No matter how sad it may sound, work takes up most of a person’s life. There is an unspoken attitude that you need to get an education, find a profession you like and work until you retire.

Older people have a special attitude towards continuous work experience. In their opinion, this is an indicator of professionalism and dedication to their work, which in the future will ensure a relatively comfortable old age.

The modern generation rarely has such dedication to the profession, and thanks to pension and social reforms there is no understanding at all of the importance of work experience. In order to correctly place the emphasis, it is useful to understand why continuous work experience is needed.

Is continuous service cancelled?

During the Soviet period, permanent work was a guarantee of receiving an increased pension and additional benefits for length of service. The accrual of social benefits, for example, sick pay, also depended on the length of service. Therefore, people of the older generation still retain the concept and meaning of long-term work.

But what value does continuous experience have now? Firstly, the rules for paying sick leave have changed. It is not based on the period of work, but on the employee’s income for the previous two calendar years.

Secondly, the calculation of pensions has a complex formula, in which work experience is also not taken into account in the first place. Thirdly, various bonuses for length of service are now preserved mainly in state and municipal organizations. In some commercial organizations, this takes the form of additional employee motivation for long-term cooperation.

Currently, the term “insurance period” is more common, i.e. the time during which taxes and insurance premiums from the organizations where he worked were paid to the employee’s personal insurance account. Of course, there is a direct relationship: the longer you work, the higher the length of service and, accordingly, the more insurance premiums paid.

Thus, the terms “insurance period” and “continuous service” can be considered identical, but there are several differences.

Insurance experience can only be obtained from an official employer, who transfers all required payments. The insurance period includes all periods of work documented not only in the work book. For example, fixed-term contracts that are not reflected in the book also need to be taken into account to calculate the length of service (if there were insurance payments for them).

The insurance period is not interrupted, even if the person did not work officially or at all. Only contributions are taken into account, and the frequency with which they were made does not matter. For continuous work experience, it was necessary to work constantly; a break of more than three months meant actually resetting the accumulated years.

The Labor Code also does not contain information about continuous length of service, its calculation and meaning, unlike insurance.

It cannot be said that continuous experience has ceased to exist. It can be considered as an indicator of a person’s performance, constancy and reliability. It is always doubtful to see a mature specialist with an empty work book; for many employers, this raises suspicions that the employee is unreliable and a reason to refuse a job.

In what cases is continuous service maintained?

In other words, NTS can be called “length of service” in the enterprise. What to do if you decide to change jobs, will your work experience be interrupted?

According to the general rules established by law, if a citizen moves from one enterprise to another, then if the break between employment is less than one month, then the length of service will not be interrupted.

There are other exceptions to the rules. A break of 2 months is allowed if:

- an employment contract is concluded with an employer in the Far North when the previous one has expired;

- the person was released from the position he held in international organizations;

- a citizen lost his job abroad, in an organization created for the social security of the population. In this case, the period will be calculated from the moment of arrival in Russia.

In addition, it will not affect the length of service if the break is 3 months in the following situations:

- citizens were laid off at the enterprise due to reorganization, staff elimination or other optimization processes by order of the Government;

- when cases of temporary disability occur when moving from one employer to another. The period begins to be calculated from the date when the person regained his ability to work and returned to work;

- in situations where a person at his previous place of work was unable to perform his job functions due to illness, and subsequently found a new employer and entered into an agreement with him;

- When the number of students in an elementary school decreases, the teacher is laid off.

These nuances and features must be taken into account when taking into account the continuity of experience at a new place of work.

Important! Commercial organizations may also establish incentive bonuses for continuous work experience. Such norms are adopted at the discretion of the enterprise management and are enshrined in local acts of the institution.

Legal meaning

The concept of “work experience” has a collective meaning, so the terminology should be separated.

Lawyers distinguish three types of experience:

- Insurance period is the period during which insurance premiums are paid per person.

- Total length of service is the actual value of how many years a person has worked in his life without taking into account breaks in work.

- Continuous work experience shows how many years you have worked without breaks for less than one month (in exceptional cases three months)

The role of each seniority is different. For example, the total length of service does not matter if a person worked unofficially for a long time, since the amount of his income was actually not taken into account anywhere, and there were no insurance payments. Therefore, this will not in any way affect the increase in social payments and benefits.

Is it important?

Previously, in Soviet times, the National Tax Service was of great importance, as it influenced various benefits and the amount of old-age benefits. After 2002 A new system for calculating pensions began to operate and the conditions changed.

Now the NS for pensions does not play such a role, and its size will depend on how many insurance premiums were paid for you, as an employee, during your work, whether under a contract, while in the civil service or as an employee.

When calculating cash benefits for length of service, continuous work experience is not taken into account. But there are some exceptions when the NS can affect the pension, for example, if the insurance part is less than continuous, then the calculation will be carried out based on the NS readings.

In other cases, the amount of your regular cash income will depend on what your salary was, how many contributions were transferred to the insurance part and on the number of years of work.

As we have seen, in order to retire, you must have a total work experience of at least 7 years today, regardless of whether you have a continuous period of work or not. Since January 2020, amendments to the law have been adopted; the insurance period will increase and by 2024 you will have the right to a pension benefit only if you have worked for 15 years.

Why do you need continuous work experience?

Nowadays, insurance experience matters, so it is difficult to determine the true role of continuous work in legislative documents. However, in some situations it is continuous experience that matters:

- full calculation of temporary disability benefits;

- calculation of temporary unemployment benefits;

- determining the possibility of providing a person with additional education and advanced training;

- pension calculation;

- wage supplement, especially important for civil servants or municipal workers;

- receiving additional benefits if they are fixed at the federal or regional level;

- preferential retirement based on length of service in professions established by law.

Although the labor code now does not contain a definition of continuous length of service, its role has been preserved and, in one way or another, contributes to the receipt of social guarantees and compensation.

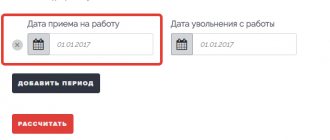

How and where to calculate work experience

When calculating how much length of service is necessary to calculate a pension for both Russian citizens and foreigners permanently residing in the Russian Federation who are entitled to old-age payments, it is necessary to take into account confirmation of the time they worked in the Russian Federation and abroad. The latter can be done provided that this norm is spelled out in the legislation or an international treaty of the Russian Federation or insurance premiums have been received by the Pension Fund of the Russian Federation.

Important! Exceptions for non-Russian citizens are established by Federal Laws or international treaties.

Such development also includes the terms from the above Art. 11. These periods before registration of a person in the compulsory pension insurance system, in accordance with the Federal Law of 04/01/1996 No. 27, are proven by a work book or other documents listed in Art. 62 TK.

If they are lost and cannot be restored, the testimony of at least two witnesses will help. The nature of the work cannot be confirmed using this method.

After registration in the system, the required periods are certified through personal accounting information.

The mode for calculating and justifying length of service, including the use of digital information and testimony for this purpose, is prescribed in Decree of the Government of the Russian Federation of October 2, 2014 No. 1015.

Calculations of how many years of experience are needed for a pension occur in calendar order from a whole year (12 months). Every 30 days of such output are reduced to months, and every 12 months - to full years. When several periods are combined in time, one of them is taken into account at the choice of the applicant or a more advantageous period is used.

This is important to know: How much is the preferential teaching experience for retirement?

The duration of each term is determined by subtracting the start date plus the day from its end date.

The corresponding periods are included in the output up to the day preceding the day of application for determination of the pension, excluding the cases indicated in parts 5 and 6 of Art. 22 Federal Law No. 400 dated December 28, 2013. In these cases, the date preceding the day of assignment of the insurance pension is used.

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

A special service has been developed for citizens, explaining how to find out their pension experience through government services. For this purpose, registered users order a statement of their personal account status from the Pension Fund of Russia.

Does continuous service affect sick leave?

Although the term “continuous service” does not actually exist, this does not mean that it has ceased to have meaning. For example, to receive sick leave benefits, the total period of work is important:

- with less than 5 years of experience, the amount of sick leave will be 60% of the salary;

- from 5 to 8 years – 80%;

- more than 8 years – 100%.

The calculation of temporary disability benefits has the following indicators:

- the employee’s average income two calendar years before the onset of the disease;

- average daily salary (calculated from the previous value);

- total work experience, which is recorded in the work book and contracts not included in the book.

At the same time, insurance contributions were transferred to the employee from each place of work.

Is continuous work experience taken into account when calculating pensions or sick leave payments?

At the moment, the use of three main categories of seniority is legally established:

- general;

- insurance;

- special.

To assign pensions, as well as when calculating sick leave payments (as a result of temporary disability), the concept of another length of service is used - insurance.

This is the time when contributions to the appropriate funds were made from wages or official income received. In addition, the total duration of employment is taken into account. NTS is taken into account exclusively in private, when the owners of commercial structures accept it as a starting condition for the system of motivation and incentives for their employees.

In addition, NTS is used to determine when, after employment, a new employee can go on vacation, namely after six months of continuous work at the enterprise.

What is the impact of continuous experience in 2018?

In connection with numerous reforms in the social sphere (pension reform, changes in methods of paying for sick leave), the meaning of continuous service has changed. Any benefit, state payments (pensions) depend on the accumulated insurance experience.

However, the role of seniority remains relevant. Length of service can be called continuous experience. This is a period when a person has worked for several years in a specific professional field without breaks.

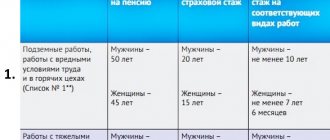

Not all workers are entitled to a preferential long-service pension. First of all, this is due to the specifics of the work, its danger, emotional and physical stress. Thanks to this, people receive additional compensation from the state.

The assigned areas of activity that qualify for early retirement at generally accepted ages include:

- state and municipal employees, including employees of internal bodies (not all, there are exceptions), the length of service must be at least 15 years;

- workers in the mining industry and underground work, 25 years of service;

- some types of work in hazardous industries, it is enough to work for 25 years;

- workers in emergency rescue operations (not all categories), minimum 15 years of experience, for firefighters - 25 years;

- employees in the field of education must have worked for at least 15 years;

- cultural and educational workers, depending on the position and specifics of the work, must accumulate a minimum experience of 15-30 years;

- medical workers of all categories and qualifications. For urban specialists – 30 years, for rural areas – 25 years;

- workers of the sea and river fleet and fishing industry. Women are entitled to early retirement after 50 years of age, and men after 55 years of age;

- military personnel are entitled to a pension after 20 years of continuous service.

This is a list of professions established by law in which a preferential pension is accrued primarily based on continuous service. It is possible to exclude the accumulation of slightly less working time if the employee stopped working for objective reasons, for example, downsizing or liquidation of the organization.

In this case, an early pension is issued. It is important to note that this is considered individually for additional applications.

What is it about

When determining the amount of old-age benefits, the length of service for calculating the pension (PV) is the most important criterion, since the greater it is, the higher the amount of this payment. The main document on the duration of professional activity is the work book, the form of which is determined in Decree of the Government of the Russian Federation of April 16, 2003 No. 225.

Pension experience can be general (now called insurance) and special. The insurance period (SS) is the total time of work taken into account when assigning a labor pension, without taking into account breaks in it, when insurance contributions were received by the Pension Fund of the Russian Federation, plus other periods that are listed in Art. 11 Federal Law dated December 17, 2001 No. 173.

This is important to know: Application for confirmation of work experience: sample 2020

Special length of service is the total time of labor practice (excluding breaks in it):

- in certain positions (for example, teachers in children's institutions need a minimum of 25 years of service to receive payments from the state; doctors working in rural areas - 25, and 30 - for those who work in the city);

- in specific industries (for military personnel - 25 years, sometimes they use mixed experience for a pension in the Ministry of Internal Affairs);

- in specific conditions - dangerous or harmful (for example, on ships of the Marine Fleet of the fishing industry for men - 25, women - 20);

- in established areas (in the Far North - 15 years).

A separate type of special vehicle is length of service - a set duration of work, the achievement of which allows you to receive pension payments upon dismissal from work, regardless of age. Length of service is used, for example, by men and women working in civil aviation flight crews, for whom it is equal to 25 and 20 years, respectively.

How many days of service is considered continuous?

From the name it follows that continuous experience must be permanent. The law defines the time frame when it remains uninterrupted. Separately, it should be noted that military service and maternity leave are included in continuous service, but some events can spoil it:

- The minimum duration of the unemployed period should be no more than one month in case of voluntary dismissal and up to three months in case of reduction or liquidation of the organization.

- Lack of work for up to a year in certain conditions: if care is needed for a minor child with HIV, when a spouse is transferred to another area, for working pensioners, sometimes for military personnel and veterans.

- Termination upon dismissal of an employee for guilty actions, for example, absenteeism, drunkenness, theft, fraud.

What is included in the NTS?

When calculating the period of continuous work experience, there are many reservations that were adopted at the legislative level and were in effect until 2002.

In addition to continuous work activity, the following is counted in the NTS:

- Military service, regardless of the type of military service. The main condition is that the break between the end/start of military duties and the start/end of employment or study is no more than three months.

- Leave for female military personnel who were forced to leave their places of service due to pregnancy, subsequent childbirth and time spent caring for children up to 1.5 years inclusive, as well as at the birth of a child and up to 3 years, with job retention.

- All types of work experience (paid).

- The period of study to obtain vocational or special education (including advanced training, higher education, secondary specialized education). A break is possible for no more than 3 months.

- Work in special areas in the agricultural sector. Including after the liquidation of collective farms.

- A period of forced break due to improper dismissal (based on reinstatement to the previous job).

The duration of educational and scientific activities at universities is not a reason for a break in scientific and technical training. Read more about your studies and work experience here.

What is continuous work experience and its legal basis?

NTS is a concept used to denote the duration of activities carried out by a citizen of the Russian Federation in one organization without interruption. However, the law establishes the terms and reasons according to which the NTS remains in force.

For a long time, the legislative basis of the NTS was Resolution of the Council of Ministers SSS No. 252, but it was repealed in 2006 due to the inconsistency of the provisions contained in the Constitution of the Russian Federation. However, in the Russian Federation there are still organizations that take into account the document of the Council of Ministers.

The concept of continuous work experience

Continuity of work experience began to be regulated by the Labor Code of the Russian Federation, Article No. 121. According to the Labor Code, the NTS will not affect the payment of sick leave or the calculation of a future pension, but will be taken into account when assigning bonuses and benefits in certain areas:

- for health workers - for many years of work;

- doctors and teachers receive benefits;

- allowance for work in special climatic conditions.

When is NTS not interrupted even in the event of dismissal?

Before the reform of the pension system, continuous work experience was characterized by a large number of exceptions.

It included subsequent employment after the employee’s dismissal. It is important that the temporary pause does not exceed 3/4 weeks (according to the legislative norms in force at different times, depending on changes). The number of transitions in one year was also taken into account. Without valid reasons, the first dismissal of a citizen from work at his own request was allowed. If within 12 months. the second occurred, then subsequent employment became part of the NTS if there were documented valid reasons that were entered in the work book. In exceptional situations - by individual decision of trade union organizations. Acceptable reasons include:

- Violation of a contract (labor/collective) by the management of the enterprise.

- Winning the selection for competitive positions.

- Disability/serious illness of family members requiring the presence and constant care of an employed citizen (must be certified by an appropriate medical certificate).

- Start of studies at any educational institution.

- Official transfer of service/work, relocation, including due to illness, of one of the spouses to another region.

- Effect of the provisions of mandatory state labor migration programs.

For disabled people, pensioners, guardians of 3 or more minor children, pregnant women and women raising a young child, there is a valid reason for the second dismissal within 12 months. – condition is optional.

In addition, the NTS remains even if there is a break of more than a month (up to 2-3 months), provided:

- changing jobs after employment in the Far North;

- moving from abroad. It was allowed if a citizen worked in international organizations, institutions and branches of state importance;

- moving from friendly countries (if there are international social security agreements);

- reorganization of enterprises and bodies of the Armed Forces. The same possibility was provided for in case of staff reduction or liquidation;

- the end of the period of disability or illness (according to the conclusion of the MSEC or VKK), as well as if dismissal from the previous place of work is related to health conditions;

- reduction of the teaching staff of primary classes (in particular, during the transition to a new education system or lack of students).

NTS is saved:

- in pregnant women who are also guardians/parents of young children and persons with disabilities under the age of 14 and 16 years, respectively. An important clarification: upon reaching this age, citizens must find a job;

- for the period of forced relocation of one of the spouses to another region;

- for all categories of employed pensioners.