Vladimir Putin's fourth term was marked not only by May decrees, but also by a whole package of programs improving the financial situation of Russians. In particular, quite recently the State Duma developed and adopted in the second reading a bill according to which it will be prohibited to withdraw funds from pension payments and benefits. Of course, the law has not yet been adopted and, moreover, has not yet entered into force, but this is an important milestone in reducing the overall “debt burden”. In this article, we study the new bill and also point out legislative possibilities for reducing the amount of monthly payments to bailiffs if the debtor’s only source of income is a pension, alimony or benefits.

Does a bailiff have the right to seize a pension?

Previously, the answer to the question whether bailiffs can calculate debt from pensions was unequivocal: yes, they can. True, with certain restrictions: an amount in an amount not exceeding 50% of the receipt of funds . In some cases, this figure could be increased to 70% - if, for example, the debtor must additionally compensate for damage to health or moral damage.

Before the new law prohibiting bailiffs from deducting pensions came into force, the debtor was often left with only the minimum subsistence level from the initial receipt of pension benefits, according to Art. 440 of the Civil Code of the Russian Federation. In addition, the debtor had to prove to law enforcement agencies the intended purpose of the account.

Note: an account can be considered a target account only if it was opened for the purpose of receiving any social benefits. If you opened an account “for education”, “for buying a car”, etc., this will not be considered opening a target account.

Previously, it was possible to repay the amount of debt from pension payments. This right was enshrined in Federal Law No. 229-FZ of October 2, 2007 On Enforcement Proceedings . Now there is a whole range of payments and benefits from which bailiffs do not have the right to collect. This will happen if the corresponding bill is adopted by the State Duma.

What part can bailiffs withdraw from a pension?

How much can a withholding amount to? When withholding part of a pension, as in the case of other income, bailiffs cannot forcibly recover an amount exceeding 50 percent of cash receipts.

For example, if a pensioner receives 20,000 rubles monthly, then the maximum amount that bailiffs can write off from him once a month will be 10,000 rubles.

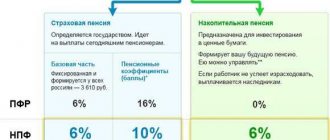

Payments on debts are levied on all types of pensions:

- insurance;

- social;

- cumulative;

- for state support.

The only exception is the survivor's pension. This means that even a person with a disability can be forced to repay the debt. However, there are types of proceeds that cannot be seized.

This includes:

- funds from the state budget that compensate for damage to health;

- payments to citizens who were injured while performing official duties;

- compensation payments to family members of the deceased; persons who suffered from man-made accidents; for caring for a person with a group 1 disability, a disabled minor or a citizen over 80 years of age;

- funeral payments;

- alimony payments.

Withholding part of a pension is very different from collecting money from wages. Working people can usually find a means to live a normal life even if 50 percent of their income is taken away. For pensioners, a pension is often the only source of income.

For example, in 2020, the Supreme Court was considering the claim of a married couple of pensioners who owed the creditor approximately 2,000,000 rubles. The FSSP decided to collect 50 percent of pensions from citizens. Pensioners filed a lawsuit because they believed that such measures were unlawful. The case was a success for the plaintiffs, since the court considered that withholding 50 percent of the pension leads to an infringement of the rights of the pensioner (in this case).

Important! In certain sources you can find expert advice regarding the protection of persons of retirement age from withholding of their FSSP pension.

For example, if you receive pension payments by mail and not on a card, the bailiffs allegedly will not be able to collect the money. In reality, there is no legal method to avoid forced withholding of funds. FSSP employees always retain the right to submit an application to the PFR settlement department and make deductions.

What types of pensions cannot be seized?

Key changes in this area occurred with the initiation of a bill, which is popularly known as the “law prohibiting withdrawal of money from pensions.”

Please note: this bill has not yet been passed. It just recently passed the second reading in the State Duma, the third reading is yet to come. Thus, it is too early to say that this law has been adopted - it must undergo a third reading, after which it will either come into force, be rejected, or come into force with amendments.

If this bill is actually adopted, bailiffs will no longer be able to collect funds to pay debts on loans and housing and communal services, if these funds come as:

- Certificate for maternity capital (after its use in a particular institution);

- Alimony;

- Child benefit;

- Funeral benefit;

- Financial compensation for causing harm to health;

- Pension for the loss of a breadwinner. The inclusion of long-service pensions in this list is also being discussed;

- Social benefits for persons caring for disabled people.

Is it possible to avoid deductions from pensions?

Some sources provide recommendations from lawyers, expressed in practical advice on protecting pensioners from the withholding of funds by bailiffs at the initiative of creditors. For example, if you receive pensions at the post office, then forced collection cannot take place. In fact, no one can legally avoid forced debt collection. Bailiffs always have the right to apply to the pension fund settlement center to make deductions.

Author of the article: Petr Romanovsky, lawyer Work experience 16 years, specialization - resolving disputes with bailiffs

Useful information on bailiffs

- How long after the trial do the bailiffs arrive?

- Can bailiffs withdraw money from a Sberbank bank card?

- How much can bailiffs deduct from salaries?

- Can bailiffs withdraw money from a salary card?

- Seizure of a car by bailiffs, is it possible to drive?

- If the bailiffs are inactive, a complaint against the bailiffs

- Who can you complain to about bailiffs?

- Submission of a writ of execution to the bailiff service

- Can bailiffs describe parents' property for children's debts?

- Actions of bailiffs on a writ of execution

- Sample complaint to the prosecutor's office against the bailiff

- Can bailiffs seize a credit account?

- Inquiry about the progress of enforcement proceedings

- The paid traffic fine was handed over to the bailiffs

- Do bailiffs have the right to withdraw money from pensions?

- Do bailiffs have the right to open an apartment without the owner?

- How to negotiate with bailiffs to pay the debt in installments

- The bailiffs do not comply with the court decision, what should I do?

- Can bailiffs seize a salary card?

- Terms of enforcement proceedings with bailiffs

- Does a bailiff have the right to seize a pension?

- Can bailiffs seize child benefits?

- Can bailiffs seize the only home?

- Can bailiffs seize a car?

- Can bailiffs seize a Sberbank card?

- Car arrest

- Can bailiffs describe property without a court order?

- How do bailiffs find out the debtor’s place of work?

- What property can bailiffs describe?

- How to remove a lien from an apartment

- Seizure of property not belonging to the debtor

- If the debtor does not pay according to the writ of execution

- Information about arrests of bailiffs

- How to revoke a writ of execution from bailiffs

- How not to pay bailiffs according to a court decision

- How to find out fines from bailiffs

- Can a bailiff withdraw money from an account without notice?

- How to submit a writ of execution to bailiffs

- What accounts cannot be seized by bailiffs?

- Search for debtors by bailiffs

- How to remove a car from being seized by bailiffs

- What to do if you receive a letter from the bailiffs

- Find out the debt from the bailiffs

- Certificate for bailiffs from the place of work about the salary card

- How to view a writ of execution from bailiffs

- Credit card seizure

- Answer to the bailiffs that the person is not working

- When bailiffs have the right to describe property

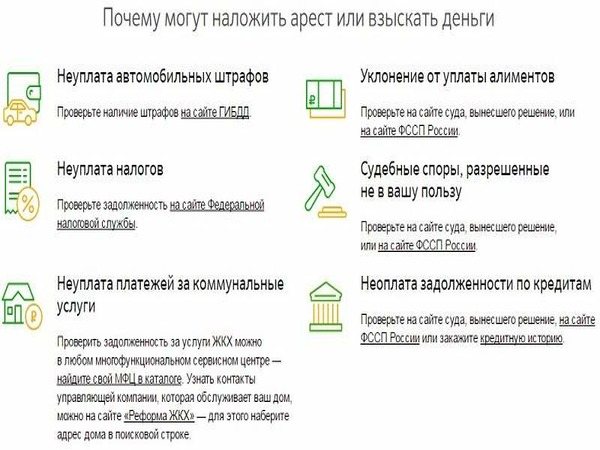

What can be the basis for arresting a pension?

Although at the moment it is too early to say that bailiffs will be prohibited from seizing funds from pensions, the bill still has a great chance of passing the third reading.

And it provides not only instructions regarding which payments are prohibited from being collected. It also contains regulations regarding the grounds for seizure of social payments (benefits, alimony, pensions, etc.):

- If the borrower does not pay at least the interest on the loan for a long time;

- If there are debts to pay alimony;

- If the debtor has unpaid utility bills.

In this case, the decision to initiate enforcement proceedings is made exclusively by a court - district, magistrate or arbitration. Even if the pension is seized, the bailiffs still do not have the right to completely seize the funds - the amount of the seized funds is always set in relation to the total amount of the debt.

In what cases does this happen?

Seizure of FSSP pension payments is an official procedure. To carry it out, a special act must be issued.

The debt collector may be:

- individual (alimony payments);

- legal entity (compensation for damage);

- Pension Fund.

Collection is carried out forcibly if:

- the pensioner does not want to voluntarily pay the debt;

- the court recognized that the debt was legitimate;

- the debt was formed due to the fault of the pensioner who was billed.

The procedure for forced payment of debts that have arisen for various reasons is described in legislative act number 229 “On Enforcement Proceedings”. In Art. 101 of this law provides a list of cash receipts that are not subject to forced collection. There are no pension payments on this list.

What the law says

In accordance with the current legislation regulating the procedure for providing pensions and deductions from this type of income, the FSSP has the right to forcibly recover part of the funds from the pension on the following grounds:

- executive documents have been drawn up;

- a decision of the Pension Fund has been formalized (for example, facts of overpayment of pensions have been identified);

- There is a court order giving the right to withhold part of the pension to pay off the debt.

How much can bailiffs deduct from pensions?

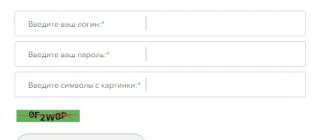

Here you need to immediately clarify:

- If the client does not notify the bailiffs about the purpose of the account, they may completely block the pension card or pension account. Thus, absolutely all funds will be spent on enforcement proceedings;

- If the client notifies the bailiffs, the amount can be significantly reduced.

Notification of the assignment of the account must be submitted to the bailiffs in writing. You need to document that it is to this account that the social payments you need are received. If this is not done, the maximum retention percentage will be 100%.

The Federal Law “On Enforcement Proceedings” answers the question of what part of the pension can be retained by bailiffs after confirmed notification of the intended purpose of the account. This is no more than 50% of incoming funds .

If, after deducting 50%, the amount remaining is less than the subsistence level in the region of the debtor’s permanent residence, part of this amount is returned to the debtor’s account. Thus, depending on the size of the pension, collection can be made in the amount of 0-50% of the initially received funds.

If the debtor caused health damage and/or moral damage to the plaintiff, bailiffs have the right to seize up to 70% of the pension.

Grounds for withholding part of the pension

A pensioner’s bank account may be seized if it has an outstanding debt on a loan or utilities. The amount of recovery may vary, reaching 100% of the funds credited to the account.

Note!

According to the new edition of the Federal Law “On Enforcement Proceedings”, the amount of the penalty can be reduced if you notify the bailiff that the purpose of the payment is an old-age pension. This must be done in advance.

The amount of recovery from a citizen’s pension cannot exceed 50%. This figure increases to 70% if we are talking about alimony debts or compensation for health damage.

What to do if the bailiffs seized your pension?

Of course, the new bill implies that pensioners will be protected from bailiffs. But to get such opportunities, the pensioner himself will also have to work hard. The simplest action to take is to send an alert. This already saves the pension from complete seizure, leaving the debtor with at least 50% of the originally received benefits.

Any enforcement proceedings begin with a court decision. Take the order issued by the court in your case and study it carefully. Find out in this document how much funds should be withdrawn from you, as well as who exactly is involved in your production. If the document does not indicate information about the persons involved in your case, information on this issue can be found on the website of the FSSP (Federal Bailiff Service).

Next, the bailiff will send the debtor a notice of the commencement of enforcement proceedings. At this moment, the debtor has the right to notify the FSSP employee that he wishes to voluntarily repay the debt within the agreed period. If the debtor does this, he will have the opportunity to defer payments, achieve debt restructuring, installment payments, and also reduce the amount of the monthly payment in exchange for increasing the duration of proceedings.

Just after receiving such a notification, you need to send an application to the FSSP employee with a request not to completely withdraw funds from the pension account. Indicate the details of your pension account in the document and attach documentary evidence of the intended purpose of the account. For example, a copy of a pension certificate, an account statement indicating the sender of funds, etc. can serve in this capacity.

From this moment on, the bailiff will not confiscate the entire incoming pension, but only a part - from 0% to 70%, depending on the size of the pension (0% is possible for a pension equal to or less than the subsistence level in the region of residence).

When will the bailiffs lift the seizure of the pension account?

In case of mistaken blocking, the bailiffs will remove the arrest from the account within 3 days. After this, employees of the FSSP of the Russian Federation will decide to collect a different, reduced amount from this account, or will begin to search for other income of the debtor.

It will be possible to completely remove the seizure from the account only after the citizen has fully repaid his debts. Unblocking is carried out by written order of employees of the FSSP of the Russian Federation.

The algorithm for removing seizure from a pension account is as follows:

- The citizen pays off debts, takes supporting papers and goes to the organization in whose favor the penalty was imposed. There you need to get a certificate confirming the absence of debt. It is valid for 10 days.

- A pensioner comes to the office of the FSSP of the Russian Federation and provides the employee conducting enforcement proceedings with a package of papers: copies of his passport, pension certificate, writ of execution, and the original document confirming payment of the debt.

- The applicant fills out a written request to remove the seizure from the account. It indicates the details of the bailiff, full name. debtor, information about the creditor, information about enforcement proceedings.

- An FSSP employee reviews documents and verifies payment facts. If everything goes well, an order is sent to the bank to remove the seizure from the account.

How to protect your pension from bailiffs?

So, in the last paragraph we have already explained that it is very important to send the bailiff a notice of the assignment of your pension account. Be sure to indicate that your pension is your only source of income. Otherwise, the bailiff may seize the benefits, believing that you have other income.

Please attach an account statement to your application, which will be stamped by the bank and signed by an authorized bank employee. If you do everything correctly, the bailiff, according to the law, will issue a decree to reduce the amount collected from the debtor’s special account. The reduction will be made by 30-100% depending on the size of the pension.

Attention: if the debtor has dependent children or incapacitated relatives, he will almost certainly receive a seizure of his pension in the amount of no more than 30% of the benefits received.

What to do if bailiffs continue to confiscate 100% of your pension?

If the notice was ignored and 100% of the pension is still withheld, the pensioner needs to complain either to the Chief Bailiff of the FSSP or to the prosecutor's office. If the complaint is sent to the FSSP, then it should be addressed to the bailiff who exercises direct control over the employees collecting funds from the debtor. Documents confirming the purpose of your account must be attached to your complaint.

Based on debt collection practice, such complaints are almost always satisfied. Exceptions are possible only if the debtor has “disclosed” his income in addition to the pension - for example, income from unofficial/official work, part-time work, regular financial assistance from children, etc.

Therefore, before filing a claim or complaint, you should carefully check whether the documentation you provide contains any information about additional income. Bailiffs must think that your pension is your only source of income, otherwise it will be very difficult to achieve a reduction in payment.

What documents are required for forced deduction of money?

Paragraph 1 of Article 29 of Law No. 400 “On Insurance Pensions” provides documents that are the basis for the forced deduction of amounts from insurance or funded content:

- if the defendant evades payment of alimony, utilities or regular loan payments, the procedure for writing off the amounts may begin upon submission of an executive act;

- decision of the Pension Fund of the Russian Federation, if it made an inflated payment of funds to the defendant;

- an act of a judicial authority that appointed a monetary penalty as a preventive measure.

Is it possible to seize a pension account a second time?

A citizen’s pension cannot be seized twice. This action can be carried out only in two cases:

- The applicant filed a second complaint after the refusal to voluntarily repay the debt at the previous consideration of the case. In this case, you must submit an application to the bailiff, in which you indicate the collection of strictly 50% of current income.

- The bailiff did not take into account that the citizen’s only income is social benefits from the Pension Fund. It is necessary to contact law enforcement agencies - the Prosecutor's Office or the Federal Bailiff Service - where to file a complaint about the unlawful actions of the bailiffs.