Average payout

Contributions for persons who were employed in mining are paid by the employer every month. The mining company sends funds to the pension fund where the employee has entered into an insurance contract. The amount of payment for such persons is indexed annually. This is necessary due to increasing amounts of employer contributions.

A list with all professions for which early payment of a pension can be issued is contained in PSM of the RSFSR No. 481. The list has not undergone changes since the law came into force.

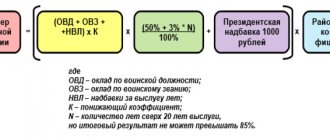

Formula and example of calculating a pension for a miner in Russia

The payment is calculated according to the following formula:

- SPst – type of benefit;

- IPC – accrued points;

- SPK – pension point value

- WMP – fixed payment.

The cost of a pension point in 2020 is 87.24 rubles. It is by this amount that all points earned by the pensioner will be multiplied.

The fixed payment amount in 2020 is 5334.19 rubles. Next year the amount will be indexed, and the percentage of the increase will depend on the economic situation in the country.

Knowing the initial data, you can calculate the size of the pension payment. As an example, let's take a man who worked in hazardous enterprises for 20 years, served in the army and worked in other fields for about 5 years. Over the course of his life, his contributions have accumulated 138 pension points. Then the size of the final pension will be:

The total amount may be increased due to additional tariffs and factors:

- duration of work;

- average salary;

- the amount of funds transferred as insurance premiums.

If the bonus is based on the number of years of service on which the person has earned seniority, the bonus will be increased by 55%. And for each year that a person continues to work after the potentially acceptable retirement age, 1% is added to the payment.

The size of the pension payment for miners will not be affected by periods of sick leave and leave taken to care for a child.

Pension recalculation

Receiving additional payment is possible only after submitting a corresponding application to the Pension Fund of the Russian Federation. The department must be selected depending on the place of temporary registration or permanent registration.

A package of additional documents must be attached to the application:

- military ID;

- family composition certificate;

- salary certificate from the accounting department;

- confirmation of the required work experience.

Expert opinion

Volkov Nikita Fedorovich

Lawyer with 8 years of experience. Specialization: criminal law. Has experience in protecting legal interests.

The pensioner will be given several ways to receive a pension to choose from, from which he can choose whichever one is most suitable for the citizen.

The law allows you to submit documents through a third party. But in this case, a notarized power of attorney must be attached to the papers.

The preferential system operates in such a way that when a pensioner returns to official work, he will stop receiving payments until he leaves the company. To re-issue the payment, you will need to collect a complete set of documentation again.

Possible additional payments and benefits for miners

Miners have the opportunity to obtain additional benefits. Citizens who were employed in hazardous and difficult types of production will be able to receive:

- free medical care;

- free dentures;

- discounted travel on public transport.

Not only the workers themselves, but also their children can count on benefits. The child is entitled to free breakfast at school and enrollment in educational institutions on a first-come, first-served basis.

The legislation clearly defines the categories of citizens who have the right to receive a pension under special conditions. To do this, you need to be a beneficiary, which includes miners.

As a main benefit, citizens receive a reduced age limit for retirement. The amount of payment will be determined for each miner individually depending on the number of accumulated pension points.

Useful video

We invite you to watch a video about the specifics of assigning pensions to miners in Ukraine:

Since 2020, Russia has been implementing a pension reform that affects all categories of citizens planning to retire. Even before this, miners were granted the right to early retirement.

Mining of mineral resources by above-ground and underground methods is associated with an increased risk to life and health. Work in hazardous conditions was compensated by social security benefits and pensions as well. The same status was retained by the mining profession within the meaning of the new pension reform.

What is preferential service?

Pension standards are defined in the following regulatory documents:

- Federal Law No. 173 “On labor pensions in the Russian Federation” dated December 17, 2001.

- PPRF N 516 “Rules for calculating periods of work giving the right to early assignment of an old-age labor pension...” dated 06/11/2002.

- Federal Law No. 400 “On Insurance Pensions” dated December 28, 2013.

This term refers to the worked period of work that allows one to retire before the maximum retirement age. In individual types of activities, a multiplying factor is used in the calculation. Thus, after working for a calendar year, a specialist receives additional days of service and retires before reaching the general age limit.

Preferential conditions may be provided for several reasons:

- For harmful or difficult working conditions (according to the list of dangerous and harmful professions). The basis is the characteristics of the work.

- For social characteristics (for example, due to health or family circumstances). The basis will be the characteristics of the employee.

The lists of preferential professions were approved back in 1991 and include all types of employment under special working conditions. They are divided into:

- a list of professions with particularly difficult and particularly harmful conditions;

- list of professions with difficult and harmful conditions.

IMPORTANT! A separate list contains categories of citizens working and living in the territories of the Far North.

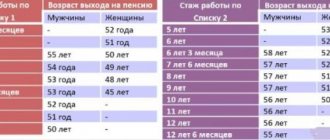

When do miners retire?

Early retirement is regulated in the Russian Federation by the provisions of Federal Law-400 dated December 28, 2013, Decree of the Russian Government No. 665 and other regulatory documents. Employees of the mining industry, which include miners, are guaranteed early retirement.

Expert opinion

Volkov Nikita Fedorovich

Lawyer with 8 years of experience. Specialization: criminal law. Has experience in protecting legal interests.

This measure of state support provides for the end of working life for men at 50 years old, for women at 45, which is 15 years earlier than the generally established period.

But early retirement is not guaranteed for all workers involved in the mining industry. A complete list of industries, positions and specialties falling under the preferential category is contained in Resolution No. 665.

Underground experience for retirement in Russia

The second list includes people engaged in activities such as:

- Parachutists.

- Psychologists.

- Theater, ballet or circus artists.

- School directors.

- Teachers.

- Defectologists.

- Pilots.

- Speech therapists.

- Pharmaceutical factory workers.

- Doctors.

- Food and light industry workers.

- Transport workers (air, sea, urban and railway).

- Workers in such sectors of the economy as communications.

- Workers working in glass production.

- Geologists.

- Workers of agrochemical services for agriculture.

This is important to know: A bill to increase the length of service from 20 to 25 years for granting pensions to military personnel

Both lists have the right to “preferential” retirement. But the first list will be exactly the list of professions that are called “harmful”. Read more about what preferential seniority is here.

What requirements must a retired miner meet?

The miner's retirement date is determined by his length of service and the value of the IPC (individual pension coefficient).

Duration of employment

Persons employed at underground and surface coal mining enterprises need at least 25 years of experience for early retirement, provided they work a full shift. This period is necessary for those who work in the field of mining, equip and maintain mine structures and communications, and participate in rescue operations.

Leading specialists, miners, machinists, and miners need to work 5 years less, that is, 20 years.

The value of the coefficient changes annually - it increases. In 2019, the IPC was 16.2.

Important! Women at the age of 45 who have worked for 15 years, half of them in a hazardous area, as well as men aged 50 with a total experience of 20 years, half of them in hazardous production, can count on an early miner's pension. 1 year is added to the length of service in case of a work-related injury.

Miners receive credit for their time spent studying and serving in the army.

Men are much less likely to survive to retirement age than women

At the moment, as RANEPA economists have calculated, the probability of 20-year-old men surviving to retirement age in Russia is 68%. Thus, if the retirement age for them is increased to 63 years, the probability of surviving until retirement for Russian men becomes one of the lowest among men from developed countries (below the level of Ukraine, Bulgaria, Lithuania and Belarus), experts have found.

Russian women, according to RANEPA, have more opportunities to live to retirement age (92%). They also live longer in retirement compared to men (about 26 years). If the retirement age of women is raised to 60 years, as RANEPA economists calculate, Russia’s indicators for the latter parameter will be at an average level (between Sweden and Slovakia), however, if the retirement age is increased for them to 63 years, these indicators will become the worst among developed countries.

Design rules

Applying for a pension begins with writing and submitting the appropriate application. Supporting documents are attached to it.

- Passport or other identification document;

- Employment history;

- SNILS;

- Military ID (for men);

- Additional documents confirming promotion, family composition, employment contract, etc.

The application is submitted to the Pension Fund branch or the nearest MFC. It can be sent by mail or registered through the State Services portal or the Pension Fund of Russia personal account. 2 weeks are allotted for consideration of the application. Based on the result, the future pensioner receives a notification. If one of the required applications is missed, he has 3 months to correct it.

Miner's pension amount

The amount a miner who has worked for 20 years will receive depends on his length of service, the value of the IPC and the region of residence.

The formula for calculating the amount receivable is as follows:

P – monthly payment amount;

A – the number of accumulated pension points;

B – the cost of the individual coefficient (in 2020 it is equal to 81.49 rubles);

B – the amount of the fixed payment according to the law.

Additional payments for overtime

We are talking about workers who worked at the mine in excess of the mandatory minimum for pensions. That is, more than 25 or 20 years (leading specialists and equivalent). Such employees can count on a monthly additional payment. It is paid from the contributions that the company paid to the Pension Fund.

What determines the amount of increase (EDV) to a miner’s pension?

The amount of the monthly increase depends on the size of the salary, the average salary in Russia and the amount of insurance premiums. The duration of work in hazardous conditions also matters.

The rate of bonus for length of service (exceeding the mandatory length of service) in 2020 was 55%. Each “extra” year adds 1% to it. The maximum surcharge for overtime is 75%.

Are there plans to increase pensions for miners in 2020?

At the end of 2020, there was no talk of increasing pensions for miners. However, it will be recounted in 2020. The revision of the salary of retired miners is associated with changes in the minimum wage, the cost of living and an increase in insurance premiums that mining enterprises pay to the budget.

If you disagree with the accrued amount, an application is submitted to the Pension Fund for recalculation. The Pension Fund Management raises the documents and verifies the correctness of the accruals, taking into account the facts specified in the application.

What is a miner's pension in Russia? You can learn about the procedure for registration, calculation and accrual of these payments in this article. We also recommend reading information about pensions for Chernobyl victims .

At what age do miners in Russia retire?

Employment in underground and open-pit mining is one of the types of activities that are included in the lists of work with harmful and dangerous working conditions by the current legislation of the Russian Federation. This fact guarantees employees of this type of employment access to pension benefits on preferential terms.

In accordance with Federal Law No. 400 , Government Decree No. 665 and other regulatory legal acts of the Russian Federation, pensions are assigned to miners until they reach the generally established retirement age. Payments are based on the duration of work under difficult conditions.

The provisions of Article 30 of Federal Law No. 400 establish that preferential insurance benefits are assigned to persons upon reaching 45 and 50 years of age for women and men, respectively.

Conditions of appointment

According to the provisions of these legal acts, a miner's pension in Russia can be accrued:

1. With full-time employment in underground and open-pit mining (coal, ore mining, etc.), regardless of age, provided that you have:

- no less than 25 years of work experience;

- individual pension coefficients. This figure is increasing every year; for the current year it is 13.8.

For workers in leading professions (miners, machinists, etc.), the indicator of duration of work, in accordance with the law, can be reduced to 20 years;

2. Upon reaching 45 and 50 years of age (for women and men, respectively) and if the person has been employed in jobs with hazardous working conditions for at least 10 and 7.5 years, as well as 20 and 15 years (for men and women, respectively ) general insurance experience.

Underground experience for retirement in Russia

Both lists contain types of activities with hazardous working conditions, which are carried out in such areas as:

- “hot” shops (this could be metallurgy, mechanical engineering, etc.);

- mines;

- printing;

- healthcare sector;

- logging;

- Russian Railways employees;

- nuclear industry;

- firefighters;

- geology;

- chemical industry;

- rescuers;

- mines;

- fleet;

- textile industry (mainly for women);

- paper production.

In addition to the two lists, there are also smaller lists covering professions in individual economic sectors. They are also regulated by law.

How to apply for a miner's pension?

In order to apply for an insurance benefit on preferential terms, a citizen interested in payments must:

- collect all necessary documents;

- draw up an application for a pension in the established form;

- submit all information to the local Pension Fund structures (at the place of registration or actual residence);

- choose a method of receiving funds.

Pensions for miners can be arranged both by future pensioners personally and by their proxies. To do this, you need to draw up and notarize a power of attorney.

Documentation

To calculate cash payments before the established retirement age, you must collect the following information:

- identification;

- work book;

- insurance certificate (SNILS);

- certificates confirming additional periods of official employment of a person (archival information, order of appointment to work, agreement between employee and employer, etc.);

- documents indicating the special nature of work activity (if this fact is not indicated in the work book);

- military ID;

- a correctly executed power of attorney (in cases where the rights and interests of the future pensioner are represented by another person);

- a certificate of family composition and the presence of dependents, as well as other documents that confirm additional circumstances.

The application form for the assignment of a pension benefit can be found on the official Internet page of the Pension Fund.

Where to submit?

The application along with the documents is submitted to the local divisions of the Pension Fund of the Russian Federation. Also, for this procedure, a citizen can use the services:

- local structures of the Multifunctional Center (MFC);

- legal representative;

- Russian Post;

- electronic services of the official pages of the Pension Fund and State Services.

It is worth saying that via the Internet a citizen can fill out an application for a pension and set a date and time for receiving the documentation. You can read about online registration with the Pension Fund here .

Deadlines

Pension Fund divisions consider the specified notification within 2 working weeks from the date of submission of all necessary documents. If the information was not provided in full, the citizen can take advantage of additional time to resolve this problem.

This period should not exceed 3 months. Benefits are accrued from the date of submission of the application, but not before the right to receive an insurance pension ahead of schedule arises.

What is the miners' pension?

Expert opinion

Volkov Nikita Fedorovich

Lawyer with 8 years of experience. Specialization: criminal law. Has experience in protecting legal interests.

The size of the pension benefit for this category of the population is influenced by many factors, including the length of the insurance period and periods of employment in jobs with hazardous working conditions, the number of pension points, etc.

Calculation

What is the pension for miners in Russia? The calculation formula for old-age insurance benefits is determined by the provisions of Article 15 of Federal Law No. 400. Thus, this law states that the amount of accruals is determined as follows:

A=B*C+D, where: A is the amount of payments for compulsory pension insurance; B — the number of pension points earned; C is the cost of one individual coefficient at the time of granting the benefit. For the current year, the price of this indicator is 81.49 rubles; D is a fixed payment determined at the legislative level.

The minimum pension of a miner in Russia must correspond to the minimum subsistence level established in a particular subject of the Federation. The indicated figure for the Russian Federation as a whole is 8,726 rubles (according to Federal Law No. 362).

Fringe benefits

In addition to early retirement, miners can also qualify for additional preferential accruals. In accordance with Federal Law No. 84, this category of the population has the right to a monthly supplement to the basic amount of pension provision, subject to employment in underground and open-pit mining for at least 25 years, or 20 years of activity in leading professions.

This bonus is paid from contributions to the Pension Fund of the Russian Federation, which are made by organizations in the coal industry.

The amount of this surcharge is calculated using the procedure established by current legislation. So, this amount is influenced by the following factors:

- average monthly earnings of a citizen;

- the size of the average salary in the Russian Federation for a certain period;

- average monthly amount of contributions to the Pension Fund, etc.

Early retirement for geologists

| Geology is a complex of sciences about the structure, composition and history of the Earth (earth's crust), about methods of prospecting for minerals |

In accordance with sub.

6 clause 1 art. 27 of the Federal Law of December 17, 2001 No. 173.FZ “On Labor Pensions in the Russian Federation” (hereinafter referred to as the Law on Labor Pensions), workers, managers and specialists employed in expeditions, parties, detachments, on sites and in teams directly on field geological exploration, prospecting, topographic and geodetic, geophysical, hydrological, hydrographic, forest management and survey work. An old-age labor pension is assigned to them: for men upon reaching 55 years of age, for women upon reaching 50 years of age, if they worked respectively for at least 12 years 6 months and 10 years in the specified jobs and have the total length of service specified in Art. 7 of the Labor Pensions Law. All of the above works are, to one degree or another, related to the study of the earth's surface and the exploration of the minerals it contains, so they should be considered geological. Geological research can be carried out both on the surface of the earth and in underground conditions. The study of seas, rivers and other bodies of water on the earth's surface also refers to geological work. In subparagraph 6 of paragraph 1 of Art. 27 of the Law on Labor Pensions provides for surface geological work. Workers engaged in geological exploration work in underground conditions enjoy the right to early assignment of an old-age pension in accordance with List No. 1 (section I “Mining work”, subsection I), approved. Resolution of the Cabinet of Ministers of the USSR dated January 26, 1991 No. 10 “On approval of Lists of production, work, professions, positions and indicators giving the right to preferential pension provision.”

For example, pension benefits in accordance with List No. 1 are provided to miners in geological work, logging workers, and geologists. Employees of geological exploration organizations engaged in open-pit mining are assigned an old-age pension early according to the list of professions and positions provided for in List No. 2 (Section I “Mining Work”).

Operators of logging station lifts, logging workers, mechanics of self-propelled logging stations, blasters, as well as some specialists and heads of field geodetic parties and teams engaged in geophysical research in wells during drilling operations and work on the production of oil, gas and gas condensate, acquire the right to pension benefits in accordance with

List No. 2 (Section XII “Drilling, production, processing of oil and gas and gas condensate, processing of coal and shale”).

As part of geological organizations, audit parties are sometimes created to clarify or verify the activities of various expeditions. They work using the same methods as the geological parties specified in subparagraph. 6 clause 1 art. 27 of the Law on Labor Pensions, but with the involvement of more qualified specialists. In this case, an audit of both field research and desk work can be carried out. Therefore, if a record of work in an audit party is made in the work book, then it is necessary to clarify what the employee who applied for an early retirement pension did. If a specialist from this batch conducted field research, then this time is counted towards the length of service, which gives the right to early assignment of an old-age pension. At the same time, the audit of desk work does not give the right to early pension provision, since these works are not field work.

When establishing the rights of employees specified in subpara. 6 clause 1 art. 27

of the Law on Labor Pensions, for the early assignment of an old-age labor pension, one should take into account the fact that this pension is assigned regardless of the profession or position in which the employees are engaged in performing geological exploration and other work provided for in this subclause.

Each name of profession and position corresponds to the nature of the work that the employee must perform in accordance with the tariff and qualification characteristics given in the Unified Tariff and Qualification Directory of Work and Professions of Workers (UTKS), or the responsibilities set out in the job descriptions of specialists and managers. Therefore, when establishing the right to early pension provision for insured persons engaged in geological field work, there is no need to confirm the nature of the work performed by a specific employee. It does not matter what organization the geologist works for.

For example, an employee performs prospecting work as part of a geological team at a research institute. The fact that this party was organized and sent to carry out prospecting work by the institute cannot serve as a basis for refusing to grant an early retirement pension if the employee directly performed field geological work.

The criteria for employment in jobs that determine the right of geologists to early pension provision in accordance with this subclause are the following factors, which the employer or insured person must confirm with relevant documents:

– employment in geological exploration, prospecting, topographical, geodetic, geophysical, hydrographic, hydrological, forest management and survey work;

– direct implementation of field geological work; – performing geological work as part of an expedition, party, detachment, brigade or site.

Geological exploration work

| The technological process of geological exploration, along with prospecting and exploration work, may include mineral enrichment operations in order to determine the qualitative and quantitative properties of ores and other minerals |

Geological exploration work is a complex of geological and special types of research for the industrial assessment of mineral deposits (establishing quantity, quality and occurrence conditions).

They include: geological surveying (studying the geological structure of the upper parts of the earth’s crust and identifying its prospects for mineral resources), prospecting work (finding new deposits) and exploration work (establishing the quantity and quality of the mineral contained in the deposit). Geological exploration work ends with the preparation of a report determining the quantitative and qualitative reserves of a particular mineral, as well as the suitability of the deposit for exploitation by industrial organizations. Workers involved in the beneficiation of mineral resources in the process of geological exploration, including crushers, as a rule, working in manual crushing, are assigned an old-age pension in accordance with subclause. 6 clause 1 art. 27 of the Law on Labor Pensions.

| Currently, geological exploration organizations can engage in the production of products from minerals, starting with the exploitation of the deposit (mining and enrichment) |

Workers of geological exploration organizations engaged in the extraction of minerals may be granted an old-age pension early according to Section.

I “Mining works” of Lists No. 1 and No. 2, and for those employees of geological exploration organizations who are engaged in the enrichment (after completion of geological exploration and mining work) of minerals - under Section. II Lists No. 1 and 2 “Ore preparation, beneficiation, agglomeration (agglomeration, briquetting, pelletizing), roasting of ores and non-metallic minerals.” Topographic and geodetic work is a complex of geological research work to study the shape and size

Land, as well as measuring land areas for displaying them on plans and maps and for carrying out various engineering activities. Employees of topographic and geodetic organizations acquire the right to early pension provision, regardless of the name of their profession and position and regardless of the purpose for which they conduct research (for mineral exploration or for other geological purposes). Topographic and geodetic research can be carried out both as an independent type of work and as a research method when carrying out other geological work.

| Exploration work is a set of research works to find mineral deposits that are produced by geochemical and other methods |

Topographic and geodetic research carried out for the purpose of mineral exploration can be carried out by topographic and geodetic (geodetic) parties, detachments, teams as part of geological exploration expeditions, as well as parties, detachments, teams sent to perform field geological work under an order (agreement) ) organizations in other sectors of the economy.

In both cases, this does not matter for establishing the right of workers to early assignment of an old-age pension. Geophysical work is one of the methods of geological exploration work, which consists of a geophysical study of the structure of the Earth and the physical processes occurring in the earth's crust, with

for the purpose of prospecting and exploration of mineral resources. Geophysical work can be carried out using different methods: seismic, gravimetric, electrometric, metallometric, magnetometric, logging, etc. When performing these works, a significant amount is made up of topographic and geodetic work. The names of parties, detachments, expeditions, brigades and sites conducting geophysical work often correspond to the method of their implementation. (for example, seismic team, logging team, metallurgical crew, etc.). Old-age labor pensions for employees of such divisions of geological (geophysical) organizations are assigned ahead of schedule, regardless of the methods by which the work is performed.

Hydrological work is a geological study (study) of groundwater in order to solve problems related to the search, exploration, assessment of groundwater resources for the needs of water supply, irrigation, industry, resort and sanatorium business, construction, etc.

Hydrographic works

Hydrographic work is part of hydrogeological work on the study of individual water bodies with qualitative and quantitative characteristics

Forest management works

Forest management works as a main element are part of state forestry management. All forest management work on the territory of the Russian forest fund is carried out by forest management organizations (expeditions).

| During forest management, control is carried out over the state of the forest fund and the results of economic activities both in individual organizations and in regions, territories, republics and in the Russian Federation as a whole. |

In the process of forest management in the forest fund of each forestry organization, a set of works is carried out, including a forest inventory, topographic and geodetic work, forest mapping, the development of scientifically based standards for the use of diverse forest resources and principles of forest management and other activities aimed at obtaining comprehensive information about the forest fund of the Russian Federation, ensuring rational use, conservation and protection of forests, increasing productivity and reproduction.

In forest management organizations, expeditions are organized to carry out field forest management work, consisting of parties, detachments and brigades and enjoying the rights of a legal entity. The main categories of workers who go to field work are workers (including drivers), as well as engineers, technicians, heads of parties, detachments and expeditions, and other workers.

In accordance with the Decree of the Government of the Russian Federation dated 04.07.02 No. 498 “On approval of the list of seasonal industries, work in organizations for which during the full season when calculating the insurance period is taken into account in such a way that its duration in the corresponding calendar year is a full year” field forest management The work is classified as seasonal work. The timing of seasonal field forest management work is established according to the geographical regions of Russia.

When determining the length of service in the relevant types of geological work, which gives the right to early pension provision, it should be borne in mind that the period of work directly in the field from six months to a year is taken into account for the year of work, less than six months - according to the actual duration.

Survey work is a complex of economic and technical studies of the area where an object will be built (railway or highway, power plant, etc.), on the basis of which a project and estimate for its construction are created. Surveys include a whole range of geological studies and observations: geophysical, topographical, geodetic, hydrological, hydrometric, etc.

The right to early pension provision is given by field survey work performed by workers as part of survey (hydrological, hydrometric, geophysical, etc.) parties, detachments, expeditions, teams, sections.

Can research in the field of game management, paleontology, land management, as well as anti-corrosion studies of pipelines be classified as survey work?

When determining the right to early assignment of a labor pension

for old age in accordance with subparagraph. 6 clause 1 art. 27 of the Law on Labor Pensions, it should be borne in mind that when assigning such a pension, it does not matter for what purposes and by what organizations geological exploration, prospecting, topographic-geodetic, geophysical, hydrogeological, hydrographic, forest management and survey work are carried out. In this case, it is necessary to confirm that certain work performed relates to the work listed in the specified subclause.

| Survey work is a complex of economic and technical studies of the area where an object of one purpose or another will be built, providing the necessary material for the project and estimates for its construction. |

When carrying out survey work, geophysical, topographical, geodetic, geological exploration, hydrogeological, hydrometric and other geological methods of studying the upper layer of the earth’s crust can be used in connection with the tasks of engineering construction.

In accordance with the building codes and regulations “Engineering surveys for construction,” survey work includes studies of the corrosive properties of the earth’s surface soil in relation to metal. The specified works, as a rule, are carried out by survey expeditions and parties of specialized organizations of Rosstroy.

Currently, organizations in various sectors of the economy

Field work is carried out for the purpose of paleontology, land inventory, introduction of the state land cadastre, land surveying, land management, determination of the boundaries of game management farms, forest parks, anti-corrosion studies of pipelines, gas pipelines using geological research methods. This work can be carried out both by expeditions and by permanent organizations.

Since neither pension legislation nor other regulatory

legal acts do not provide a clear definition of survey work, then when considering the issue of early assignment of an old-age labor pension in accordance with sub. 6 clause 1 art. 27 of the Law on Labor Pensions, the bodies providing pension provision in each con. In a particular case, they must require from the employer or the insured person documents confirming that the research being carried out, not related to the tasks of engineering construction, relates to survey work. In the absence of supporting documents, there are no grounds for early assignment of an old-age labor pension in accordance with this subparagraph.

Field geological work

As a rule, any method of geological work can consist of field research and office processing of the collected material. In the process of desk work, the results of field research are clarified and a geological report is compiled. As you know, office work is not field work, since it is not carried out at the site of direct geological work, but at the base of the expedition or in stationary parties. The period of desk work is not included in the length of service that gives the right to early assignment of an old-age labor pension.

As already noted, the old-age labor pension in accordance with subclause. 6 clause 1 art. 27 of the Law on Labor Pensions is assigned to employees regardless of the name of their profession and position, therefore, issues related to determining the direct employment of a particular employee in field geological work specified in this paragraph are not always resolved unambiguously and correctly.

When determining employment in geological field work that gives the right to early pension provision, you can use List No. 2, approved. Resolution of the Council of Ministers of the USSR dated August 22, 1956 No. 1173. This List contains a section. II “Geological exploration”, which contains a list of professions and positions of employees of geological organizations who are entitled to early pension provision. It includes workers who, by the nature of their work, are directly involved in performing field geological exploration, topographic, geodetic and other geological work: these are drillers, hydraulic monitor operators, rock crushers, sump operators and other workers, including managers and specialists involved in technological in the process of geological work, as well as workers servicing the technological equipment with which field geological work is carried out. Therefore, when determining the employment of workers performing field geological work, there should be no difficulties in relation to those workers whose professions and positions correspond to the professions and positions specified in this section. In this case, for such employees, the content of section. II List No. 2, approved. in 1956, can serve as a document (in the absence of other materials) confirming their direct employment in geological field work.

The issue of determining the employment directly in field geological work of those insured persons whose professions and positions are not provided for in List No. 2, approved in 1956, is ambiguously considered. This may apply to car drivers, tractor drivers, bulldozer operators, etc. As a rule, not in all

In cases, they are constantly and directly engaged in conducting or servicing the technological process of geological work.

For example, if a car driver or a bulldozer driver of a party (squad) transports drilling rigs to the drilling site, rolls out temporary roads, serves the field party with the necessary fuels and lubricants at the site of geological work, then in this case he can be classified as a worker engaged in geological work. works.

Documents confirming employment directly in field geological work can be: an order to send for geological work, indicating the location of its implementation; receiving field allowances; salary document, etc.

Work as part of expeditions, detachments, parties, brigades

and sections B subp. 6 clause 1 art. 27 of the Law on Labor Pensions lists the units that perform geological work. One of the main production units during all geological work is a party or detachment. Depending on the nature and volume of work, the party can be single-team or multi-team. To carry out complex geological work, parties and detachments can unite into expeditions, which, under certain conditions, can have the status of a legal entity. This allows them to have in their structure workers and even services that are not directly involved in field geological work: employees of warehouses, motor transport departments, personnel services, etc. Geological work can also be carried out by teams or sections.

In some cases, an entry is made in the workers’ work books,

indicating that they worked in a stationary field organization (expedition or party). The transfer of such organizations to the number of stationary ones involves conducting geological work for a long time. In this regard, employees of such organizations are sometimes not paid field pay, but they do not lose the right to early retirement if they continue to perform field geological work, which is confirmed by documents. The termination of payment of field allowance in this case does not always mean the termination of field geological work.

The main document confirming the employment of the insured

persons performing field geological work as part of an expedition, party, detachment, can serve as a work book, staffing table, structure of an organization, which includes permanent expeditions, parties, detachments, brigades, sections, as well as orders for the creation of expeditions, parties, etc. d.

Calculation of work experience

To calculate the length of service in the relevant types of work of insured persons who directly perform field geological work as part of expeditions, parties, detachments, teams and sections, giving the right to early assignment of an old-age pension in accordance with subparagraph. 6 clause 1 art. 27 of the Law on Labor Pensions, the criterion (factor) of employment in the field is of significant importance

conditions.

Geological work provided for in this subparagraph and

performed continuously during a full working day, in accordance with the Rules for calculating periods of work, giving the right to early assignment of an old-age pension in accordance with Art. 27 and 28 of the Federal Law “On Labor Pensions in the Russian Federation” (hereinafter referred to as the Rules), approved. by Decree of the Government of the Russian Federation dated July 11, 2002 No. 516 (clause 5), are calculated on a calendar basis. This procedure applies to workers of expeditions, parties, detachments, brigades and sites who perform field geological work outside the field conditions.

Periods of field geological work provided for in subparagraph. 6

clause 1 art. 27 of the Law on Labor Pensions, which are carried out in field conditions, are calculated in the manner provided for in paragraph 7 of the Rules, namely: work from 6 months to one year is counted as a year of work, and work less than 6 months is counted according to the actual duration of what is the procedure for calculating the period work giving the right to early assignment of an old-age labor pension in accordance with subclause 6 of clause 1 of Art. 27 of the Law on Labor Pensions, compensates employees employed directly in the field for a special regime of their labor activity associated with exceeding the normal working hours during the field period and the lack of an objective opportunity, due to climatic conditions, to continue this labor activity during the non-field period. The benefit provided to these employees is of a compensatory nature and consists of crediting a period of actual work of shorter duration to the length of service in the relevant types of work for a full year of work. The acquisition by employees of the right to such a benefit is subject to compliance with two restrictions provided for in clause 7 of the Rules.

Firstly, the actual duration of work directly in the field should not be less than 6 months.

Secondly, the actual duration of work directly in the field, calculated using the specified benefit,

should not exceed 12 months of special work experience.

The concept of “field conditions” is contained in the Payment Regulations

field allowance for employees of geological exploration and topographic-geodetic enterprises, organizations and institutions of the Russian Federation engaged in geological exploration and topographic-geodetic work, approved. Resolution of the Ministry of Labor of Russia dated July 15, 1994 No. 56.

Field conditions are special conditions for the production of geological exploration and topographic-geodetic work related to the lack of facilities for the work and life of workers and the location of production facilities outside of urban settlements.

Documents evidencing the payment of field allowance may be proof of the employee’s employment performing field geological work in the field. Such a document can be an order to send an employee to geological field work. As a rule, this order contains information about the payment of field allowance to the employee. In some cases, in the absence of an order to send an employee to field geological work, other data indicating payment of field allowance is presented as a confirming factor. It should be borne in mind that the payment of field allowance (if this is the only data) cannot serve as confirmation of the employee’s employment directly in field geological work. This is due to the fact that field allowance is also paid to those workers who are not directly involved in geological work, but serve expeditions. For example, employees of schools, medical and cultural and educational institutions, receiving field allowance,

are not directly involved in geological work.

Field allowance is not paid when living or performing work in cities and urban-type settlements (except for those located in the regions of the Far North and equivalent areas, in the Khabarovsk and Primorsky Territories and the Amur Region. Sometimes this restriction is violated and field allowance is paid in urban cities and towns such as those persons whose activities are not related to field geological work. This once again indicates that

that the very fact of payment of field allowance cannot serve (in the absence of an order to be sent to field work) as confirmation of employment in field geological work in field conditions.

Normative base

Federal Law of December 17, 2001 No. 173-FZ “On Labor Pensions in the Russian Federation” (as amended and supplemented) Resolution of the USSR Cabinet of Ministers of January 26, 1991 No. 10 “On approval of Lists of production, work, professions, positions and indicators, giving the right to preferential pension provision” (with amendments and additions)

Decree of the Government of the Russian Federation dated 04.07.02 No. 498

“On approval of the List of seasonal industries, work in organizations of which during the full season when calculating the insurance period is taken into account in such a way that its duration in the corresponding calendar year is a full year”

Decree of the Government of the Russian Federation dated July 11, 2002 No. 516

“On approval of the Rules for calculating periods of work giving the right to early assignment of an old-age labor pension in accordance with Articles 27 and 28 of the Federal Law “On Labor Pensions in the Russian Federation””

Resolution of the Ministry of Labor of Russia dated July 15, 1994 No. 56 “On approval of the Regulations on the payment of field allowances to employees of geological exploration and topographic-geodetic enterprises, organizations and institutions of the Russian Federation engaged in geological exploration and topographic-geodetic work” (as amended and additionally)

Lists of industries, workshops, professions and positions, work in which gives the right to a state pension on preferential terms and in preferential amounts, approved. Resolution of the Council of Ministers of the USSR dated 08.22.56 No. 1173

Useful video about miners' pensions

Do you want to know how early retirement is processed? You should watch the following video:

Miners are a category of workers belonging to the list of professions with hazardous working conditions.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

For this reason, the Government of the Russian Federation provides benefits for these employees.

In 2020, there will be no reduction in the list of benefits for former miners; on the contrary, it is planned to increase social support for this category of persons.

Early

The opportunity to retire earlier than other citizens of the Russian Federation is the main privilege of miners.

This is explained by the fact that their working conditions are considered harmful. Early retirement is regulated by Law No. 400-FZ of December 28, 2013.

The state guarantees early pensions for miners if they have a certain amount of work experience in the mine.

Law No. 173-FZ of December 17, 2001 states that early pension provision is provided to the following categories of citizens:

- have worked for 25 years in the coal industry on a full shift (this must be indicated in the work book);

- employees of the mine rescue service;

- quarry miners;

- persons who are engaged in the arrangement of communications and structures in mines;

- who have reached retirement age.

Citizens whose work activity consists directly in the extraction of mineral resources (shale, ore, uranium miners) and coal are entitled to a pension after twenty years of experience in such work.

20 years of work experience is sufficient for retirement for the following categories of workers:

- miners at the working face;

- miners;

- coal combine operators;

- miners who extract coal using jackhammers.

If you have not worked for 20 or 25 years as a miner, and the retirement age has arrived, then the existing length of service (for example, 10 years) is calculated on a preferential basis.

Not full underground experience for retirement in Russia

But also in the work book there are 5 years in the North. Upon turning 55 years old, he has the right to apply for transfer to a pension on the “northern” basis. This work adds up. Then the calculation will be made using the “northern” coefficient. The ability to use earnings at an increased rate was introduced into law on January 1, 2002. Therefore, if he applies for an appointment already in a “regular” area, but on the specified date lived in the North, the benefit applies regardless of his age. In other words, first he uses the old age benefit, and then the opportunity to increase the size of his pension. Important! If you have different preferential length of service and different reasons for early retirement, you need to get advice from specialists of the Pension Fund. The law allows for different options for determining both age benefits and the size of the pension.

How old are they?

Many people are interested in information about what time miners retire.

- Citizens who work full time in open and underground mining areas, as well as mine rescuers and those who construct mines and shafts, regardless of age, can retire if they have 25 years of experience.

- Miners who work with jackhammers, mining face workers, and mining machine operators only need to work for 20 years to qualify for a pension.

- An accident is added to the length of service if it occurred at work. In this case, the employee’s age is reduced by 1 year (that is, 1 year is added to the length of service).

- When working underground, there is a reduction of ten years for men and seven and a half years for women.

Study and military service are also included in the preferential miner's length of service, which allows such citizens to become pensioners earlier.

Benefits for miners in the field of pensions

Important! A miner has the right to choose between receiving an annual bonus while working in the mine and a pension supplement after leaving work at the mine.

Regarding the pension provision of miners, the following points must be taken into account:

- 25 years of work experience in the mining industry in ordinary positions (or 20 years if the miner worked in a leading profession, for example, a mining machine operator).

- If a miner worked with a jackhammer, participated in rock excavation or in the face, the work experience must be equal to 12 years .

- An injury received during work allows you to retire 1 year earlier than the length of service is reached.

- If a miner worked underground, you can retire 7.5 and 10 years earlier for women and men, respectively.

- The period of receiving specialized education and military service is counted towards the length of service.

- After retirement, you can continue to work at the mine, but you lose your right to a bonus.

Follow the link to view ⇒ Sample application to the Pension Fund for early retirement.

You can get an answer to your question by calling the numbers ⇓

Free consultation Moscow, Moscow region call: +7

St. Petersburg, Leningrad region call: +7

Has there been minimal changes?

In 2020, the minimum provision for miners depends on several factors, the main one of which is the cost of living in a particular region of the Russian Federation.

Expert opinion

Volkov Nikita Fedorovich

Lawyer with 8 years of experience. Specialization: criminal law. Has experience in protecting legal interests.

The minimum pension in 2020 averages 17 thousand rubles, this amount varies depending on the region of residence of the pensioner, since the cost of living varies in different regions.

Is there a promotion planned?

Additional payment to the security is carried out through the Russian Pension Fund and is accrued along with the pension.

Payments to pensioners are financed by employers, who transfer funds to the Pension Fund every month for employees working in hazardous conditions.

There are no plans to increase miners' pensions in 2020, but recalculations will be made. The Russian Pension Fund will adjust the amount of additional payments, since the amount of contributions made to the Pension Fund has changed. The increase is made after the citizen submits an application for recalculation.

Additional payment to miners for pensions in 2020

When miners retire and payments are made, they are entitled to an additional payment accrued every month. Many people are interested in how the surcharge is calculated in Russia and its size.

The calculation of the amount of the surcharge is made by multiplying the values:

- average wages for the period July-September 2001;

- quotient from dividing the average monthly salary for 24 months of work in hazardous conditions (60 months of work in another position) and the average salary in the Russian Federation for the same period of time;

- private, obtained by dividing the average amount of contributions to the Russian Pension Fund and the total amount of money in the form of additional payments to pension provision;

- coefficient of average employee payments.

A revision of the formula according to which the pension supplement for miners is calculated is planned for November 2020.

Perhaps after this the surcharge will be increased.

Size

What additional payment to the miner's pension will be does not depend on the amount of security, but it is approved specifically for it.

Factors on which the size of pension benefits depends:

- duration of work in the coal mining industry;

- average monthly salary of a former miner;

- contributions transferred by the employer to the Russian Pension Fund.

In the case where the bonus is calculated based on the amount of security for length of service, its value in 2020 will be 55%. If a citizen works for one year in excess of the required length of service, then another percentage (56%) is added to the amount due to him.

Interest accrual above 55% continues until the value of 75%, calculated from the pension provision, is reached.

Parental leave and sick leave are excluded from the list of factors influencing additional payments.

The average monthly salary of an employee applying for a security supplement includes:

- bonuses;

- government cash rewards.

Design features

It is impossible to accrue additional payments to miners' pensions in 2020 by default.

To receive money, a citizen must write an application to the Pension Fund of the Russian Federation and attach a package of documentation to it:

- papers confirming the duration of work activity, according to which it is possible to receive a bonus;

- a document containing information about the average monthly salary for the last 24 months.

The interests of the pensioner can be represented by a representative, provided that a notarized power of attorney is issued in his name.

Privileges

If in the past a pensioner was a miner and he has papers that confirm this, then such a citizen has the right to benefits at the federal and regional level.

List of benefits at the federal level in 2020:

- medical care in state hospitals for a former miner will be free;

- prostheses made from inexpensive materials are installed free of charge;

- state pharmacies provide preferential distribution of medicines (but there are few such points left in the Russian Federation, so a limited number of pensioners can take advantage of this benefit).

Does a pension depend on the minimum wage? Find out here.

Regional benefits include free travel for pensioners on public transport.

If a citizen does not want to receive medicines for free, then he has the right to submit an application to the Pension Fund with a request to receive this amount in cash equivalent.

Preferential medical care includes:

- insurance;

- free diagnostics;

- free prosthetics and dental checks;

- free treatment for work-related injuries.

List of benefits for children of miners:

- free breakfasts at school twice a week;

- provision of new school uniforms free of charge;

- priority admission to educational institutions.

Miners are rewarded for their length of service or quality of work done - a lump sum payment is made once a year.

Former miners have the right to choose this or a pension supplement.

If injured or disabled, a miner has the right to receive financial assistance.

If a miner dies, his family members have the right to receive the following assistance:

- from an insurance company (500 thousand rubles);

- benefits in the amount of one million rubles from the government;

- free funeral of the deceased is provided.

Upon receipt of disability, a miner has the right to choose a specialty and study for free in order to subsequently work elsewhere.

After the official assignment of a disability group, the former miner becomes entitled to benefits for the disabled.

Who retires at 50? Find out here.

What is the pension of deputies? Read on.

Not full underground experience for retirement in Russia

Not only the periods entered in the work book or which are considered to be business activity will be taken into account, but also: maternity leave (1.5 years for 1 child); Military service; public service; caring for a disabled or elderly person; periods of receiving benefits due to temporary disability. All about early retirement pensions production of artificial and synthetic fibers; production of medicines, medical and biological preparations and materials; certain types of work in healthcare institutions (for example, the work of radiologists, as well as doctors constantly employed in X-ray and angiography rooms, etc.); transport (certain types of work); work with radioactive substances, sources of ionizing radiation, beryllium and rare earth elements; nuclear energy and industry.

Contents: Requirements for special length of service By what rules is preferential length of service taken into account? Which pension is more profitable with “mixed” service? Employees who have worked in hazardous and difficult production conditions, as well as in the Far North, are granted early retirement. How is the preferential length of service summed up if a person changes his profession, place of work and place of residence during his life? Many questions arise when determining the right to a preferential pension, especially when the special length of service is “mixed” or has not been fully developed on any basis. Requirements for special experience The Government has established a list of industries and professions that give the right to benefits. But they are largely outdated, legislation is constantly changing and not all enterprises submit information to the Pension Fund about their employees.