After the death of a pensioner, the law of the Russian Federation provides for the payment of 2 full pensions of the deceased. Close relatives of a deceased pensioner or unemployed citizens who were dependent on him can receive the payment. To receive funds, you need to prepare the appropriate package of documents.

Relatives have the right to the pension not received by the pensioner for the current month in which the pensioner died. Payments can be received within six months from the date of his death. If after this time no one comes to collect the money, it will be added to the deceased’s estate.

Where does the pension go after a person dies?

After the death of a pensioner, all funds from his pension that were not paid to him for the current month may be:

- paid to his relatives;

- are left in the budget of the Russian Pension Fund (PFR), if the deceased has no relatives.

According to paragraph 4 of Art. 26 of Federal Law No. 400-FZ of December 28, 2013, unpaid insurance coverage can be inherited on a general basis in accordance with Chapter. 63 of the Civil Code of the Russian Federation (Civil Code of the Russian Federation). This happens if the relatives of the pensioner, who have the right to the deceased’s funds, did not submit documents within the prescribed period.

Relatives who lived with him . These are his:

- children;

- spouse;

- brothers, sisters;

- grandchildren;

- grandfathers, grandmothers.

In addition, regardless of the fact of cohabitation with the deceased pensioner, persons who were dependent on the deceased can apply for payment of funds. It can be:

- minor children of a deceased pensioner;

- pensioners;

- disabled people.

It is also worth noting that the unpaid pension of the deceased is divided among all relatives who applied for it in equal shares .

Marital relationships

An equally pressing issue remains the possibility of receiving an unissued pension of a deceased spouse. Since Federal Law No. 173 talks about granting such a right to children, grandchildren, parents, brothers and sisters, grandparents, as well as the disabled and dependents, the picture with spouses is not sufficiently disclosed.

In accordance with current legislation, widowers can also claim benefits from a deceased spouse. At the same time, if a time frame is set for everyone to submit a request, then there are no time limits for spouses. A widow or widower can submit an application to the Pension Fund even after several years. Of course, if this amount was not received by someone else earlier.

To do this, you will need to attach to the application a personal passport, a certificate of official marriage and death of the spouse, SNILS of the deceased person, papers confirming the loss of regular income (often we are talking about a work book), information about the salary and work experience of the deceased spouse.

If no one applies for an unpaid pension, this money goes to the state budget. However, if deductions were made through non-state funds, it is important to carefully read the agreements concluded with them.

The information in this article is provided for informational purposes only. We recommend that you contact our lawyer.

Upon the death of citizens who were pensioners, relatives have the right to seek help from the state. But to do this, it is worth first understanding what payments are due upon the death of a pensioner.

How much of the pension is inherited upon death?

After the death of a citizen, relatives are paid only the security that was accrued in the current month, but not paid in connection with his death. In other words, if a pensioner died before receiving funds in a given month, his relatives can receive them after his death. If the death of a citizen occurred after he received his pension for the current month, payment of pension funds to family members is not provided.

Not all types of pensions can be paid after the death of the pensioner. In accordance with the legislation of the Russian Federation, relatives of a deceased citizen can receive unpaid funds if during his lifetime he received any type of insurance payment or formed a funded pension .

At the same time, according to Article 63 of Law of the Russian Federation No. 4468-1 of February 12, 1993, this rule also applies to relatives of deceased military pensioners . They can also receive unpaid security funds, but only under one condition - if they performed the funeral of the deceased . This amount is not included in the inheritance, but in some cases it can be paid to the heirs on a general basis in accordance with the Civil Code of the Russian Federation.

It is worth noting that relatives can apply for unpaid pension funds of a deceased citizen only once . to take over his pension and receive funds monthly . At the same time, some categories of citizens, after the death of a pensioner, have the right to receive another payment - a survivor's pension.

Can a wife, after the death of her husband, receive his pension instead of hers?

Many women think that after the death of their spouse they will be able to receive his pension benefits instead of their own. Unfortunately, it is not. Registration of a deceased husband's pension for his wife is not provided for by the legislation of the Russian Federation .

However, in some cases, the widow of a pensioner can separately apply for a survivor's pension. This is possible only in cases specified by law. In this situation, you need to contact the appropriate department and submit the necessary package of documents.

To whom is the deceased's savings portion paid?

In accordance with the legislation of the Russian Federation, at present, many citizens, in addition to old-age insurance, also have a funded pension. Having reached retirement age, a citizen has the right to receive his pension savings in the form of a lump sum payment, urgent (within a certain period) or arrange payment of funds indefinitely.

This type of security has a special advantage over insurance payment - all pension savings on a citizen’s individual personal account are subject to payment to legal successors, that is, in certain cases they can be inherited . A citizen can bequeath his funded pension before retirement. In the event of his death, pension savings are inherited:

- according to the application for the distribution of funds ;

- in law.

Savings funds can be paid to absolutely any people (not necessarily relatives) who are indicated in the application for distribution of funds. The application also contains information about the amount of payments due to each heir.

If the deceased citizen did not leave a corresponding statement, all savings are inherited among first-degree relatives in equal shares. First-degree relatives are natural and adopted children, spouses and parents (adoptive parents). If a deceased citizen does not have first-degree relatives, his funded pension is distributed equally among second-degree relatives - brothers, sisters, grandparents and grandchildren.

It is worth considering that legal successors can receive a funded pension only if the citizen died before he was assigned a pension, or after an urgent payment was assigned, as well as after a lump sum payment was established but not paid to him. If the deceased was granted a funded pension for an indefinite period, then it cannot be inherited.

Limitations and significant nuances

Before you start making any plans, it is important to know one very significant feature - only those citizens who have not reached retirement age can receive pension payments. But this is not the only limitation. Only the legal heirs of the first and second stages and no one else have the right to claim this money. However, this is possible if during his lifetime the person receiving the pension submitted a corresponding application to the Pension Fund with an order to whom, if something happens, his money should be transferred. It may not even be relatives. This is somewhat similar to a will, but in a simpler form.

For inheritance, in addition to the documents that were listed earlier, you will also need a certificate of pension savings and a statement that the inheritance case has been opened.

To submit documents, citizens have several options, for example, personal appearance of the applicant or his authorized representative to the Pension Fund, as well as sending papers by registered mail (only copies certified by a notary are sent). After this, the Pension Fund is legally given no more than five days to review the received documents. As a result, a monetary payment will be made or the applicant will be sent a written official refusal explaining the reasons.

How to receive a pension for a deceased relative?

To receive pension benefits for a deceased citizen, you must contact the appropriate authority within six months from the date of death Where exactly depends on what payments the deceased received during his lifetime:

- insurance payments - to the Pension Fund of Russia;

- military pension - to the relevant law enforcement agency;

- pension savings - in the Pension Fund or Non-State Pension Fund (depending on where they were formed).

It is also worth noting that in case of payment of a funded pension, the successor has the right to refuse these funds in the same way as any inheritance. But to do this, he must submit a corresponding application to the pension fund.

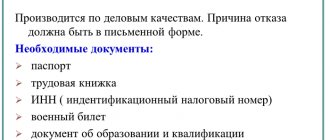

What documents are needed for registration?

To receive an unpaid insurance pension due to the death of a citizen, his relatives must provide the following documents :

- an application for payment of the amount accrued but not received by the pensioner (the application form is available on the official website of the Pension Fund);

- passport;

- death certificate of the pensioner;

- confirmation of family relationships (marriage certificate, birth certificate, adoption certificate, etc.);

- confirmation of the fact of cohabitation (certificate from housing authorities, copy of registration certificate, etc.);

- details for non-cash transfers if the applicant plans to receive funds to a bank account or card.

If the deceased citizen was a recipient of a military pension , then his relatives, in addition to the above documents, must additionally submit to the relevant law enforcement agency (military registration and enlistment office) the work book and military identification card of the deceased.

In special cases, other documents confirming certain circumstances, for example, a notarized power of attorney, court decision, etc. After the documents are accepted, employees of the relevant authority check the authenticity of the documents and make a decision - to transfer funds to the applicant or to refuse payment.

What is needed for this?

In order to receive the pension of a deceased pensioner according to the law, you should know that priority here will be given to those persons who lived together with the deceased citizen. Priority categories also include citizens recognized as officially disabled and those who were completely dependent on the pensioner. These can be not only disabled people, but also minor children.

In accordance with Federal Law No. 173, if the payment was identified as not received, that is, the person did not have time to receive it, the heirs are given the right to make claims within six months. However, this is only possible when it comes to a labor pension. If the pension is not a labor pension, but of another type, no more than four months are provided for the claim. Within the allotted time frame, you must submit a corresponding application and the required papers to the Pension Fund.

Documents for the Pension Fund:

- Personal passport of each applicant for an unreceived payment;

- Original death certificate;

- Papers certifying family ties with the testator (usually a certificate of official marriage or birth);

- Certificate of residence and registration.

The submitted application with documents will be reviewed within no more than one month.

For what period is the pension paid after the death of a pensioner?

In accordance with paragraphs. 1 clause 1 art. 25 of Federal Law No. 400-FZ of December 28, 2013, the territorial body of the Pension Fund stops accruing and paying security from the first day of the month following the month in which:

- the death of a pensioner occurred;

- a court decision has entered into legal force, according to which the recipient of the payment is officially recognized as dead.

Payment of pension benefits after the death of a citizen is carried out only for one month and only if the pensioner did not receive the amount of money due to him before his death.

Registration of certificates

In cases of death of a pensioner, his relatives have the right to apply to the Pension Fund within six months to receive a death benefit. It is necessary to choose the branch to which the deceased person belonged at the place of registration.

To receive assistance you will need to provide:

- a document confirming the death of a citizen (original certificate);

- certificate of death;

- Russian civil passport;

- work book or extract from a pension fund account, bank account.

The specified set of documents gives the right to receive compensation payments for funerals after the death of the pensioner.

Relatives also have the right to use an alternative option and write an application for a free funeral. In this case, funds are allocated from the budget for burial. You should contact a specialized municipal service that provides funeral services. At the same time, you must present a certificate confirming that funeral benefits were not paid to relatives.

Other payments in case of death of a pensioner

In addition to the pension not received by the deceased citizen, his relatives also have the right to receive funds that were due to the deceased pensioner, but were not paid to him in connection with his death . It can be:

- some Social Security benefits;

- payments that the deceased received as compensation for harm caused to life;

- alimony, etc.

In addition, in some cases, citizens can count on social benefits for funerals . In accordance with Article 10 of Federal Law No. 8 of January 12, 1996, this payment is a one-time payment and can be paid to any citizen (not only family members) who has taken responsibility for organizing the funeral.

The Pension Fund of the Russian Federation pays this benefit if the deceased pensioner was not officially employed . If he was working at the time of death, the funds are paid by the Social Insurance Fund (SIF).

In the event of the death of military pensioners, as well as citizens who were participants and disabled people of the Great Patriotic War, the costs associated with their burial are reimbursed by the Ministry of Defense of the Russian Federation .

To receive social benefits for the funeral of a deceased pensioner, you must contact the territorial office of the Pension Fund of the Russian Federation within six months You must have with you:

- application for payment of social benefits for funeral;

- passport;

- a certificate from the registry office, form No. 33, about the death of the pensioner;

- an extract from the work book of the deceased or another document confirming that on the day of death the pensioner was not employed;

- a certificate from the Social Insurance Fund (if the deceased pensioner was engaged in individual activities and was not subject to compulsory social insurance).

This benefit is paid on the day the applicant applies. The legislation sets a maximum payment amount . From February 1, 2020, the amount of this benefit is 5,946.47 rubles (in 2020 - 5,562.25 rubles). However, in some areas the payment is set in an increased amount due to regional coefficients.

8 085

Deadlines for receiving payments

The Civil Code provides for deadlines for the relatives of the deceased to apply in order to receive the payments due to him, accrued during his lifetime. Thus, they have the right to receive payments in the event of the death of a relative when applying to the Pension Fund within 4 months from the date of promulgation of the inheritance (the day of the pensioner’s death). If we are talking about the payment of labor pensions, then this period increases to six months from the date of death of the pensioner.

If no one lived with the deceased pensioner, or during the specified period no one applied to the Pension Fund with a request to pay the due funds, then they are transferred to the inheritance fund

and paid to heirs on a general basis. This happens after six months, all payments are made based on the norms of the Civil Code of Russia.

In such cases, in order to register an inheritance and receive it, as well as agree on the inclusion of pension payments in the general inheritance fund, you need to contact a notary at the place of residence of the deceased relative. If the notary refuses to register, then the inheritance can be registered in your name by contacting the judicial authorities, if there are legal grounds for such an appeal.

In order to take over the inheritance of a deceased pensioner, you need to obtain information about his financial support before death. For this information, you also need to contact the local authority of the Pension Fund, which, upon request, is obliged to issue a certificate stating what payments were accrued and not paid

. Within six months from the death of the pensioner, his heirs have the right to receive these funds legally.

To obtain a certificate of the amount due for payment, you need to draw up a corresponding application and make a request from a notary.

Comments (42)

Showing 42 of 42

- Chris 02/05/2017 at 18:56

Recently my mother’s husband, my stepfather, died. He was a military man and had been receiving a military pension for several years. It so happened that he died on December 1st. That is, he was not paid his pension for December. I heard that some pensions can be received after the death of the pensioner. Can my mom get this money?answer

- Yulia 02/06/2017 at 11:10

- a corresponding application (the form is available on the official website of the Pension Fund of Russia);

Yes, indeed, after the death of a pensioner, you can receive all types of insurance coverage, as well as military and funded pensions. However, this is only possible if the funds were not paid in the current month before the death of the citizen.

Your case is just like that. Your mother can contact the military registration and enlistment office (since military personnel receive support through the Ministry of Defense) if she lived with him and was his legal wife. To do this, she must submit the following documents within 6 months from the date of his death:

passport;

- husband's death certificate;

- Marriage certificate;

- confirmation of the fact of cohabitation (certificate from housing authorities, copy of registration certificate, etc.);

- work book and military ID.

answer

My father, a pensioner, was an individual entrepreneur. Two months ago he died. Shortly before his death, he re-registered the IP in my name. That is, it turns out that he himself became unemployed. I recently learned that funeral expenses can be reimbursed. Is it so?

answer

- Yulia 02/13/2017 at 11:12

Yes, you can submit a corresponding application within six months from the date of your father’s death and receive social benefits for funeral expenses. Since your father was not employed on the day of his death, in order to reimburse the costs you need to submit all the documents described in the article to the territorial body of the Pension Fund of the Russian Federation.

This benefit is paid on the day you apply for it and has a maximum amount, which from February 1, 2020 is 5562.25 rubles. If you live in areas with difficult climatic conditions, the payment amount may be increased in accordance with regional coefficients.

answer

Hello! Our mother recently died. She was disabled group 1. My father wanted to apply for the last pension he had not received, but it didn’t work out. The fact is that the parents’ marriage was concluded in the Kazakh SSR. During the move, the marriage certificate was lost. When the pension was issued, my mother issued a duplicate of this certificate in the registry office where they were registered, that is, in Kazakhstan. The document was written in Russian, but the blue stamp is in Kazakh and the note “repeated” is also in Russian. The pension fund demanded a notarized translation of this seal into Russian. Do Pension Fund employees have the right to do this, because it is very expensive? And where should we do this? We live in the countryside. Is there really no other way to get your pension? Sincerely, Irina.

answer

I'm a grandson. My grandmother was accrued a pension for 5 years, but she did not receive it because she did not need it - she lived in the village, and I helped her. Now my grandmother has died. Can I get her pension in five years, and what is needed for this?

answer

- Oksana 08/23/2017 at 19:08

That is, the pension was assigned but not received? Where was it credited then? When submitting an application for a pension, the pensioner must indicate the method of receiving it.

answer

Hello, my mother-in-law's aunt died. My aunt has no relatives other than my mother-in-law. In recent months she lived with her mother-in-law, but was registered in her apartment, where she did not live. Can my niece (my mother-in-law) receive my aunt's pension? She died before they gave it to her.

answer

Tell me, is it possible to receive pension compensation if my grandfather died before reaching retirement? Died 21 years ago.

answer

Hello, my husband died 10 years ago, 5 years before he reached retirement. Hot grid pension. He must have savings, how can he get them?

answer

Can I get compensation if my dad died before retirement? Died 18 years ago.

answer

Hello. Tell me, my mother is a pensioner, she took care of my sister, who is disabled, the care was officially confirmed by the Pension Fund of Russia (more than 60 months), the sister died. Can a mother receive her sister's pension instead of her own?

answer

- Edward 08/23/2017 at 19:06

No, she cannot receive her pension instead of her own. Moreover, if you mean monthly or compensation payments for care, then they should only be made by able-bodied people who have no income (i.e. if your mother received a pension and was simultaneously caring for her sister, then such a period may not be officially counted ). Therefore, your question is not entirely clear. If your mother was granted a pension after the death of her sister, then when calculating the pension, periods of care should have been included in the length of service, for which 1.8 points are awarded for each full year of care.

answer

Please tell me, my mother died eight months ago, she did not have time to receive her pension and additional payment in the amount of 5 thousand. What should I do in this case? Can I receive them after the expiration date (6 months)?

answer

- Oksana 09.25.2017 at 10:36

If you prove in court that the deadline was missed for a good reason. Contact the Pension Fund office at your mother’s place of residence.

answer

Hello, my mother received a pension on a Sberbank card, after the expiration of its validity the card was not reissued, they decided not to withdraw the pension, they did not withdraw it for two years, my mother died on the 20th. Do I have the right to an account and funds in my mother’s Sberbank account? And I also read that if there was no movement on the pension recipient’s account, the bank submits information to the Pension Fund and they suspend the payment of the pension! Why didn’t anyone tell us about this?! It turns out that the state took away my mother’s pension after a year since we stopped withdrawing? On what basis? Please help clarify the situation!

answer

My husband died on 7/27, and received his pension on the 11th. They gave the main pension, but the mayor’s 8 thousand social security simply refuses to give it back.

answer

Hello! 2.5 months ago my father passed away, a notification came from the Pension Fund of the Russian Federation stating that I, as a legal successor, have the right to payment, since he had not reached retirement age. I submitted an application and received a refusal due to the fact that the savings were in a non-state pension fund. I applied to the NPF, but when my father got a job, the HR department incorrectly indicated my name in the will, the fund said “you are not the only one with this situation and the case will win in your favor.” I filled out the application again, I was notified that I should receive a refusal indicating the reason and with this refusal I should send a package of documents to the court. A month has passed, the refusal has not yet arrived, I called the NPF and they told me that the refusal will come within 7 months. The question is: are they deliberately delaying the refusal or is this the case, the case is obviously a losing one or should we wait for the notification and go to court?

answer

- Trofim 06/10/2018 at 13:12

You should always go to court with a package of documents - your evidence.

answer

Hello... Our grandmother died on October 1st. Is it possible to get a pension? She was registered alone, but we lived with her for 2 years and the apartment was bought with maternity capital. But no one else is registered there except her.

answer

- Nina 02/02/2019 at 13:00

Hello! My aunt died on February 1st, can I get a pension for February?

answer

Good afternoon. Please tell me how I can find out the balance of my father’s pension?

answer

Hello, my mother-in-law died in 2005. She had an insurance, funded pension, 37 years of experience, and was a labor veteran (born in 1939). A year later, her son (my husband) died. I called the Pension Fund then and they told me that I was not eligible. Children and grandchildren only. Her grandson (my son) was small at the time. The Pension Fund of Russia said: when he becomes an adult, let him apply. Now my son is 21 (the only heir of his mother-in-law). How do you know if you should go to court? The Pension Fund says nothing. I know that her pension was 30,000. Please tell me. Thank you in advance.

answer

Hello, my mother filed for retirement at the beginning of May. The first one was paid only in October, for one month. On October 26, my mother died. They brought her pension for the previous unpaid months, but of course they didn’t give it back when they found out that she had died. Should they pay all the money to the father, i.e. to her husband?

answer

My husband’s father died, his father was in Chechnya and received a pension. Now dad is dead. Can a husband receive this pension, and how is it paid?

answer

Hello! On January 8, 2020, my husband, a group 2 disabled person, died. I received my pension on the 16th. He had an SMS alert enabled. Information about the receipt of the pension did not arrive. Questions: 1. Will the pension be paid? 2. If yes, when and how can we receive the money? 3. Because he was a working disabled person and made all social contributions; was he entitled to pension savings?

answer

Mom died on January 5th of this year, she did not receive a pension for January. She lived (registered) in an apartment alone, but required care because... I practically didn’t go. Social workers and I, my daughter, looked after her. The pension department sent me to a notary to draw up documents to receive my mother’s pension for January. Please tell me, is it possible to obtain documents in another way (certificate from a doctor, from the social security department)? After all, you will have to pay for a document from a notary? Thank you.

answer

That is, my children will be able to inherit a pension in one month? Where does all the other money that I gave to the state go? Does the pension fund just take them away?

answer

Hello. My father died in 2011, and in the chaos they forgot about payments. I understand that 7 years have passed. Can we count on any payments? And how can I check if someone received them (the left person)?

answer

- Antonina Makarovna 02.23.2020 at 22:20

I kindly ask you to clarify this question. The pensioner did not receive a pension for 4 years; payment was suspended because the pensioner lived with his daughter during this time. Will I be able to receive the unpaid pension during this time after the death of the pensioner from the pension department and what documents are required for the heirs? Thank you.

answer

Hello, how can I find out if a third party took the death benefits? Is it actually possible to find out where the money went? And what is needed for this? I am the son of the deceased.

answer

Hello! My dad died on April 19, but due to the stupidity of the Pension Fund employee, he did not receive his March pension! Do I now owe March and April, or what?

answer

Hello! Here’s a question: my father lived for two years in a nursing home, this institution took 100% of his pension (they said that a percentage would go towards his funeral). As I understand it, he will be buried, and where will the rest of the money that has accumulated over two years go?

answer

- Galina 10/02/2018 at 09:16

Maria, aren't you ashamed? They didn’t want to look after me, they handed over my father, and now you want some money? Horror!

answer

And they looked after him for free for these two years, and fed him for free? Some strange question))

answer

Good afternoon Grandfather died on September 29, 2018 at 3:46 am. Does the grandmother have the right to receive her grandfather’s pension if it is accrued on the 27th?

answer

Hello! My husband's grandmother died on September 20, his pension was on September 18. Tell me whether the pension payment is due for the next month and how to find out whether the grandmother had any other pension or money savings. My grandmother and I were not registered together, but due to illness in the last month of her life, we moved in with her and looked after her, and also buried her ourselves. The will does not name her husband, but her other grandchildren are listed.

answer

- Elena 11/28/2018 at 10:43 pm

Mom and dad were divorced, but lived together. Dad died on October 10, received his pension on the 18th. They didn’t give my mother a pension because she was divorced. Who can receive dad's pension?

answer

My husband worked at FGC UES. For his length of service, this organization was supposed to pay him some extra money to his pension every month. My husband died, can I get this money?

answer

- Galina 03/13/2019 at 06:04

Mom received her pension on the 5th and died on the 13th of the same month. What will they pay?

answer

Only for burial. The pension is received month to month. Your mother received money for the month in which she died. Accruals stop on the 1st day of the month following death.

answer

8 months have passed since my mother’s death (she died at 93). Can I get my unpaid pension?

answer