A special feature of the pension system in the Russian Federation is that it is based on an insurance model. Within its framework, there is a system of compulsory pension insurance, in which every citizen of the Russian Federation is registered from birth.

In practice, this means that if a previously working citizen of the Russian Federation for one reason or another loses his ability to work, then he has the right to count on material support in the form of a pension. It is paid from the state pension fund.

Depending on what caused the loss of ability to work, there are three forms of pension insurance:

- by old age;

- for loss of a breadwinner;

- on disability.

The features of accrual and payments of the latter will be discussed further in this article.

What is a disability insurance pension?

For people with disabilities, subject to certain conditions, the state assigns a cash payment called an insurance pension. There are several types of insurance benefits, but for this group the concept of “disability pension” is applicable. Funds are transferred regularly once a month .

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

State cash payments to disabled people are assigned as a measure of social support for a vulnerable category of people who have persistent health problems that limit their life activities.

Where to go

To apply for a disability insurance pension, apply at any time after your right to it arises, without any time restrictions. An application for an insurance pension with documents must be submitted to the territorial body of the Pension Fund of Russia at the place of registration (including temporary) or to the multifunctional center (MFC). If you live at an address that is not confirmed by registration, then contact the Pension Fund at your place of actual residence. An application with documents can be submitted in person or through a legal representative (authorized representative) directly to the territorial office of the Pension Fund of Russia, by mail or through the MFC. When submitting an application by mail, the day of application for an insurance pension is considered to be the date indicated on the postmark at the place where the application was sent, through the MFC - the date of receipt of the application by the MFC.

Russians who have left Russia for permanent residence and do not have a place of residence and place of stay in Russia confirmed by registration, submit an application directly to the Pension Fund of Russia (Moscow, Shabolovka St., 4).

Conditions for granting a disability pension

To qualify for a disability pension, certain conditions must be met. For people with disabilities, the following requirements are put forward for payment:

Availability of an official document confirming the status of a disabled person

As a rule, an extract from the medical and social examination report is sent by the organization to the relevant pension authority within 3 days from the moment the citizen is recognized as disabled.

Experience of any length

In the absence of a period of labor activity, the citizen is paid a social benefit.

Deadline for assigning a disability insurance pension

After submitting an application for a pension payment with all the documents attached to it, the application will be considered by Pension Fund employees within 10 working days from the date of acceptance.

Disability insurance benefits are established for a limited period of time:

- before the end of the period of recognition of a citizen with the appropriate status;

- for the period of validity of the medical certificate;

- before reaching retirement age.

If a person has not renewed the required documents or has ceased to be documented as disabled, or has reached the age that gives the right to retire, in this case, the citizen loses his status and no longer has the right to receive state cash benefits.

Set of services for the disabled

The formation of the NSO is carried out automatically when a citizen submits documentation for the EDV.

The monthly allowance includes:

- 807 rubles for medical supplies;

- 124 rubles for treatment in a sanatorium or resort;

- 116 rubles for public transport.

If a citizen wishes, he can use a set of services in cash . To do this, you will need to write an application and submit it to social security. This must be done before the beginning of October of this year.

Amount of disability insurance pension for group 1

The basic state cash payment to disabled people of group I currently includes:

- for work in the absence of dependent persons - 10,668.38 rubles. ;

- if there is one dependent – 12,446.44 rubles. ;

- if there are two dependents - 14,224.50 rubles. ;

- if there are three dependents – 16,002.56 rubles.

An increased pension is assigned to citizens who have lived in the Far North for 15 years, as well as those who have insurance coverage.

Calculation of benefits for disabled military personnel

This payment is reflected in the framework of support for citizens who were injured during military service. Category 1 is represented by the military themselves, category 2 by their families.

A payment of 1000 rubles is intended for:

- persons who took part in the Second World War and disabled people;

- citizens with war trauma;

- those who were prisoners as minors.

There is also a surcharge of 500 rubles. It is intended for persons who served during the Second World War, but were not included in the army, and widows of war participants.

Thus, the calculation of disability benefits depends on the category of disability and the type of pension. The calculation takes into account the territory in which the recipient lives. This is due to the fact that the pension is equal to the minimum wage level.

Amount of disability insurance pension for group 2

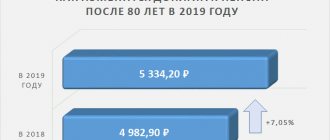

The amount of pension payments to disabled people of group II is paid in the general manner on a monthly basis, and for 2020 it amounted to 5,334.19 rubles. For persons with disabilities since childhood RUB 10,567.73.

If there are periods of working activity, the amount of payment changes:

- in the absence of dependent persons - 5,334.19 rubles. ;

- 1 dependent – 7,112.25 rubles. ;

- 2 dependents – 8,890.31 rubles. ;

- 3 dependents – 10,668.37 rubles.

Calculation of disability pension

To calculate the amount of a disability pension benefit, you need to know the values of the following indicators:

- the amount of a fixed payment depending on the group, established by a regulatory legal act;

- number of pension points (IPC);

- cost of one point.

Formula for calculating disability insurance benefits:

Pension size = number of IPC * cost of 1 point + amount of fixed cash payment

Who is entitled to payments?

This cash benefit is available to individuals who have documented health-related limitations.

Depending on the amount of damage caused to health by illness or injury, disability is divided into several groups:

- Group I - the degree of deviations from the normal functioning of the body ranges from 90% to 100%;

- Group II - almost 80%;

- Group III - from 40 to 60%

We especially note the following categories:

- military personnel who suffered serious health problems while performing their duties, representatives of other professions equated to this category;

- military pilots, cosmonauts;

- veterans, participants in military operations;

- civilians injured in military operations or exercises; participants in the liquidation of the consequences of man-made disasters, those who suffered from radiation during the disaster; persons with the status of “Resident of besieged Leningrad”, etc.

Attention !

To confirm the presence of disability, as well as the group, a medical examination is carried out annually. However, for people who have suffered certain diseases and have significant irreversible abnormalities in the body, the group is assigned indefinitely, without annual confirmation:

- with amputation or deformation of limbs;

- for cancer, brain tumors;

- the presence of absolute blindness or deafness.

Fixed payment to the disability insurance pension

When assigning an insurance pension to citizens with disabilities, a fixed payment was automatically calculated, the amount of which was indexed annually depending on the level of inflation for the previous year. Starting from 2020, the payment amount is set without taking into account the increase in consumer prices, but the increase will still be carried out. This procedure for calculating payments will be valid until 2024 inclusive.

For 2020, the fixed amount is RUB 5,686.25. If we consider future years, the following values are established by law:

- 2020 – 5 thousand 696 rubles. 25 kopecks;

- 2021 – 6 thousand 44 rubles. 48 kopecks;

- 2022 – 6 thousand 401 rubles. 10 kopecks;

- 2023 – 6 thousand 759 rubles. 56 kopecks;

- 2024 – 7 thousand 131 rubles. 34 kopecks

Attention! Due to recent changes in legislation, the legal information in this article may be out of date!

Our lawyer can advise you free of charge - write your question in the form below:

The procedure for calculating the amount of disability insurance pension

defined by clause 2 of Art.

15 of the Federal Law of December 28, 2013 N 400-FZ “On Insurance Pensions”. The new pension legislation from 2020 has significantly changed the possibilities for both receiving and increasing the disability insurance pension.

Who is entitled to a disability insurance pension?

First of all, we will determine who has the right to a disability insurance pension under the new pension legislation from 2020.

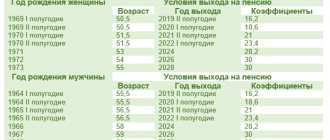

The following are entitled to a disability insurance pension:

- citizens insured under compulsory pension insurance,

- recognized as disabled people of groups I, II or III, regardless of the cause of disability, duration of insurance coverage, continuation of work and (or) other activities, as well as whether the disability occurred during work, before entering work or after termination of work.

If a disabled person has no insurance coverage, a social disability pension is established in accordance with the Federal Law “On State Pensions” dated December 15, 2001 N 166-FZ (Article 9 of the Federal Law dated December 28, 2013 N 400-FZ “On Insurance Pensions” ").

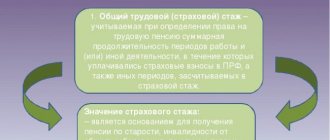

Attention. The insurance period includes periods of labor activity on the territory of the Russian Federation, provided that during these periods insurance contributions to the Pension Fund and other periods were accrued and paid (Articles 11, 12 of the Federal Law of December 28, 2013 N 400-FZ “On insurance pensions"; clause 2 of the Rules, approved by Decree of the Government of the Russian Federation of October 2, 2014 N 1015 "On approval of the Rules for calculating and confirming the insurance period for establishing insurance pensions").

These periods of work are confirmed on the basis of individual (personalized) accounting information (clause 2 of Article 14 of the Federal Law of December 28, 2013 N 400-FZ “On Insurance Pensions”).

The amount of the disability insurance pension is calculated according to the formula (clause 2 of Article 15 of the Federal Law of December 28, 2013 N 400-FZ “On Insurance Pensions”):

SP = PC x C + FV, where

SP - disability insurance pension;

PC - the sum of all annual individual pension coefficients (pension points);

C - the cost of one individual pension coefficient (pension point) as of the day from which the disability insurance pension is assigned;

FV - fixed payment to the insurance pension.

Annual individual pension coefficient (pension point) for calculating the amount of disability insurance pension

Annual individual pension coefficient (pension point) is an indicator that evaluates each calendar year of labor activity of a citizen registered in the compulsory pension insurance system, taking into account annual deductions of insurance contributions to the Pension Fund (Part 9 - 14 Article 15 of Federal Law of December 28, 2013 N 400 - Federal Law “On Insurance Pensions”).

When calculating the amount of the disability insurance pension, the sum of annual pension points for the periods is taken

- until January 1, 2020 and

- after January 1, 2020.

When calculating the amount of pension points for periods before January 1, 2020, the amount of the disability insurance pension as of December 31, 2014 is calculated

Attention. This does not take into account the fixed base amount of the disability insurance pension.

The resulting amount of the disability insurance pension as of December 31, 2014 is divided by the cost of one pension point as of January 1, 2020 - 64.10 rubles.

If a citizen does not work and is caring for a child , the corresponding period is counted towards the insurance period and

- The citizen is awarded pension points.

For example, in relation to the period of care of one of the parents for the first child until he reaches the age of one and a half years, a pension point of 1.8 is applied (Parts 12 - 14 of Article 15 of the Federal Law of December 28, 2013 N 400-FZ “On Insurance Pensions”). These pension points are added to the amount of already calculated pension points.

The period of child care is taken into account if it is not already taken into account (at the choice of the citizen) when calculating the amount of the old-age insurance pension or the survivor's insurance pension.

The value of these pension points is also affected by the coefficient

- equal to the ratio of the standard duration of the disabled person's insurance period (in months) on the day from which the disability insurance pension is assigned to 180 months.

At the same time, the standard duration of the insurance period until the disabled person reaches the age of 19 is 12 months and increases by four months for each full year of age starting from 19 years, but not more than up to 180 months (Part 10 of Article 15 of the Law of December 28, 2013 N 400-FZ “On insurance pensions”).

The number of pension points per year is limited and differs for those who have chosen the option of pension provision with the formation of a funded pension, and those who have refused to form a funded pension. At the same time, the maximum value of pension points will gradually increase from 2020 to 2021 (Part 19, Article 15 of the Federal Law of December 28, 2013 N 400-FZ “On Insurance Pensions”; Appendix No. 4 to the Law of December 28, 2013 N 400- Federal Law “On Insurance Pensions”):

— for those who do not have pension savings in the corresponding year, from 7.39 points in 2020 to 10 points in 2021;

— for those forming pension savings from 4.62 points in 2015 to 6.25 points in 2021 .

The cost of one individual pension coefficient (pension point) as of January 1, 2020 is set at 64.10 rubles. (Part 10, Article 15 of the Federal Law of December 28, 2013 N 400-FZ “On Insurance Pensions”).

Moreover, every year

- from February 1, the cost of one pension coefficient (pension point) should, according to the new pension legislation, increase by no less than the consumer price growth index for the past year, and

- from April 1 should be established by the federal law on the budget of the Pension Fund for the next year and planning period.

The annual increase in the value of the pension point should not be less than the consumer price growth index for the past year (Parts 20 - 22, Article 15 of the Federal Law of December 28, 2013 N 400-FZ “On Insurance Pensions”).

The only question is how to correctly calculate the consumer price growth index and how it is calculated by the government in reality!

For reference. From February 1, 2020, the cost of one individual pension coefficient (pension point) is 71 rubles. 41 kopecks (Clause 2 of the Decree of the Government of the Russian Federation of January 23, 2015 N 39 “On approval of the consumer price growth index for 2014 to establish the cost of one pension coefficient from February 1, 2020”).

Fixed payment for calculating the amount of disability insurance pension

A fixed payment in a fixed amount is established for the disability insurance pension, which depends

- from the disability group,

- presence of dependents and

- place of residence of the recipient of the disability insurance pension (Articles 16, 17 of the Federal Law of December 28, 2013 N 400-FZ “On Insurance Pensions”).

The fixed payment to the insurance pension is actually a close analogue of the fixed basic size of the labor pension in the previous pre-reform pension formula.

Thus, a fixed payment to the disability insurance pension, with the exception of payment to the disability insurance pension for disabled people of group III, is established

- in the amount of 3935 rubles. per month (Part 1, Article 16 of the Federal Law of December 28, 2013 N 400-FZ “On Insurance Pensions”);

- the fixed payment to the disability insurance pension for disabled people of group III is 50% of this amount, that is, 1967.50 rubles;

- in addition, the size of the fixed payment to the disability insurance pension must be increased annually by a coefficient (index) approved by the Government of the Russian Federation. This index should not be lower than the inflation rate for the previous year (Parts 6, 7, Article 16 of the Federal Law of December 28, 2013 N 400-FZ “On Insurance Pensions”).

From February 1, 2020, the indexation coefficient of the size of the fixed payment to the insurance pension, including for disability, is 1.114, that is, the size of the fixed payment to the insurance pension is indexed by 11.4% (clause 1 of the Decree of the Government of the Russian Federation dated January 23, 2015 N 40 “On approval of the indexation coefficient from February 1, 2020 of the amount of a fixed payment to the insurance pension”).

A fixed payment to the disability insurance pension in an increased amount is provided (Article 17 of the Federal Law of December 28, 2013 N 400-FZ “On Insurance Pensions”):

- for disabled people of group I;

- citizens who have reached the age of 80;

- citizens who worked or lived in the Far North and equivalent areas;

- citizens who have dependent disabled family members.

How to influence an increase in the size of the disability insurance pension

Thus, the size of the disability insurance pension is affected by:

- disability group;

- the amount of accrued and paid insurance contributions to the compulsory pension insurance system, depending, accordingly, on the size of the “white” salary;

- the standard duration of your insurance period;

- presence of dependents;

- Do you live in the Far North and equivalent areas?

Now, knowing what factors and how they influence the size of the disability insurance pension, in your pension planning you can influence the increase in the size of the disability insurance pension.