Recently, online payments have become a part of people's daily lives. If at the beginning of this decade the overwhelming majority of payments in the country were made in cash, then, according to Sberbank, in the first quarter of 2020, almost half of all transactions occurred electronically.

Today, a plastic card is not only a means of withdrawing cash from the nearest ATM, but an everyday means of payment. The vast majority of organizations, including budget ones, pay salaries by card, and each retail outlet has a terminal for accepting the corresponding payments. In addition, citizens can pay for many services, including housing and communal services, online.

This format is extremely convenient for citizens, as it significantly saves them time and frees them from performing many actions related to making cash payments. Pensioners also managed to appreciate the innovations, many of whom receive their pension payments on the card.

At the same time, despite the abundance of banking products, recipients of pension payments are limited in their choice. If a pensioner wants to receive money on a card, then it should only be from the domestic payment system “Mir”. The leading issuer in this case is Sberbank.

Differences and key features

The most important differences of the MIR

for pensioners, which Sberbank offers, are as follows:

- Absolutely free production and maintenance of plastic

. Moreover, re-issuance of a card after the expiration of the previous one also occurs without charging any fee; - accrual of interest on the balance of funds placed on the card

. Today this interest rate is 3.5% per annum; - Providing a preferential service for SMS informing the client

. The first two months of notification are free, and then the monthly payment for using the service is only 30 rubles; - An extremely convenient procedure for receiving a pension

. Funds are automatic and very quickly credited to the card balance immediately after they are transferred by the Pension Fund.

Photo No. 1. The most important features of the MIR pension card issued by Sberbank

Rosselkhozbank

In this bank, the pension card is also serviced free of charge, and the client receives:

- up to 6% on balance;

- 5% cashback for purchases in pharmacies.

Despite the small ATM network, you can also get money for free from partners:

- Alfa Bank;

- ROSBANK;

- Raiffeisenbank;

- Promsvyazbank.

Fig.5. Thanks to the offer from Rosbank, you can receive a stable income of up to 6% and cashback of 5% in pharmacies.

Reviews from Rosselkhozbank cardholders

“I really like this card because I get 5% cashback at pharmacies, i.e. essentially a permanent discount. I have already recommended it to all my friends and colleagues.”

Tamara, 63 years old, St. Petersburg

“A very convenient product from Rosselkhozbank - both interest on the balance and a discount in pharmacies. True, there are not many ATMs. But there are partners – Alfa-Bank, for example.”

Igor, 60 years old, Yaroslavl

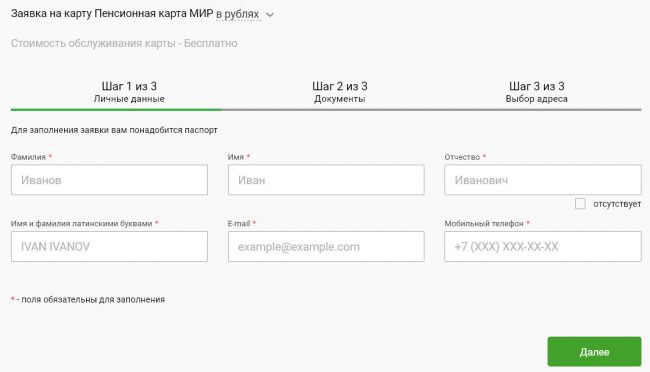

Conditions for receiving and validity of the MIR pension card from Sberbank

In order to apply for a MIR pension plastic card, it is enough to fill out the appropriate application in one of three authorities located at the place of registration of the pensioner:

- PF department;

- Sberbank office;

- MFC branch.

When filling out and submitting the application, the pensioner will only need to provide two documents. The first of them must confirm the client’s identity, and the second – the right to receive a pension. In addition to the application, you will need to additionally fill out a Sberbank client questionnaire, the data of which is necessary to obtain a MIR pension card. The plastic is produced automatically, and the client is notified in advance of the possibility of receiving it. The standard card validity period is 5 years.

What is the World social card

Mir is a relatively new type of domestic payment system, the main developer and founder of which is the Central Bank of the Russian Federation. In almost 4 years of its existence, the product has managed to establish itself as reliable and absolutely unaffected by external factors of an international nature. The main functional purpose is targeted accrual of payments to public sector employees and pensioners.

There are currently two types of product in circulation:

- debit – issued for a period of three years;

- pension – a completely free offer with the same validity period.

Today, you can get plastic as part of a special program in dozens of large banks in the country.

From this video you will learn more complete information about the Mir card, as well as tariffs, conditions of issuance and people's reviews:

Cost of servicing a Sberbank MIR debit card for pensioners and tariffs

As noted above, the production and maintenance of the card in question is carried out by Sberbank free of charge. The only case when the client will have to pay, and only 30 rubles. – the need for early reissue of plastic in case of its loss or change in the user’s name.

Other most important tariffs offered by Sberbank to MIR pension card holders are as follows:

- There is no commission for replenishing plastic at the cash desk and ATMs of a financial institution;

- payment by card for any goods or services in non-cash form is also carried out without commission;

- cash withdrawal at the Sberbank cash desk or at one of its ATMs up to 50 thousand rubles. per day and 0.5 million rubles. per month is also completely free. If the specified limits are exceeded, the commission is 0.5%;

- Cash withdrawals from cash desks and ATMs of third-party financial institutions incur a 1% commission.

Photo No. 2. Tariffs offered by Sberbank for the MIR social card

Card conditions

For a long time, pensioners received their money on plastic cards of the Maestro system. However, this system is part of the Master Card, so today Sberbank offers social cards of the Mir payment system for those citizens who receive pensions.

The conditions for this product are very favorable. The pensioner will not have to spend additional funds to maintain it, while its benefits remain the same. Thus, the card is serviced at any retail outlet in the Russian Federation without commission.

Cash withdrawals from Sberbank ATMs are also free, as is depositing them into a card account. At the same time, you can receive banknotes from ATMs of third-party banking institutions by paying a commission of 1% of the withdrawal amount (but not less than 100 rubles).

The maximum cash withdrawal limit is:

- per day - no more than 50 thousand rubles;

- per month – no more than 500 thousand rubles.

In addition, bank clients have the right to receive free information about the flow of funds in the account, and can also request a statement of transactions carried out for a certain period.

Service cost

Servicing the Sberbank Mir social card is completely free . In addition, you will not have to pay for its reissue due to expiration. At the same time, the production of a new card to replace a damaged or lost one will cost a pensioner 30 rubles.

In addition, monthly use will cost the same amount.

Attention! In the first two months the provision is free, after which it can be disabled.

Bonuses and Thanks from Sberbank

Sberbank offers its regular customers various bonuses as part of their loyalty programs. This fully applies to holders of the Mir social cards. These include:

- Interest on balance . To stimulate non-cash payments, Sberbank pays cash for funds in the card account. Thus, the interest rate is 3.5% per annum. Interest payments are made once every three months. Considering that the amount of funds on the card is constantly changing, to calculate the funds to be paid, special methods are used that take this circumstance into account.

- “Thank you from Sberbank.” This loyalty program is a cashback, within which customers are returned a portion of the money, which is a certain portion of the purchase amount. However, this program assumes that the money is not returned directly, but in the form of bonuses, the cost of one of which is 1 ruble. With bonuses, a Sberbank client can also pay part of the cost of goods and services. Social card owners can count on 30% cashback depending on the frequency of non-cash payments and their amounts.

Card restrictions

The Sberbank Mir card can be used in Russia without restrictions. In addition, this payment system is the only one operating in the Crimea and Sevastopol. However, it is impossible to pay it somewhere outside the country, with a few exceptions. This imposes some restrictions on the actions of citizens who use non-cash payments when traveling abroad.

How to apply for and receive a social card?

A simple and convenient procedure for obtaining a MIR

, which is often also called social, was described above.

It is important to note that today’s domestic legislation provides for the possibility of receiving pensions currently exclusively on cards of the national payment system MIR

.

This can be plastic from Sberbank or other credit institutions in the country.

Refusal of the MIR card to receive a pension

However, if the pensioner does not want to receive the funds due to him on the MIR

he has the right to write a corresponding statement to the Pension Fund of the Russian Federation. At the same time, he does not have the opportunity to apply for receiving a pension on cards of other payment systems, so the issuance of money will be carried out in the classical way exclusively in cash.

Promsvyazbank

This bank offers a free card, but if you do not use it for a year, a service fee will be charged (up to the account balance, but not more than 1000 rubles). At the same time, it also has its own advantages:

- interest on the balance is one of the highest 5%;

- discounts for purchases from partners are also quite large - up to 40%;

- cashback for purchases in pharmacies and gas stations – 3%.

Fig.6. With this card you can receive a guaranteed interest on the balance of 5% and discounts of up to 40%.

Important! Interest on the balance of 5% is accrued only if there is constantly more than 3,000 rubles in the account.

Reviews from Promsvyazbank cardholders

“I am satisfied with the Prosmvyazbank card because there is a constant cashback for gas stations and medicines. In addition, there is interest on the remaining 5% - I think this is one of the most profitable offers for pensioners.”

Alexander, 64 years old, Moscow

“With the Promsvyazbank card everything is fine, but there are not enough ATMs. True, now there are already partners where money is withdrawn without cash - these are Alfa-Bank and Rosselkhozbank. Otherwise there are only positives.”

Marina, 55 years old, St. Petersburg

Advantages and disadvantages

The main advantages of the MIR pension card from Sberbank are two factors: free production and maintenance, as well as the accrual of interest on the account balance. In addition, do not forget about the low rates for SMS notifications and cash withdrawals, which makes using the card more convenient and profitable for customers.

To the disadvantages of plastic WORLD

for pensioners issued by Sberbank, it should be attributed to the impossibility of opening a foreign currency account.

In addition, today not every payment terminal supports the MIR

, which can cause certain difficulties when servicing at some retail outlets.

Photo No. 3. Most of the pros and cons of the Sberbank pension card are associated with the use of the MIR system

How to get a card

Considering that the social card offers a number of advantages (free service and interest on the balance), only a limited number of people can receive it. These include only recipients of pensions and social benefits. Other categories of citizens cannot count on it.

The easiest way to apply for a card is to contact a Sberbank branch. You should have with you:

- passport;

- a document confirming the receipt of payments (for example, a certificate from the Pension Fund);

- SNILS.

Registration of a card at a bank branch will take no more than 30 minutes.

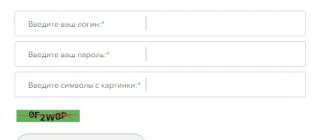

Is it possible to apply on the Sberbank website?

On the Sberbank website you can apply for a card. In the proposed electronic form, you should indicate the passport and contact details of the applicant, as well as information about the types of security received.

Upon receipt of the card, the citizen is obliged to provide the specified documents to a bank employee for review and for making copies.

Reviews of Sberbank MIR debit card for pensioners

Most of Sberbank clients using the MIR

for pensioners, the above mentioned pros and cons are noted as the main ones. Naturally, almost all of them highlight the free production and subsequent maintenance of plastic as the main advantage. It is quite problematic to find such favorable conditions on the Russian financial market today.

It is important to note one more detail. The number of negative reviews regarding problems with accepting payments using the MIR

has recently decreased sharply.

This can be explained extremely simply - today, almost all payment terminals carry out transactions made using the national payment system without any problems.

Moscow Industrial Bank

At this bank you get a MIR card for free, and it is valid for 5 years. But at the end of this period, a monthly commission of 200 rubles begins to be charged. Among the advantages are the following:

- up to 6% on balance;

- 5% for purchases in pharmacies and supermarkets.

Fig.9. Thanks to this offer, pensioners can save on purchases in pharmacies and supermarkets - a permanent 5% discount is provided

Reviews from Moscow Industrial Bank cardholders

“It’s a very good card, although maintenance costs 1,200 rubles a year. However, keep in mind that you receive a permanent 5% discount in supermarkets and pharmacies - this is a very significant amount, which is certainly more than 1,200 rubles.”

Yulia, 55 years old, Moscow

“I really like this card. The service is free for now, plus constant discounts in pharmacies and even grocery stores - I believe that this is the only offer on the market.”

Olga, 59 years old, Moscow

What payments must be transferred to MIR cards?

The following benefits are covered by the resolution:

- Accrued during pregnancy and childbirth (maternity benefits);

- Regular (monthly) payments for children under 1.5 years old;

- For temporary disability (so far only for victims of the Chernobyl accident, the accident at Mayak in 1957, collection of radioactive waste on the Techa River, testing of nuclear devices at the test site in Semipalatinsk).

Those who wish can do without issuing a new card - funds can be transferred to a bank account or received by postal order.