The legislation of the Russian Federation is interested in increasing the birth rate in the country, therefore material benefits for young families have been and will be allocated.

Moreover, the amount of financial assistance to families with children is growing every year, even if in times of crisis this growth does not seem noticeable to many, so it’s time to talk about what the amount of gubernatorial payments will be in 2020?

Important! Financial assistance to families with children in Russia is divided into federal and regional, and if in the first case the benefit is paid in a fixed amount and from the federal budget, then in the second case the regions themselves decide how much and to whom to transfer money in the form of financial assistance. Funds are allocated from the local budget, and these are the gubernatorial payments.

Governor's pension: to whom and how much? (“Surgut Tribune” N 174, September 2005)

Governor's pension: to whom and how much?

Recently, non-working pensioners have often contacted the newspaper's editors asking for clarification on who is paid the governor's pension supplement, what its size is and whether it depends on length of service.

Director of the Surgut branch of the Khanty-Mansiysk non-state pension fund Elena Belyankina answers the question:

— The assignment and payment of additional pensions to non-working pensioners, public sector employees, as well as citizens who have achievements and services to the Khanty-Mansiysk Autonomous Okrug, is carried out in accordance with the Law of the Khanty-Mansiysk Autonomous Okrug N 81-oz dated December 16, 2004 “On additional pension provision for certain categories of citizens.”

Based on Article 6 of the above law, the amount of an additional pension for achievements and services to the Khanty-Mansiysk Autonomous Okrug - Ugra is set in the amount of 1,160 to 3,000 rubles.

For non-working pensioners - public sector employees, the additional pension consists of two parts: basic and funded. The minimum amount of the basic part of the additional pension is set at 700 rubles and increases depending on the length of work in the public sector of the Autonomous Okrug. Its maximum amount is 800 rubles.

An additional old-age and disability pension for non-working pensioners is established depending on the number of calendar years worked in the territory of the Autonomous Okrug and is: 500 rubles (for up to 5 years of experience); 600 rubles (with experience from 5 to 15 years); 700 rubles (with work experience from 15 to 20 years) 800 rubles (with work experience of more than 25 years).

Additional pension in case of loss of a breadwinner and social pension (with the exception of disabled family members under the age of 18 and full-time students in educational institutions until the age of 23; disabled children) are set at 400 rubles.

An additional social pension for people with disabilities of groups I and II since childhood is set at 800 rubles.

base.garant.ru

What is the average salary in Khanty-Mansiysk Autonomous Okrug

Author: Marina Demidova. Economist, mathematician. 30 years of experience in government statistics. Date: March 29, 2020. Reading time 7 minutes.

The average salary in Khanty-Mansiysk Autonomous Okrug in December 2020, according to official statistics, was 95,941 rubles, unofficial - 41,645 rubles. Over the period from 2013-2020, nominal wages grew continuously, while real wages showed a decline of 8.2%. According to state statistics, in December 2020, those engaged in scientific research and development received the most - 178,917 rubles.

Khanty-Mansiysk Autonomous Okrug (Yugra, or KHMAO for short) is a very small region of Russia, but very wealthy. Its main asset is oil deposits. According to statistics, more than half of all Russian oil is produced in the district. The economy of Khanty-Mansi Autonomous Okrug is the second largest in Russia after Moscow. In many regions of the Russian Federation there are people who want to go here to earn money. Because the average salary in Khanty-Mansi Autonomous Okrug is only slightly inferior to capital earnings.

In December 2020, residents of the region earned an average of 95,941 rubles. This is significantly higher than wages in many other regions of the Federation.

According to official data, the average income of district residents for January-December 2020 was 68,783 rubles.

Table 1. Average salary in Ugra for 2014-2020

| 2014 | 2015 | 2016 | 2017 | 2020 | |

| Wage | |||||

| nominal accrued, rubles | 57 976 | 60 068 | 63 568 | 66 719 | 68 783 |

| real, % compared to the previous year | 100,3 | 90,5 | 97,4 | 99,7 | 104,2 |

Over the past five years, accrued wages have been constantly growing, the increase compared to 2013 was 26.2%. At the same time, real earnings over the same period decreased by 8.2%.

Real wages are a quantity expressed in material terms that characterizes the goods that can be purchased for the amount of money received.

Rice. 1. Change in real wages and growth rates of accrued wages in Khanty-Mansi Autonomous Okrug, in% compared to the previous year

Recruiting agencies and job sites analyze offers from employers in the area and publish their own ratings. It must be said that they differ significantly from the data of the territorial body of Rosstat. And residents of the region more actively agree with these assessments.

Rice. 2. Average salary in Khanty-Mansi Autonomous Okrug in December 2020 according to official and unofficial statistics, rubles

According to the same unofficial source, the average salary of Khantymansi residents in January 2020 was 42,735 rubles, in February - 41,574 rubles.

Offers on the labor market

According to one of the open vacancy sites, out of more than 11 thousand vacancies, only 2% offer a salary of 100 thousand rubles. The vast majority of offers range from 25,000 – 40,000 rubles. (29.3%).

Table 2. Distribution of vacancies by salary level

| Salary range | In % of total |

| 0 – 15000 | 2,8 |

| 15 000 – 25 000 | 11,3 |

| 25 000 – 40 000 | 29,3 |

| 40 000 – 60 000 | 18,1 |

| 60000 – 100000 | 14,1 |

| 100 000 – + | 2,0 |

| By agreement | 22,4 |

Earnings at enterprises of different types of activities

Employees engaged in research and development earn the most in the Autonomous Okrug. In December 2020, they were paid an average of 178,917 rubles. The top three also include those working in the production of computers, electronic and optical products, as well as employees of financial and insurance companies.

Table 3. The highest paid activities in the economy of Khanty-Mansi Autonomous Okrug

| No. | Types of economic activities | Average salary, rub. | |

| in 2020 | in December 2020 | ||

| 1 | Research and development | 101 858 | 178 917 |

| 2 | Production of computers, electronic and optical products | 104 579 | 169 452 |

| 3 | Financial and insurance activities | 86 547 | 162 137 |

| 4 | Crude oil and natural gas production | 104 000 | 142 567 |

| 5 | Providing services in the field of mining | 91 357 | 139 312 |

| 6 | Public administration and military security; social security | 74 664 | 126 767 |

| 7 | Production of coke and petroleum products | 110 034 | 125 031 |

| 8 | Providing electricity, gas and steam; air conditioning | 79 288 | 107 087 |

| 9 | Repair and installation of machinery and equipment | 66 232 | 98 025 |

| 10 | Professional, scientific and technical activities | 67 809 | 95 979 |

Rice. 3. Oil in Ugra

According to official statistics, the lowest earnings were in textile manufacturing enterprises, a total of 12,037 in December 2020.

Table 4. Lowest paid activities in the labor market in December 2020

| No. | Types of economic activities | Average salary, rub. | |

| in 2020 | in December 2020 | ||

| 1 | Textile production | 22 989 | 12 037 |

| 2 | Production of rubber and plastic products | 22 164 | 24 252 |

| 3 | Crop and livestock farming, hunting and provision of related services in these areas | 25 678 | 26 567 |

| 4 | Electrical equipment production | 51 160 | 31 140 |

| 5 | Postal and courier activities | 32 921 | 32 928 |

| 6 | Wholesale and retail trade; repair of vehicles and motorcycles | 35 848 | 37 833 |

| 7 | Food production | 32 608 | 40 438 |

| 8 | Metallurgical production | 55 591 | 41 105 |

| 9 | Production of other non-metallic mineral products | 47 089 | 46 725 |

| 10 | Production of motor vehicles, trailers and semi-trailers | 49 030 | 49 655 |

Salaries of workers in certain professions

Let's look at the statistics from the district's employment service. Among the highest paid offers from employers are an engineer with a salary of 133 thousand rubles, a foreman with earnings of 120 thousand rubles

Table 5. Highest paid vacancies in the Khanty-Mansiysk Autonomous Okrug - Ugra in January 2020

| Categories | Professions, specialties | Maximum offer, rub. |

| Employees | Engineer | 133 056 |

| Master | 120 000 | |

| Mechanic | 108 385 | |

| Specialist (health and safety, purchasing, sales support department) | 95 448 | |

| Software Engineer | 80 546 | |

| Working professions | Car driver | 100 000 |

| Motor grader operator | 95 000 | |

| Bulldozer driver | 95 000 | |

| Lift operator | 91 779 | |

| Operator of a steam mobile dewaxing unit and mechanic for instrumentation and automation | 90 000 | |

| Unskilled workers | Worker for complex maintenance and repair of buildings | 45 000 |

| Waiter | 32 000 |

Source: Department of Labor and Employment of the Khanty-Mansi Autonomous Okrug

According to the district's employment authorities, the TOP 5 professions with the highest average earnings are headed by mechanics. They are paid an average of 75.2 thousand rubles.

Rice. 4. TOP professions with the highest average earnings, thousand rubles.

In the TOP-5 professions with the lowest average earnings, workers in the improvement of populated areas are in the lead. They receive an average of about 14 thousand rubles.

Rice. 5. TOP professions with the lowest average wage, rub.

Another source gives leadership in the TOP to the welder-installer. A representative of this profession turned out to be the highest paid specialist with a monthly salary of 89,167 rubles. in February 2020.

Table 6. The highest paid specialties in February 2020.

| Professions | Rubles |

| Welder-installer | 89 167 |

| Real Estate Sales Specialist | 86 858 |

| Welder | 78 365 |

| Head of Department | 77 167 |

| Supervisor | 73 563 |

| Dump truck driver | 72 445 |

| Excavator driver | 71 806 |

| Motor mechanic | 70 479 |

| Head of laboratory | 70 467 |

| Loader driver | 70 267 |

The government constantly talks about increasing wages for this category of workers. According to official statistics, the earnings of specialists in the region are as follows:

In the medical and scientific field the situation is as follows:

Many people want to make money in Ugra. To do this, it is not at all necessary to live here permanently. You can work on a rotational basis. Shift workers lay branches of oil pipelines and create infrastructure. And at the same time they earn much better than in their home region. All thanks to the increased northern coefficients and allowances for difficult working conditions.

The cities in the country with the highest wages included Surgut and Khanty-Mansiysk

Save and share information on social networks:

Average size of insurance pension in Surgut

The average insurance pension in Surgut after indexation is 20,200 rubles. Every year this indicator changes in accordance with the existing inflation in the country and is determined individually for each region.

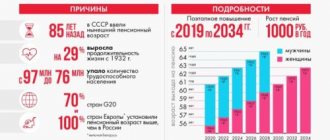

Many questions about pension payments concern citizens, so they are considered with greater care. After finishing work and entering a well-deserved retirement, for the majority, a pension remains the only means of subsistence, which is why it is so important that the state continues to carry out indexation every year.

Today, in order to retire, you must reach the appropriate age and have at least 8 years of work experience, if you plan to receive a labor pension, and not a social pension, for disability, loss of a breadwinner, and so on.

Since last year, the amount of pension points has been increased to 11.4, which was an unpleasant surprise for some. Working pensioners are not subject to re-indexation and do not make additional payments, even if they are already receiving payments from the Pension Fund.

No innovations other than re-indexing are expected in the coming years. The age is planned to be changed gradually, but this resolution has not yet come into force. The government plans, as always, to carry out pension reform slowly, without much of a shake-up for the population. In 2020, they want to improve the savings system so that pensioners can better take care of themselves in old age and save the necessary funds for the future.

Minimum pension amount

The amount of pension accrual depends on how many points a pensioner has and what his total length of service is, but it also happens that its amount does not reach the required subsistence level. The legislation clearly states that everyone has the right to receive a minimum pension, even if their length of service is not sufficient.

Today, the total number of pension points cannot be less than 11.4, and the amount of the minimum pension in the region is 11,300 rubles.

The minimum wage in Surgut

The minimum wage after indexation at the beginning of 2020 is 7,500 rubles. This value remains unchanged for all regions and cannot be changed, only indexed.

Additional payments (allowances) to pensions in Surgut

In accordance with the law, the amount of pension payments cannot be lower than the subsistence level; the missing funds are added from the budget after calculating the length of service and determining the required level of pension. An insufficient level of pension leads to the accrual of additional payments from the federal or regional budget, but they are available only to non-working pensioners.

The amount of such payment is always individual and depends on how much is missing from the minimum subsistence level established in the region.

Conditions for obtaining a pension in Surgut

Pensions are calculated only at the place of permanent residence. You can contact the Pension Fund in person with an application or submit it through the government services website and attach a scan of the necessary documents, the authenticity of which will later have to be confirmed.

In order for a citizen to qualify for a pension, he must meet certain legal requirements:

- Have the required work experience;

- Reach retirement age.

- SNILS;

- Military ID;

- Employment history.

- Statement;

- Work book;

- Passport;

- Certificate confirming terms of service in the army;

- Certificate of income.

A survivor's pension is issued only if you have a certificate of death and relationship. A disability pension can be issued after providing the appropriate medical report. Without these documents, payments will not be accrued.

Among the main documents:

When applying for an old-age pension at a branch of the Pension Fund, they will require:

Now it is possible to prove your employment even if you do not have the relevant documents on hand, to do this you need to go to court after receiving a refusal. In addition, every citizen has the right to send his application to the Pension Fund through the official website of government services or in person, but only to the department where he permanently resides.

Disagreement with the decision of a PF employee can be appealed in court. The decision will be implemented immediately after signing by the judge.

Addresses of branches of the Pension Fund of the Russian Federation in Surgut

— Department of the Pension Fund of the Russian Federation, Surgut, st. Mayskaya, 8/1 +7 (3462) 522-710 - Office of the Pension Fund of the Russian Federation, Surgut, st. 30 years of Victory, 19 +7 (3462) 778-815

Who is entitled to a social pension supplement in the Moscow region?

More than 106 thousand residents of the Moscow region will receive an increased social supplement to pensions from September 1. To date, a positive decision on additional payments from all regions of the country has been made only in the Moscow region. How this was achieved and whether we should expect a further increase in social payments is in the story of the 360 Moscow Region TV channel.

The regional social supplement to pensions in the Moscow region will increase from 7.5 thousand to 8.4 thousand rubles. This means that the government of the Moscow region will compensate the missing amount up to the subsistence level.

First of all, the innovation will affect non-working pensioners, pensioners receiving a disability pension who have no work experience, as well as residents of the region receiving a survivor's pension. Currently, 106 thousand people receive this additional payment. And from September 1, the number of recipients will increase to 152 thousand. Most of them - about 70% - are single elderly women over 70 who can no longer work and need special care.

The last time social supplements increased was at the beginning of the year from 6,812 rubles to 7.5 thousand rubles. Governor of the Moscow Region Andrei Vorobyov gave instructions to develop a similar increase in the amount of social payments for 2020. To increase additional payments to pensions, an additional 320 million rubles have been allocated from the Moscow region budget for four months until the end of this year.

According to the Minister of Social Development of the Moscow Region, Irina Faevskaya, 52 thousand old-age pensioners will receive an additional payment to their pension, 49 thousand receiving a survivor’s pension, and 4.6 thousand receiving a disability pension. Read more>>

360tv.ru

Minimum old-age pension from May 1, 2020: table by region

What is the minimum old-age pension in 2020 in Russia? How much is it, taking into account indexation from April 1, 2020 and the increase in the minimum wage from May 1, 2020? What is the minimum pension amount possible now? When can we expect the next promotion? We will tell you about the minimum amount of the pension for return today, taking into account all indexations and provide a table of values by region of Russia. Also see “The issue has been resolved: Medvedev announced an increase in the retirement age.”

What is “minimum pension”

Let us say right away that there is no such definition as a “minimum pension” in the legislation. But it is also clear that we are talking about an amount less than which the old-age insurance pension cannot be. How is the minimum size determined?

To do this, let us pay attention to the concept of long-term socio-economic development of the Russian Federation for the period until 2020. It says that the minimum level of pension is set not lower than the subsistence level of a pensioner in the region of his residence (Part II of the Concept, approved by Order of the Government of the Russian Federation of November 17 .2008 No. 1662-r).

Thus, the cost of living of a pensioner in his region can be conventionally called the size of the minimum old-age pension.

What does the minimum old-age pension consist of?

It happens that a person was assigned an old-age pension, but its amount turned out to be lower than the pensioner’s subsistence level. In this case, he is entitled to an additional payment up to the “minimum wage”. It is correctly called “social supplement to pension” up to the pensioner’s subsistence level. The right to it arises when 2 conditions are simultaneously met:

Keep in mind that in order to calculate the “total amount of material support”, almost everything is taken into account - all cash payments, including pensions and cash equivalents of social support measures to pay for telephones, housing, utilities and travel on all types of passenger transport (urban, suburban and intercity) , as well as monetary compensation for the costs of paying for these services.

The amount of PMP for determining the size of federal and regional social supplements to pensions is established in the whole of the Russian Federation and in each subject of the Russian Federation. So, for 2020 in the Russian Federation it is 8,726 rubles, and, for example, in Moscow – 11,816 rubles.

The pensioner must receive a larger payment (when choosing between federal or regional). Also see “Where to apply for a social supplement to your pension: to the Pension Fund or Social Security?”

Are indexations taken into account when determining the minimum pension amount?

Insurance pensions of non-working pensioners were indexed from January 1, 2020 to 3.7. The cost of one pension coefficient after the increase was 81.49 rubles, and the size of the fixed payment was 4,982.9 rubles.

Social pensions have been indexed since April 1, 2020 by 2.9%, taking into account the growth rate of the cost of living of a pensioner in the Russian Federation over the past year.

As a result of indexation of insurance and social pensions in 2020, the average amounts of old-age pensions in Russia were:

These figures are provided by the Pension Fund on its official website.

The cost of living for a pensioner has not changed in any way due to the aforementioned indexations in 2020. Therefore, the minimum old-age pension remained at the same level. On many Internet sites you can find tables with strange amounts as minimum pension amounts, where the cost of living is indexed by an indexation factor. This is fundamentally wrong. The minimum cost of living for a pensioner remained at the same level. No need to index it!

From May 1, 2020, the minimum wage was equalized to the subsistence level. Now the federal minimum wage is 11,163 rubles. However, this increase also did not in any way affect the size of the minimum old-age pension, since the pensioner’s cost of living did not change). Its size for determining the amount of additional payment to the pension is established in accordance with the Federal Law of the Russian Federation of October 24, 1997 N 134-FZ “On the cost of living in the Russian Federation” for the country once every next year . In the constituent entities of the Russian Federation, the size of the subsistence minimum for determining the amount of social additional payments is also established once a year no later than November 1 of the current year.

Legislative regulation of the issue

Article 5 of NLA No. 64-OZ fixed the categories of citizens who have a preference for receiving a pension supplement:

- Honored Writers of the Joint Stock Company.

- Artists with specific achievements in the region.

- People marked with insignia in the field of labor on the territory of Ugra.

- Individuals with years of service in the public sector.

Also, the above-mentioned legislative act distinguishes between compensation for services to the region and for length of service in government institutions, and the conditions for their registration.

Government Resolution No. 344-p establishes an algorithm for receiving gubernatorial payments to pensioners in the Khanty-Mansi Autonomous Okrug, a list of necessary documentation for registration, cases of suspension and termination of accruals and other important points.

An analysis of regional legislation allows us to come to the conclusion that Ugra pensioners who have dedicated their work for the benefit and prosperity of the region have certain privileges, and the local authorities provide them with all kinds of support measures.

What payments and benefits are due to pensioners of Khanty-Mansi Autonomous Okrug in 2018?

Often the only source of income for older people is their pension. However, the state at the federal level does not forget socially vulnerable categories of citizens and establishes various support measures for them. Regional authorities have the right to expand the range of assistance provided to pensioners.

Many people living in the Autonomous Okrug are wondering what payments are due to non-working pensioners of the Khanty-Mansi Autonomous Okrug in 2020. Thus, since January 2018, pension payments have been increased for such pensioners in the region. The labor pension increased by 3.7%, and the fixed payment amounted to 4982.9 rubles.

In Khanty-Mansi Autonomous Okrug, a monthly social benefit has been established for non-working pensioners. For 20 to 25 years of experience - 969 rubles, more than 25 - 1107. It is paid if the following conditions are met:

- A pensioner should not work.

- Permanent residence in the region.

- Lack of other social support measures expressed in monetary terms.

- Having at least 20 years of work experience in the territory of the joint-stock company.

Every year, from November to December, payments are made to pensioners for the day of the Khanty-Mansi Autonomous Okrug. According to clause 1 of government order No. 594-rp, funds are paid in the amount of 1,000 rubles for 2020. For the current year, 2018, the payment was not indexed and remained the same amount. These target amounts are assigned and provided without a request based on information about non-working pensioners stored in the departmental fund.

Since 2020, a lump sum payment to pensioners of the Khanty-Mansi Autonomous Okrug from the funded part of the pension began to be assigned. It is permissible to apply for a repeated payment once every five years. The amount provided is determined by the total amount of funds in the individual’s personal account.

Workers of the Khanty-Mansiysk Okrug are awarded a governor's bonus to the existing pension provision:

- for writers and artists - 3989 rubles;

- Ugra residents with one national level distinction - 1499;

- winners of two awards - 2745;

- if there are three or more orders - 3989.

The current legislation of the Russian Federation provides for payments to pensioners for children born before 1991. While caring for a child, a woman is awarded points, which are then multiplied by the cost of one such point. For one child, 2.7 is charged, for the second - 5.4, for subsequent ones - 8.1. Article 5 of Federal Law No. 420 fixed the size of the IPC in 2020 - 81.49 rubles. That is, payments to pensioners for children in Khanty-Mansi Autonomous Okrug (two) will be: (2.7 + 5.4) × 81.49 = 660.07.

Justification for coronavirus financial assistance.

The mayor of Moscow called on residents of the capital over the age of 65 not to leave their homes from March 26 to April 12 due to the threat of the spread of the new coronavirus.

In turn, young relatives are advised to refrain from contact with older people.

At the same time, citizens who have reached retirement age can count on financial support for self-isolation.

Muscovites who have chronic diseases such as diabetes, oncology, etc. will also be able to receive financial assistance.

The main recommendations for people suffering from chronic diseases are that they should stay at home and reduce the number of trips to stores and pharmacies.

According to the Decree of the Mayor of Moscow dated 03/05/2020. No. 12-UM, citizens in quarantine are allowed to leave home in emergency cases.

Employers, in turn, are obliged to provide the above categories of citizens with remote work, paid days off or sick leave.

By the way, if a sick leave is issued, citizens in isolation will be able to receive it delivered to their home. To do this, you just need to call the social security authorities.

Government measures also affected telecom operators. They are prohibited from limiting or completely disconnecting communications if the account of a subscriber in home quarantine has zero or a negative balance.

By the way, those Russians who arrived from countries with unfavorable coronavirus situations are also subject to a mandatory 14-day quarantine. The same goes for their family members.

Procedure for processing payments and benefits

To apply for gubernatorial payments to non-working pensioners in the Khanty-Mansiysk Autonomous Okrug in 2020, you must contact the Non-State Pension Fund of the Khanty-Mansiysk Autonomous Okrug or its division. In addition to the application, the institution must provide the following package of documentation:

- applicant's passport;

- pension document;

- employment history;

- certificate of membership in the Union of Writers and Artists;

- confirmation of awards;

- SNILS;

- TIN;

- personal account information.

When moving to another area, this type of payment remains with the individual.

Where and how to get benefits?

There is nothing complicated about the information about where and how to receive gubernatorial payments at the birth of a child in 2020, because it is necessary to collect a complete package of Documents giving the right to receive them, which again varies depending on the region in which the family lives, and then contact the social security authorities at your place of registration with this package.

Social Insurance representatives are required to write a statement, which is supported by documents. After which the application is considered within 10 days by a special commission, which makes a decision on whether payments will be accrued. After the specified period of time, the family receives a notification about the availability of payments or refusal, which must be explained.

Legislative regulation of the issue

Article 5 of NLA No. 64-OZ fixed the categories of citizens who have a preference for receiving a pension supplement:

- Honored Writers of the Joint Stock Company.

- Artists with specific achievements in the region.

- People marked with insignia in the field of labor on the territory of Ugra.

- Individuals with years of service in the public sector.

Also, the above-mentioned legislative act distinguishes between compensation for services to the region and for length of service in government institutions, and the conditions for their registration.

Government Resolution No. 344-p establishes an algorithm for receiving gubernatorial payments to pensioners in the Khanty-Mansi Autonomous Okrug, a list of necessary documentation for registration, cases of suspension and termination of accruals and other important points.

An analysis of regional legislation allows us to come to the conclusion that Ugra pensioners who have dedicated their work for the benefit and prosperity of the region have certain privileges, and the local authorities provide them with all kinds of support measures.

What payments and benefits are due to pensioners of Khanty-Mansi Autonomous Okrug in 2018?

Often the only source of income for older people is their pension. However, the state at the federal level does not forget socially vulnerable categories of citizens and establishes various support measures for them. Regional authorities have the right to expand the range of assistance provided to pensioners.

Many people living in the Autonomous Okrug are wondering what payments are due to non-working pensioners of the Khanty-Mansi Autonomous Okrug in 2020. Thus, since January 2018, pension payments have been increased for such pensioners in the region. The labor pension increased by 3.7%, and the fixed payment amounted to 4982.9 rubles.

In Khanty-Mansi Autonomous Okrug, a monthly social benefit has been established for non-working pensioners. For 20 to 25 years of experience - 969 rubles, more than 25 - 1107. It is paid if the following conditions are met:

- A pensioner should not work.

- Permanent residence in the region.

- Lack of other social support measures expressed in monetary terms.

- Having at least 20 years of work experience in the territory of the joint-stock company.

Every year, from November to December, payments are made to pensioners for the day of the Khanty-Mansi Autonomous Okrug. According to clause 1 of government order No. 594-rp, funds are paid in the amount of 1,000 rubles for 2020. For the current year, 2018, the payment was not indexed and remained the same amount. These target amounts are assigned and provided without a request based on information about non-working pensioners stored in the departmental fund.

Since 2020, a lump sum payment to pensioners of the Khanty-Mansi Autonomous Okrug from the funded part of the pension began to be assigned. It is permissible to apply for a repeated payment once every five years. The amount provided is determined by the total amount of funds in the individual’s personal account.

Workers of the Khanty-Mansiysk Okrug are awarded a governor's bonus to the existing pension provision:

- for writers and artists - 3989 rubles;

- Ugra residents with one national level distinction - 1499;

- winners of two awards - 2745;

- if there are three or more orders - 3989.

The current legislation of the Russian Federation provides for payments to pensioners for children born before 1991. While caring for a child, a woman is awarded points, which are then multiplied by the cost of one such point. For one child, 2.7 is charged, for the second - 5.4, for subsequent ones - 8.1. Article 5 of Federal Law No. 420 fixed the size of the IPC in 2020 - 81.49 rubles. That is, payments to pensioners for children in Khanty-Mansi Autonomous Okrug (two) will be: (2.7 + 5.4) × 81.49 = 660.07.

New procedure for crediting pension payments

From October 1, citizens of the Russian Federation who were assigned a pension after July 1, 2017, will receive a card from the national payment system “MIR” - funds will be credited to it. Those pensioners who use cards from other banks to receive payments will be transferred to the MIR system after the expiration of their bank card.

“At the same time, the legal deadline for banks to transfer clients to the MIR card is until October 1, 2020,” says a message on the Pension Fund’s website.

Procedure for processing payments and benefits

To apply for gubernatorial payments to non-working pensioners in the Khanty-Mansiysk Autonomous Okrug in 2020, you must contact the Non-State Pension Fund of the Khanty-Mansiysk Autonomous Okrug or its division. In addition to the application, the institution must provide the following package of documentation:

- applicant's passport;

- pension document;

- employment history;

- certificate of membership in the Union of Writers and Artists;

- confirmation of awards;

- SNILS;

- TIN;

- personal account information.

When moving to another area, this type of payment remains with the individual.

Legislative regulation of the issue

Article 5 of NLA No. 64-OZ fixed the categories of citizens who have a preference for receiving a pension supplement:

- Honored Writers of the Joint Stock Company.

- Artists with specific achievements in the region.

- People marked with insignia in the field of labor on the territory of Ugra.

- Individuals with years of service in the public sector.

Also, the above-mentioned legislative act distinguishes between compensation for services to the region and for length of service in government institutions, and the conditions for their registration.

Government Resolution No. 344-p establishes an algorithm for receiving gubernatorial payments to pensioners in the Khanty-Mansi Autonomous Okrug, a list of necessary documentation for registration, cases of suspension and termination of accruals and other important points.

An analysis of regional legislation allows us to come to the conclusion that Ugra pensioners who have dedicated their work for the benefit and prosperity of the region have certain privileges, and the local authorities provide them with all kinds of support measures.

What payments and benefits are due to pensioners of Khanty-Mansi Autonomous Okrug in 2018?

Often the only source of income for older people is their pension. However, the state at the federal level does not forget socially vulnerable categories of citizens and establishes various support measures for them. Regional authorities have the right to expand the range of assistance provided to pensioners.

Many people living in the Autonomous Okrug are wondering what payments are due to non-working pensioners of the Khanty-Mansi Autonomous Okrug in 2020. Thus, since January 2018, pension payments have been increased for such pensioners in the region. The labor pension increased by 3.7%, and the fixed payment amounted to 4982.9 rubles.

In Khanty-Mansi Autonomous Okrug, a monthly social benefit has been established for non-working pensioners. For 20 to 25 years of experience - 969 rubles, more than 25 - 1107. It is paid if the following conditions are met:

- A pensioner should not work.

- Permanent residence in the region.

- Lack of other social support measures expressed in monetary terms.

- Having at least 20 years of work experience in the territory of the joint-stock company.

Every year, from November to December, payments are made to pensioners for the day of the Khanty-Mansi Autonomous Okrug. According to clause 1 of government order No. 594-rp, funds are paid in the amount of 1,000 rubles for 2020. For the current year, 2018, the payment was not indexed and remained the same amount. These target amounts are assigned and provided without a request based on information about non-working pensioners stored in the departmental fund.

Since 2020, a lump sum payment to pensioners of the Khanty-Mansi Autonomous Okrug from the funded part of the pension began to be assigned. It is permissible to apply for a repeated payment once every five years. The amount provided is determined by the total amount of funds in the individual’s personal account.

Workers of the Khanty-Mansiysk Okrug are awarded a governor's bonus to the existing pension provision:

- for writers and artists - 3989 rubles;

- Ugra residents with one national level distinction - 1499;

- winners of two awards - 2745;

- if there are three or more orders - 3989.

The current legislation of the Russian Federation provides for payments to pensioners for children born before 1991. While caring for a child, a woman is awarded points, which are then multiplied by the cost of one such point. For one child, 2.7 is charged, for the second - 5.4, for subsequent ones - 8.1. Article 5 of Federal Law No. 420 fixed the size of the IPC in 2020 - 81.49 rubles. That is, payments to pensioners for children in Khanty-Mansi Autonomous Okrug (two) will be: (2.7 + 5.4) × 81.49 = 660.07.

How to make a payment?

Financial support from the Moscow authorities will be available to:

- Moscow pensioners over 65 years of age;

- citizens with chronic diseases, regardless of age. According to the appendix to Decree No. 26-UM, such diseases include:

- obstructive pulmonary disease;

- asthma;

- bronchiectasis;

- impaired pulmonary circulation, including cor pulmonale;

- condition after organ transplantation;

- kidney disease;

- oncology;

- diabetes mellitus, but only with insulin therapy.

Moreover, in order to receive 2,000 rubles, it is enough to go into self-isolation. The remaining 2,000 rubles will be paid after April 12.

This was reported by the head of the Moscow district police department Valentina Kudryashova.

It is quite easy to receive the indicated amounts; for this you do not need to visit the social security authorities and present any documents confirming your age or diagnosis. The payment will be processed without a request.

Citizens with chronic illnesses who are covered by support must call the call center at the number to receive the first 2,000 rubles.

In this case, the caller must be prepared to identify himself, confirm the existing diagnosis, and also provide his account information.

List of chronic diseases for self-isolation.

| List of diseases requiring self-isolation: |

| 1. Disease of the endocrine system - insulin-dependent diabetes mellitus, classified in accordance with the International Classification of Diseases - 10 (ICD-10) with a diagnosis of EC. |

| 2. Respiratory diseases from among: |

| 2.1. Other chronic obstructive pulmonary disease classified according to ICD-10 under diagnosis J44. |

| 2.2. Asthma classified according to ICD-10 by diagnosis J45. |

| 2.3. Bronchiectasis, classified according to ICD-10 with diagnosis J47. |

| 3. Disease of the circulatory system - cor pulmonale and pulmonary circulation disorders, classified in accordance with ICD-10 according to diagnoses I27.2, I27.8, I27.9. |

| 4. The presence of transplanted organs and tissues classified in accordance with ICD-10 according to diagnosis Z94. |

| 5. Disease of the genitourinary system 1 - chronic kidney disease stages 3-5, classified in accordance with ICD-10 according to diagnoses N18.0, N18.3-N18.5. |

| 6. New growths from number 2: |

| 6.1. Malignant neoplasms of any localization 1, including independent multiple localizations, classified in accordance with ICD-10 according to diagnoses C00-C80, C97. |

| 6.2. Acute leukemias, high-grade lymphomas, relapses and resistant forms of other lymphoproliferative diseases, chronic myeloid leukemia in the phases of chronic acceleration and blast crisis, primary chronic leukemias and lymphomas 1, classified in accordance with ICD-10 according to diagnoses C81-C96, D46. |

Chronic diseases for self-isolation.

After the call, an employee of the district social protection department will contact the citizen.

An advance of 2,000 rubles will be transferred to a social card, where pensions and other social benefits are usually transferred.

It is possible that the specified amount will come to the card along with the pension, as an additional payment for pensioners over 65 years of age.

At the same time, money for self-isolation is due regardless of whether a citizen over 65 is employed or not.

By the way, for those people who receive payments not on a plastic card, but at post offices, financial assistance will be delivered directly to their home. They do not need to write any statements for this.

Since these payments are transferred on the basis of the Decree of the Mayor of Moscow No. 26-UM dated March 23, 2020, pensioners in other regions of the country cannot count on them.

There is no federal legislation establishing payments for self-isolation during the coronavirus pandemic.

However, the authorities of other Russian constituent entities have the right to adopt their own regulations establishing similar assistance to the most vulnerable segments of the population to coronavirus.

Thus, earlier the authorities of Tambov, Ryazan and several other regions spoke about allocating additional financial resources to pensioners.

Payments to pensioners in the Moscow region.

By the way, payments will be made for residents of the Moscow region on the same conditions as for Muscovites. But the amount will be lower.

Thus, for home quarantine, an amount of 1,500 rubles is required, and after April 12, the citizen will receive the remaining 1,500 rubles on the card.

Procedure for processing payments and benefits

To apply for gubernatorial payments to non-working pensioners in the Khanty-Mansiysk Autonomous Okrug in 2020, you must contact the Non-State Pension Fund of the Khanty-Mansiysk Autonomous Okrug or its division. In addition to the application, the institution must provide the following package of documentation:

- applicant's passport;

- pension document;

- employment history;

- certificate of membership in the Union of Writers and Artists;

- confirmation of awards;

- SNILS;

- TIN;

- personal account information.

When moving to another area, this type of payment remains with the individual.

Increase in pensions for non-working pensioners of Khanty-Mansi Autonomous Okrug in 2018

Indexation of pension payments took place in January 2020. Pensioners began to receive increased financial support from the same month, and not as before - from February. The average pension in Ugra will be 20,175 rubles. Labor pensions will increase by 3.7%.

Federal benefit recipients will receive an increase in their monthly allowance by 3.2%. Some elderly people will receive a social supplement if they do not reach the subsistence level in the region.

posobie.net

This is interesting:

- MREO on the Highway of the Revolution state duty Discussions Bank details and the amount of state duty 80 messages BANK DETAILS Recipient of payment: UFK for St. Petersburg (State Traffic Safety Inspectorate of the Main Directorate of the Ministry of Internal Affairs of Russia for St. Petersburg and the Leningrad Region) Taxpayer Identification Number: 7830002600 Checkpoint: […]

- Housing subsidy in 2014 Those on the waiting list will receive housing subsidies totaling 6 billion rubles from the Moscow budget in 2020. According to the press service of the Moscow City Property Department, in 2016 families on the waiting list will be given subsidies to improve their housing […]

- Tsapki Kushchevskaya court Three life sentences for Tsapkov The Krasnodar Regional Court announced the verdict in the case of a gang from the village of Kushchevskaya On Tuesday, the Krasnodar Regional Court sentenced three defendants to life imprisonment in the case of a gang from the village […]

- Application for renewal of a security guard's license Renewal of a private security guard's certificate ANO "Caiman" is engaged in professional training and advanced training for employees of private security organizations and offers advanced training for private security guards when renewing a private security […]

- Work in Novosibirsk as a tractor driver with accommodation Work in Novosibirsk as a tractor driver with accommodation Individual entrepreneur • Novosibirsk Mechanic for repairing road-building machines and tractors 5 Limited Liability Company “SibirHydroService” • […]

- Accounting contractual penalties Reflection of expenses for using the site Accounting entries for costs associated with the site Example: company employees created the site independently, without the involvement of a web studio. The costs of creating a website consist of: - salaries [...]