees?

Monthly compensation for an employee who suffered health damage while performing service is paid after leaving the place of work and being unable to continue serving. In this way, a one-time benefit is also paid. In this case, further possibility of working in the Ministry of Internal Affairs is excluded.

The commission of the Ministry of Internal Affairs, which deals with issues of payment of benefits, reviews the submitted documents for the assignment of EDP. The period is up to 20 days. Next, the head of the department issues an order indicating the basis for payment or its refusal with justified reasons. The applicant is notified within 10 days of the decision made.

Payments of insurance funds are also possible in the case of compulsory state insurance.

One-time insurance payments will depend directly on the received disability group of the insured person:

- 1st group – 1.5 million rubles

- Group 2 – 1 million rubles

- Group 3 – 500 thousand rubles

To receive these payments, you must submit an application to the insurance company after receiving a certificate of disability.

Register now and get a free consultation from Specialists

Payments from the Ministry of Internal Affairs for disability in 2020

Disability payments from the Ministry of Internal Affairs depend directly on the group. This year, monthly payments from the state are set in the following amounts:

- 1 group – 14,000 rubles

- Group 2 – 7000 rubles

- Group 3 – 2800 rubles

Documentation of disability and benefits

State benefits are paid regardless of whether the employee is insured or not. To register disability, the injured employee provides the following documents:

- conclusion and accompanying materials of verification of the circumstances that occurred in which the damage occurred, as well as the cause-and-effect relationship

- documents on service in the Ministry of Internal Affairs

- conclusion of the IHC.

A package of documents is prepared in both originals and copies.

After assignment of a disability group, the employee has the right to submit documents to the Commission for assignment of payment:

- application of a person dismissed from the Ministry of Internal Affairs due to professional incompetence for payment of a monthly allowance. A copy of the MSEC act is submitted with the application

- documents submitted for assignment of disability - conclusion, inspection materials, certificates of termination of service, conclusion of the Higher Inspectorate Commission

- certificate of pension assignment, size and type, issued by the pension department.

State benefits and payments are made throughout the entire period of disability.

Register now and get a free consultation from Specialists

Amount of disability pension of the Ministry of Internal Affairs

The payment of a pension is a set percentage of the amount of official salary, allowances in the established amounts:

- Groups I and II – 85%

- Group III – 50%.

Benefits are accrued during the established period of MSEC incapacity for work. After the end of the period, you must undergo re-examination. If a person misses this period, then payments to him stop. When the group is confirmed, benefits resume from the period of acceptance of the status.

The disability pension for employees of the Ministry of Internal Affairs is calculated using the formula:

(Salary for current position + additional payment for title + additional payment for length of service) × 62.12% × pension percentage

The percentage of pension, as previously indicated, depends on the type of disease and the established group in accordance with Article 22.

Source: https://www.bp-u.ru/yuridicheskiy-likbez/invalidnost-sotrudnika-mvd/

Dismissal during probationary period

It is also possible to dismiss personnel during the internship period. But, there are several features of such a procedure. The most important thing is to draw up and sign a preliminary contract, which specifies all the conditions for performing the work, as well as the procedure for terminating the employment relationship. Only a signed contract is a sufficient basis for hiring an employee.

Upon termination of employment relations during the probationary period, the dismissed person has the right to the following compensation:

- wages for the period worked.

How is it paid?

Insurance pensions formed through the Pension Fund of the Russian Federation are issued at the territorial branches of the Pension Fund. The right to receive benefits is assigned in the month of application. Payments are made in accordance with the deadlines established for the given territory.

At the request of the applicant, he can choose the most convenient way for him to receive a pension:

- to a bank card;

- to a personal account;

- at the post office;

- in person at the Pension Fund;

- through a trusted person.

You can indicate the appropriate accrual option when submitting documents for a pension, or by contacting the Pension Fund in person. If desired, the pensioner can change the method of receiving payments.

Dismissal after maternity leave

According to the Labor Code of the Russian Federation dated December 30, 2001 N 197-FZ (as amended on December 31, 2017), every woman who is on maternity leave retains her job. Therefore, the employer does not have the right to fire an employee before she starts working.

After starting work after maternity leave, the contract with the employee can be terminated on a general basis. And payments will be made depending on the length of service, age and accumulated vacation periods.

Features for certain categories of citizens

In the standard case, the rules for calculating benefits vary depending on the employee’s status, working conditions, place of residence and other factors. However, regional and special coefficients affect mainly the fixed part of the payment, which is not accrued to employees of the Ministry of Internal Affairs.

For northerners

Residents of the Far North and territories that are equivalent to it can receive benefits several years earlier than citizens from other regions of Russia. The northern regions include the Murmansk region, Khanty-Mansi Autonomous Okrug, Yamalo-Nenets Autonomous Okrug, Nenets Autonomous Okrug, areas of the Khabarovsk Territory, Buryatia, the Altai Republic, etc.

In 2020, the northern pension age is 50.5 years for women and 55.5 years for men. Moreover, their insurance experience must be 20 and 25 years, respectively.

Regional multiplying factors only affect the base payment. With seniority in the Ministry of Internal Affairs, employees can retire earlier based on length of service. This allows you to accumulate more individual points and a longer work history.

Persons over 60 years of age

Registration of a pension after the established period allows you to increase the IPC due to increasing allowances. By postponing receiving benefits for 3 years, a citizen will be able to increase the insurance portion by 1.24 times, by 5 years by 1.45 times, and by 10 years by 2.32 times.

If during this period the pensioner works, then the IPC will be accumulated in full, without a limit of 3 points per year.

Dismissal one year before retirement

According to the norms of domestic legislation, there are several features of calculating payments to employees upon dismissal from the police based on retirement age or length of service (Federal Law “On Insurance Pensions”). These include:

- having a minimum experience;

- reaching the general retirement age.

What kind of payments an employee is entitled to upon his voluntary dismissal from the Ministry of Internal Affairs depends on the circumstances of termination of the contract.

Important! According to the general rule, to receive an insurance pension, a police officer must have at least 20 years of experience. .

If the length of service in law enforcement agencies is more than two decades, then the pensioner has the right to a one-time payment in the amount of seven salaries. If you have fewer years of work, you must pay only two salaries. But, an additional amount of benefits is also accrued if the citizen has state awards for exemplary service.

If for some reason the length of service is not enough, then you can count on the least number of salaries, as well as vacation compensation.

How to calculate the amount of pension for an employee of the Ministry of Internal Affairs

The retirement of a police officer assumes that a final settlement will be made with the citizen. The types of payments due to a person are reflected above. To find out the amount of benefits due to a former law enforcement officer, you need to use a special formula.

P = 1/2* (O+C+H) *69.45% , where

- P – amount of pension payment;

- O – the amount of salary taken over the last five years;

- C – salary established for the rank;

- N – additional payments for length of service.

Depending on how much time a citizen works, the amount of the benefit increases over time. For example, if the service life exceeds 20 years, then 3% of the salary is added for each year.

If a person has mixed experience, then the indicated value increases by 1%, but cannot become more than 85% of the salary.

Compensation for uniform

Payments upon dismissal from the Ministry of Internal Affairs at one's own request also include the need to provide the dismissed person with monetary compensation for uniforms. In this case, it refers to uniforms that should have been provided, but were never issued.

The amount of compensation for an unissued form at the Ministry of Internal Affairs in 2020 will depend on the following factors:

- the number of units of property that the employee did not receive;

- the period during which the security was not provided.

In this case, it is important to take into account that calculation of payments is possible only for the three years preceding dismissal, regardless of the fact that the form was received before that time. This is due to the fact that the period of use of the uniform is limited.

Who is entitled to

All citizens and residents of the Russian Federation can participate in the formation of an old-age insurance pension. To do this, you need to register with the Pension Fund and select the most optimal option for forming savings.

In accordance with the legislation of the Russian Federation, the following can apply for pension insurance payments:

- applicants who have reached retirement age;

- citizens with one of the disability groups for the period of disability;

- dependents who have lost their breadwinner (claim his pension benefits through the Ministry of Internal Affairs and the Pension Fund of the Russian Federation).

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

To receive benefits, each of the listed categories of citizens must meet a number of requirements.

Other payments

Staff reduction is a reason for terminating a contract that is not related to the wishes of the parties. In this case, the laid-off employee is entitled to the following payments;

- compensation of days for unused vacation in the Ministry of Internal Affairs;

- one-time payment in salary;

- provision of two salaries that compensate for the costs of the job search period.

It is possible to lay off employees who are on maternity leave only when the enterprise is completely liquidated. And, in this case, the maternity leaver is paid the entire amount of the monthly benefit at the same time.

Pension for military pensioners upon reaching 60 years of age

Important

Retired citizens can apply for a disability pension if their health deteriorates within 3 months. The exception is wounds, contusion injuries, which can have consequences over a long period of time.

Who is entitled to receive benefits and in what order? The right to receive a second pension arises for employees of military departments or law enforcement agencies only if the military pensioner works again in a “civilian” position. In this case, the employer is obliged to make all necessary contributions to the Pension Fund in accordance with the provisions of pension legislation. These funds will be used to form the insurance part of the benefit, which is due to working citizens after reaching the age of 55 - for the female half of the population and at the age of 60 for men.

What to do with a military mortgage upon dismissal

Each employee of the law enforcement system receives funds into their account, which can later be used to purchase real estate. This is the so-called military mortgage. If a citizen has not had time to use his savings, then he can dispose of the money as follows:

- if there is a minimum period of work of 10 years, it is possible to purchase housing using this money;

- after 20 years of service, finances come into personal possession and can be spent on other needs;

- upon dismissal before 10 years, the money goes to the state.

Read more in the article: Military mortgage upon dismissal

Payments to a police officer upon retirement in 2020

According to the latest news, in January 2020, some types of benefits were indexed, which also affected the Ministry of Internal Affairs system. This cannot but rejoice, since in the last five years payments to employees of the Ministry of Internal Affairs upon retirement have not increased.

Read more in the article: How much salary do military personnel receive upon retirement?

But from February 2020, the benefit amount will increase by 4%.

In addition, other types of financial assistance, as well as social benefits, remain in effect. [Total votes: 0 Average: 0/5]

Benefits for disabled people of the Ministry of Internal Affairs of groups 1, 2, 3 in 2020

Disability is established only after the degree of the disease has been established, which is why there is no specific list of diseases for which a group is issued. So one person may have visual impairment, which is equal to 70% deviation from the norm (after the examination, the second group will most likely be issued), and another person may have complete loss of vision (he will be assigned the first group). The staff conducting the medical and social examination will also take into account other illnesses the person has.

How to apply for disability?

- Social benefits that include:

- Receiving a social pension;

- Free or discounted travel on public transport (depending on the group);

- Discount on payment of fees when applying to court or a notary;

- Receiving a labor pension;

- Insurance payment.

- Medical:

- Providing medications that a disabled person needs;

- Vouchers to the sanatorium;

- Prosthetics, orthopedic products;

- Receiving medical care as part of rehabilitation;

- Housing:

- Discount on utility bills;

- Obtaining housing from the state;

- Tax:

- Tax deductions are provided for official employment;

- Transport;

- Property;

- Land.

- Labor benefits are provided if the disabled person continues to serve:

- Shortened working day no more than 35 hours;

- Vacation with pay of 30 days;

- Additional leave without pay for two months;

- The right to refuse to carry out labor activities outside of working hours, weekends or holidays;

- Tax deductions apply to wages, which reduce personal income taxes.

- Additional days off in the amount of 4 days, which are paid as working days.

- Vocational education received before entering the workforce. Only full-time training for a period of no more than 5 years is taken into account according to the scheme: two months for one month of work.

- Change of positions at different levels in the Ministry of Internal Affairs (taking into account the probationary period upon entry into service).

- Secondment, if it was carried out under Article 32 of the Law on the Service of the Russian Federation.

- A break in service in law enforcement agencies, if it was caused by the need to work in another government body or department.

- Service in the prosecutor's office, the Federal Penitentiary Service, the Federal Drug Control Service, the National Guard and fire safety.

- Work as a judge, in the Investigative Committee or customs, if special titles were obtained for this, etc.

The amount of money content indexation is subject to the inflation rate. The target for 2020 is 4.3%. Along with the 2% increase, payments rose by 6.3%. The inflation rate is forecast for 2020 to be 3.8%. This means that next year pensions will increase by another 5.8%. When calculating them, the following are taken into account: length of service, salary, rank.

What will be taken into account

Whether the pensions of the Ministry of Internal Affairs and other security forces will be canceled in 2020 or not, they began to talk from the beginning of the reform, which affected all citizens of Russia. The Ministry of Finance is considering the issue of providing security forces who have completed their service with a significant severance pay instead of paying them for life. This approach is justified, since service ends at a fairly young age. With severance pay, they can rest for 1-2 years, then retrain in a civilian profession to continue working. This solution is largely economically beneficial and annual savings will amount to 700 billion rubles. For now, this issue is only being discussed and no changes are expected in 2020.

We recommend reading: Re-registration with the employment center with payment of benefits

If permanent disability of group 2 is assigned, then early retirement is possible with social security amounting to 5686.25 rubles. (100% EF). If you refuse preferential medications, sanatorium treatment and travel to the resort, monthly payments will increase to 2 thousand rubles. Persons who became disabled group 2 in childhood will receive 11,307.47 rubles.

Russia provides insurance and social disability pensions. Although both types are indexed no lower than inflation, as stated in the Federal Law of the Russian Federation No. 350 of October 3, 2020, the government decided to increase pensions for disabled people in 2020 by 6.6%. Inflation is expected to be 3.8% in 2020.

Children with disabilities

Insurance coverage will increase from 1.01 to 6.6% for non-working pensioners. This is due to a change in the fixed part from 5334.19 to 5686.25 rubles, which is a coefficient of 1.066, and the size of the IPC from 87.24 to 93 rubles.

In addition to recalculation, government payments will be indexed in March 2020. They will increase by approximately 4%. The exact amount will be known at the beginning of the year. There are a few recipients of two types of financial assistance at the same time - there are not many of them, as a rule, these are veterans of the Great Patriotic War or residents of besieged Leningrad with disabilities. They receive government assistance and an old-age insurance pension.