( 10 ratings, average: 5.00 out of 5)

Let's consider what, in essence, the system of guaranteeing pension savings is. Three years ago, our country passed a law according to which funded payments were separated into a separate type of pension provision. But not all citizens have the opportunity to work until retirement, and sometimes unscrupulous employees do not contribute anything at all. A situation may arise when, at retirement age, a person will be left without any money at all. To prevent this from happening, a guaranteed pension was created.

- How is the pension formed?

- Sources of pension accumulation

- Actions when revoking a license from a non-state PF

- Deposit insurance institution

- Fund guaranteeing pension savings

- What is the fund made up of?

- Conclusion

Pension savings: what it is and how it is formed

Pension savings are understood as funds available in the individual account of a citizen registered in the OPS system of an extra-budgetary fund.

Since the adoption of the federal normative act “on insurance pensions”, these funds have received the status of self-sufficiency.

The funded part of the pension consists of:

- Insurance contributions paid by the employer in accordance with previously effective pension regulations (before the adoption of a number of pension reforms, state old-age benefits consisted of three parts (now there are two), one of which was funded);

- Additional contributions to the funded part (voluntary contributions from citizens and participation in co-financing programs);

- Income from investment activities of the named funds;

- Amounts of money transferred under the assistance program in the form of a maternal certificate.

Peculiarities:

- In the event of the death of a citizen who formed the funded part of the pension, his close relatives or persons mentioned in the law become the legal successors of the funds;

- Pension savings are formed from:

- Funds transferred by the direct owner of the individual account or persons obliged to make such fees in his favor;

- A payment reserve that guarantees the provision of accumulated funds.

Payment of the difference under the state guarantee Printable version

In this article we will talk about what payment of the difference to pensioners under a state guarantee is, how to check it and register it.

The Kazakhstan pension system guarantees the safety of pension savings taking into account inflation. This is stated in paragraph 6-3 of Article 6 of the Law “On Pensions”, as well as in the Rules for the implementation of these guarantees by the state.

According to the rules, Kazakhstanis may receive the right to payment of the difference between the amount of compulsory pension contributions actually made, compulsory professional pension contributions, taking into account the level of inflation, and the amount of pension savings formed through compulsory pension contributions, compulsory professional pension contributions.

This payment is a one-time payment and is calculated according to special formulas.

Who is entitled to receive a state guarantee payment?

Payment of the state guarantee is due:

- persons who have reached retirement age;

- persons who received disability of groups 1 and 2 for an indefinite period;

- foreigners and stateless persons who left for permanent residence outside the Republic of Kazakhstan, on the date of withdrawal of pension savings from the UAPF;

- heirs of the person entitled to receive payment in the event of his death.

An authorized person (if you have a notarized power of attorney) can apply for paperwork to receive payment.

Where to contact

To find out whether you are entitled to a guarantee payment, it will be more convenient to use a special online service, which is located in the left block of the main page of the eGov.kz portal.

If the answer is positive, you must contact the nearest branch of the NJSC GC “Government for Citizens” to submit an application.

! If a citizen has previously applied for this payment or does not have the right to this payment, then this service will report this.

Required documents

For old-age pensioners who are already recipients of pensions and other social benefits, the difference in payment of the state guarantee is assigned on a proactive basis without the need to submit an application or additional documents.

The remaining persons entitled to payment of the difference provide the following documents to the NJSC GC “Government for Citizens”:

- statement;

- identification document;

- information about the recipient's bank account number.

Foreigners provide the following documents:

- statement;

- international passport;

- information about the bank account number;

- if his attorney is applying on behalf of a foreigner, then all copies of the necessary documents must be notarized.

Attorneys must provide their own identification document, the original power of attorney or its notarized copy.

According to paragraph 8 of Chapter 2 of the Rules, in the event of the death of a person entitled to payment of the difference, the amount of payment of the difference is paid to the heir in the manner established by the Civil Code of the Republic of Kazakhstan.

In this case, the heir is:

- application form;

- an identity document of the heir (passport of a citizen of the Republic of Kazakhstan, identity card of a citizen of the Republic of Kazakhstan, identity card of a stateless person, residence permit for a foreigner in the Republic of Kazakhstan, foreign passport);

- a notarized copy of the death certificate of the person entitled to payment of the difference;

- the original or a notarized copy of the certificate of inheritance, or the original or a notarized copy of the agreement on the division of inherited property, a court decision that has entered into legal force;

- information about the heir's bank account number.

Procedure for consideration of appeals

NJSC GC “Government for Citizens”, within 2 working days from the date of acceptance of the application, requests from the UAPF information about the availability of an individual pension account and the amount of pension savings formed from mandatory pension contributions and (or) mandatory professional pension contributions.

The UAPF provides the requested information to the NJSC GC “Government for Citizens” within 2 working days.

NJSC GC “Government for Citizens”, within 1 working day from the date of receipt of information, reconciles information on the amounts of pension savings received from the Unified Pension Fund with the amount of mandatory pension contributions, mandatory professional pension contributions, taking into account the inflation rate for the corresponding period.

The formulas used in calculating the amount of payment of the difference are prescribed in paragraph 13 of Chapter 3 of the Rules.

NJSC GC “Government for Citizens”, within three working days after calculating the amount of payment of the difference, creates and sends an electronic layout of the recipient’s case (EMD) to the authorized social security body.

The authorized body, within five working days from the date of receipt of the EMD, makes a decision on the appointment or refusal to assign, indicating the reasons for the refusal to pay the difference, and sends it to the branch of the NJSC GC “Government for Citizens”.

NJSC GC "Government for Citizens" notifies the applicant within two working days of the appointment or refusal (indicating the reasons for the refusal) to pay the difference by sending an SMS alert to the applicant's mobile phone specified in the application.

Next, NJSC GC “Government for Citizens” interacts with authorized bodies regarding the transfer of budget funds.

Having received budget funds, NJSC GC "Government for Citizens" generates payment orders with payment purpose code 030 in accordance with the payment schedule and transfers the amount of payment of the difference to the recipient's bank account opened in second-tier banks or organizations carrying out certain types of banking operations opened on territory of the Republic of Kazakhstan.

Examples of calculating state guarantees

Payment of the state guarantee is calculated using the formula:

Amount of payment under the state guarantee = amount (OPV + CPI) - amount (NPF), where:

- OPV+CPI – the amount of contributions taking into account the inflation rate;

- NPF – the amount of pension savings in JSC UAPF.

If, as a result of investment, the amount of savings in the fund turns out to be greater than the amount of pension contributions taking into account the level of inflation, then the state guarantee is not provided.

Example 1:

Askarov Azamat Armanovich, born March 25, 1960

The moment of entitlement to pension payments from JSC UAPF in connection with reaching retirement age is September 25, 2018.

At the time of entitlement – September 25, 2018, the amount of mandatory pension contributions (CPC) was 55,241.70 tenge.

The amount of OPV taking into account the inflation rate (OPV + CPI) is 161,714.57 tenge.

The amount of pension savings in UAPF JSC, taking into account investment income (APF) – 116,178.62 tenge.

Calculation of the payment amount under the state guarantee: the amount of OPV + CPI minus the amount of NPF - 161,714.57 - 116,178.62 = 45,535.95.

The total amount of payment under the state guarantee is 45,536 tenge .

Example 2:

Ivanova Galina Sergeevna, born September 15, 1957

The moment of entitlement to pension payments from JSC UAPF in connection with reaching retirement age is September 15, 2015.

At the time of entitlement – September 15, 2015, the amount of mandatory pension contributions (CPC) was 489,326.93 tenge.

The amount of OPV taking into account the inflation rate (OPV + CPI) is 577,889.53 tenge.

The amount of pension savings in UAPF JSC, taking into account investment income (APF) – 579,864.24 tenge.

Calculation of the amount of payment under the state guarantee: the amount of OPV + CPI minus the amount of NPF - 577,889.53 - 579,864.24 = - 1,974.71 , that is, the amount of payment under the state guarantee is not due and the authorized body makes a refusal decision .

Guarantee system

The system of guaranteeing payments of pension savings began to operate simultaneously with the adoption of the latest pension reform - in 2015. Its main goal is to protect the reserves formed by citizens and ensure their subsequent payment.

The created system implies two levels of protection, in particular:

- Reserve fund for payments from compulsory insurance;

- Statewide Pension Guarantee Fund (PFGF).

Deposit insurance institution

In accordance with federal legislation (422FZ), our country has a Deposit Insurance Agency (DIA). It is necessary to fully guarantee pension payments. Its tasks include:

- transfer of money as a guarantee of compensation under the law,

- collection of contributions that make up the guarantee fund, as well as control of the regularity of their receipt,

- investing money in the fund to make a profit,

- bearing responsibility for the members of the system,

- performing actions to complete the activities of funds in cases established by the legislation of our country (FZ-422).

In fact, the DIA is intended to protect the funded pension of individuals and become a guarantor of the safety of all money located in a separate part of their account. But this does not include the additional income they accumulated. The guarantee is provided by designated transfers from pension savings. Moreover, their value cannot decrease over time.

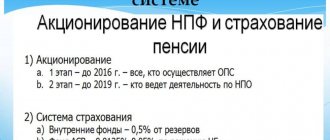

It should be noted that the pension security system can be called consisting of two stages, namely including:

- money that is a pension insurance reserve, formed in each non-state pension fund,

- guarantee fund, controlled by the DIA.

The responsibilities of the DIA include keeping records of each member making up the list of NPFs . To join the guarantee system, a non-state PF must meet the following requirements:

- have a license;

- go through the process of incorporation;

- must pay dues;

- have a satisfactory decision from the country's Central Bank after the fund has been checked accordingly.

If a non-state fund is not listed in the register and was unable to get there, it should no longer enter into compulsory pension insurance agreements. He is also required to transfer all previously accumulated funds to the Pension Fund.

How the system works

The return of pension savings under the payment guarantee system is carried out upon the occurrence of an insured event, the most likely of which is the revocation of the license of the NPF, the declaration of bankruptcy or the termination of the fund’s activities due to non-compliance with its obligations for other reasons.

If these circumstances arise, the citizen is provided with the following protective measures:

- The safety of savings is ensured by the Central Bank of the Russian Federation;

- Responsibility for payments, their accumulation and increase is assigned to the DIA (deposit insurance agency).

Within three months, after recognizing the case as insured, the Central Bank of the Russian Federation automatically initiates the transfer of funds accumulated by the citizen from the NPF account in favor of the Pension Fund, which assumes obligations for:

- Investing savings and using financial instruments that allow you to increase the initial amount of savings;

- Payment of savings, the decision on which was made before the occurrence of an insured event with a non-state pension fund.

The law allocates funds for pension savings that are considered obligatory for payment . These include:

- Funds allocated under the maternal certificate;

- Accumulated during the operation of the co-financing program;

- Insurance contributions transferred by the employer (with the exception of income from their investment during the period of stay in the accounts of the NPF).

A citizen who has invested pension savings in a non-state pension fund, which is now being forcibly liquidated, can claim to receive investment income from their use, provided for in an agreement with the said institution, only if the sale of his assets ensured debit after the fulfillment of all financial obligations.

If an insured event occurs with a non-state pension fund, the insured person (owner of an individual account) has the right to dispose of guaranteed payments according to the following alternatives:

- Grant the right to manage funds to the Pension Fund of Russia;

- Conclude an agreement and transfer savings to another NPF.

How the decision was made to reduce and cancel the funded part of the pension

In September 2014, information appeared that the state decided to send the pension savings of Russian citizens for 2014 to the distribution system. Therefore, the funded part of the mandatory pension system was suspended for a year, and then for an indefinite period. Previously, the Government thought to reset the funded part of the pension only for those who were “silent”. These are those citizens who have not notified the relevant authority of their desire to transfer their own pension savings to a private management company and non-state pension fund. Many assumed that from 2014 there would be a reduction in contributions to the funded part of the pension from 6% to 2%, and the remaining 4% would be redistributed to the insurance part of the pension. The following development of events is also possible: a citizen writes a statement and all 6% will remain in his funded part.

DIA

The Deposit Insurance Agency is the basis of the guarantee system, implementing the following tasks:

- Providing warranty compensation in cases provided for by law;

- Investing funds of fund participants to increase them;

- Collection and control over the receipt of guarantee fees;

- Monitoring activities and taking measures to eliminate unscrupulous participants in the system.

Features of DIA:

- Provides payments in the event of an insured event from a special fund;

- The amount of the provided guaranteed payment includes amounts placed in a special part of the personal account (additional income from investment is not taken into account);

- Forms a register of fund participants and carries out their accounting.

Entry into the DIA is considered mandatory for non-state pension funds. If the agency refuses to include a non-state pension fund in the register, the latter is obliged to cease activities and transfer the existing reserves to the management of the state extra-budgetary fund.

Conditions for including NPFs in the register of the guarantee system:

- Availability of a valid license;

- Successful completion of an audit organized by the Central Bank of the Russian Federation;

- Making mandatory contributions;

- Carrying out the corporatization procedure.

The official website of the agency contains a list of non-state pension funds included in the register of participants in the guarantee system. Among these are (the list is not complete):

- VTB PF;

- Future;

- Lukoil-Garant;

- GAZFOND pension savings;

- Russian Standard NPF;

- NPF Sberbank;

- National;

- KIT Finance;

- HERITAGE;

- Agreement.

List of NPFs included in the system

To date, the pension savings guarantee system includes 46 participants who have passed extensive checks from the Central Bank of the Russian Federation with positive results and were able to confirm their eligibility in the chosen industry.

Find out who is entitled to a lump sum payment from the funded part of the pension. Does the child of a deceased common-law husband have the right to inherit pension savings? The lawyer's answer is here.

How to refuse the funded part of the pension in favor of the insurance one? Details in the article.

The activities of full members of the guarantee system are fully approved at the state level and meet all the requirements specified in Federal Law-422. Among the most popular and sought after non-state pension funds are:

- VTB Pension Fund;

- Gazfond-Pension savings;

- Heritage;

- NPF Sberbank;

- Transneft and Surgutneftegaz;

- Lukoil-Garant;

- Uralsib and many others.

Video: Latest news

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- 8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

For future retirees

Pension Fund under DIA

Guaranteed pension payments are formed within a special fund managed by the DIA, and their accumulation is carried out from the following sources:

- From contributions of NPF participants:

- At the expense of citizens' savings;

- Pension Fund contributions;

- Revenue from investment activities and projects;

- Penalties charged for late fulfillment of obligations by participants.

Key points in forming the fund:

- The law provides for minimum limits on participant contributions and the volume of fund reserves;

- The contribution rate is set/adjusted by the Central Bank of the Russian Federation;

- Payment of premiums is the responsibility of the insurer, the deadline for transferring payment is April 15 of the year following the reporting period;

- For late fulfillment of the obligation to pay the contribution, a penalty is imposed in the amount of 0.1% of the amount of the arrears;

- The accumulated reserves of the fund are distributed in the following areas:

- Payment of guarantee compensation in the event of revocation of a license from a non-state pension fund or the occurrence of another insured event;

- Ensuring the operation of the system and covering the costs associated with it;

- Problems that the fund solves:

- Ensuring the safety of citizens' savings;

- Ensuring compliance with the rights of depositors.

What does the new pension formula imply?

In the fall of 2014, the government approved a new pension formula, which involves one significant innovation. It consists in the fact that the calculation of the insurance part of the labor pension will be carried out not in absolute numbers, but in pension coefficients. The pension coefficient is an indicator designed to evaluate a citizen’s work activity every year. It is equal to the ratio of the employee’s salary, with which the employer paid contributions to the Pension Fund for him in a particular year, to the maximum salary, with which, according to the law, employers pay contributions to the pension insurance system. This is done from the so-called maximum annual earnings, which in 2013 was 568,000 rubles.

That is, according to the new pension formula, those citizens whose annual salary would be 568,000 rubles and who, in addition, refused the funded part of the pension, could receive the maximum number of points equal to 10.

The decision of the Ministry of Labor has been repeatedly criticized due to the fact that this mechanism is unfair to those Russians whose income is less than the specified figure. After a while, the developers of the formula decided to make a number of transitional provisions. For example, in addition to the increase in the maximum salary announced earlier, a parallel increase in the value of maximum points is envisaged.

Which Russian citizen will be able to “earn” the maximum number of odds? This will be the category of workers for whom employers pay insurance contributions to the Pension Fund in full and at the maximum salary, which is popularly called “white”. In short, with the new pension reform, people will have to work for a long time, and show a “white salary”. When hiring, preference will need to be given only to clean employers who honestly pay taxes on the maximum salary. With the advent of the new formula, strict requirements will be introduced that will need to be met in order to become eligible for a retirement pension upon reaching the appropriate age. In fact, the maximum value of 10 points in the new pension formula appears only after 3 years, that is, in 2021, when the maximum base for calculating contributions reaches approximately 1,100,000.00 rubles. You need to understand that this is an approximate figure without taking into account annual inflation.

Chairman of the Committee of Civil Initiatives Alexei Kudrin, the former Minister of Finance, harshly criticized the pension reform, saying the following: “The new pension formula leads to the fact that all the coefficients that a citizen accumulates will depend on current government revenues and budget transfers. We are living today at the peak of oil prices, and what is happening to us now – both our deficit financing capabilities (DFF) and our transfers – is a somewhat artificial story.”

Why is state insurance of pension savings necessary?

Providing for compulsory pension insurance is one of the parts of the system built in the state, the purpose of which is to guarantee financial security for citizens who can no longer work, for example, due to reaching old age. It’s good when there are children and grandchildren whose financial condition allows them to provide quality care for an elderly relative, but in modern conditions this is not always possible. In addition, not all descendants are conscientious and ready to help their parents. And many pensioners simply have no one to count on; they are alone.

An elderly person is no longer able to work fully; concentration drops, forgetfulness occurs, and he needs more rest and peace. But the completion of a work history is not the end of existence. Life goes on, and a person needs money.

Another category of citizens who require social support are children who have lost their breadwinner. The pension is paid to them until they reach the age of majority or until they graduate from a secondary specialized educational institution or university where the child is studying full-time.

Another type of pension is for disability. A person who has received injuries that become an insurmountable obstacle to his work activity, or has been disabled since childhood and finds it incredibly difficult to find a decent job, have the right to a normal life, which is provided by social benefits.

Material support for these categories of disabled and economically vulnerable citizens in the Russian Federation is provided through funds from compulsory pension insurance (MPI).

Who is entitled to a state guarantee?

The state guarantee is paid to depositors upon the onset of the right to pension payments, and this is:

- persons who have reached retirement age;

- people with disabilities of groups I and II, if the disability is established for an indefinite period;

- foreigners and stateless persons who have left for permanent residence outside the Republic of Kazakhstan, who have submitted documents determined by the legislation of the Republic of Kazakhstan, confirming the fact of departure.

- heirs in the event of the death of the depositor (recipient) who had the right to payment under the state guarantee.

Let us remind you: the age at which the right to receive pension payments begins is 63 years for men, and for women it increases annually by six months.

In 2020, women retire at age 59. A further gradual increase in the retirement age for women will look like this:

- from January 1, 2020 – 59.5 years;

- from January 1, 2021 – 60 years;

- from January 1, 2022 – 60.5 years;

- from January 1, 2023 – 61 years old;

- from January 1, 2024 – 61.5 years;

- from January 1, 2025 – 62 years;

- from January 1, 2026 – 62.5 years;

- from January 1, 2027 – 63 years.

The guarantee applies to both compulsory pension contributions and compulsory professional pension contributions.

How to manage compulsory pension insurance savings

In modern Russia, the pension is three-component. The first component is the basic part, formed through solidarity contributions. This is the minimum that a citizen who has a minimum official work experience of five years can count on, during which the employer strictly fulfilled its obligations to make contributions to the Russian Pension Fund. The second component is the insurance part, which directly depends on the length of service and the amount of wages from which contributions were deducted. The third component is the funded part, which the citizen formed independently or with the help of the employer and which he has the right to dispose of.

Savings in the pension insurance system can be transferred:

- Managed by a non-state pension fund. An application to the NPF becomes the basis for the fund to invest your savings. If the operations are successful, there is a chance to count on an increase in the initial amount. Having reached retirement age, a citizen again applies to the fund and claims his money in a lump sum, or the NPF will accrue a monthly certain amount, calculated based on the amount of savings and the payment period.

- One of 34 private management companies (MCs). Their register is maintained on the Pension Fund website. All companies undergo a strict selection procedure, and their activities are strictly controlled. If a citizen indicates in an application that he is transferring funds to a specific management company, you can be sure that his savings will be managed exclusively by the selected company.

- To the state corporation “Bank for Development and Foreign Economic Affairs” (VEB), which is also a management company, but is owned by the state;

- In addition, savings may remain in the Russian Pension Fund.

How to make the right choice between the Pension Fund, public administration, and private offices? Of course, you need to carefully study the information and analyze the profitability ranking. Each method of investing savings in the compulsory insurance system has its own advantages and disadvantages, so you can find the best option only by comparing and prioritizing.

So, NPF. Its advantage is the distribution of capital between different types of investments. The fund cooperates with management companies, to which it transfers the received funds (for the most part), and management companies invest money in different assets, trying to find the most profitable option. Companies are directly interested in this, since their percentage often depends on the success of the investment. It is clear that the profitability in this case is usually higher than that of a state management company.

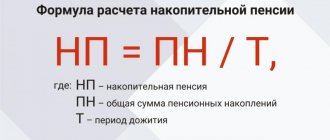

A valuable feature for investors is the ease of tracking their funded pension. Its size and calculations using a simple formula allow you to calculate the monthly payment (if you choose this type of calculation) or simply track the dynamics of changes in the volume of funds, to understand whether the investment is successful.

Disadvantages include commission fees (they are charged by both non-state pension funds and management partners).

If you transfer savings directly to a private management company, the associated costs will be lower, but diversification is not expected. One company will invest your funds. The advantage of this choice is maintaining funds in the state Pension Fund, which transfers the money for management to a private partner - a management company.

When choosing VEB as a savings manager, the advantage will be its state status, which citizens associate with reliability. The Pension Fund transfers money to VEB, which is not too interested in high investment returns - and this is the main disadvantage of choosing a state management company.

What awaits the pension insurance system in the future?

The compulsory pension insurance system is an important component of normal life in the state. In modern conditions, many are confident that it must be abolished and replaced with voluntary insurance, so that each person can plan his own future: today he deposited a certain amount into an account, and decades later he received it in the form of a pension.

It makes no sense to deny the rationality of such proposals: indeed, by working well at a young age, you can ensure yourself a decent old age. But not every citizen of the country has the opportunity to donate serious funds from their salary for a future pension, otherwise there will simply be nothing to live on now: some professions that are important for the state are valued very low in monetary terms. But there are also disabled people, children who lose their mother or father who supported their family. What should they do if everyone is responsible only for themselves?

Violation of the Constitution of the Russian Federation, and this is precisely what the abolition of the compulsory pension insurance system will lead to, is a serious crime that the state has no right to commit.

This is largely why we had to take an unpopular measure – increasing the retirement age. The state is obliged to fulfill social obligations, but it is becoming increasingly difficult for it to do so. Officials talk about the imbalance of the pension system, there are more and more pensioners, and the share of the working population is declining.

The guarantee of ensuring a normal life for pensioners, disabled people, and children who have lost their breadwinner is the system of compulsory pension insurance, with the help of which the state fulfills its obligations to its citizens. Compulsory pension insurance is the basis for constructing a payment system and a tool for replenishing the budget, from which funds for various types of pensions are taken. Each working citizen makes his contribution to the general fund, from where, over time, he will also receive monthly payments.

The system of compulsory pension insurance cannot be erased from the life of the state, since in many ways it is thanks to it that this life is ensured.