Home > Pension insurance subjects > For future pensioners > Compulsory pension insurance system > Insurance contribution rate

- Collapse

- Expand

Article navigation

- Principles of compulsory pension insurance Contributions to compulsory pension insurance - what is it?

- Insurance premium rate

4 014

The key point of our pension system is insurance contributions. We are all participants in the compulsory pension insurance system (OPI) . Pension security is guaranteed to all citizens of our country.

All policyholders, payers of insurance premiums, make payments for themselves and for their employees in accordance with the standards established for each case and within the time limits specified by law.

- The basic tariff provided for the main category of employers is 22%. However, there are certain categories for which the tariff is much lower, and in some cases it is completely absent.

- In addition, there is a restriction regarding the maximum amount of accrued income from which contributions are paid to the Federal Tax Service (until 2017 - to the Pension Fund).

All these concepts are disclosed in Law No. 167-FZ of December 15, 2001 “On compulsory pension insurance in the Russian Federation.”

Thus, the importance of the role assigned to insurance contributions is obvious, since they are the only source of financing pension payments and form the basis of our future pension .

Principles of compulsory pension insurance in the Russian Federation

Compulsory pension insurance (MPI) is a whole system of measures created by the state to partially compensate citizens for their lost income after retirement. Citizens who are covered by compulsory health insurance are called insured persons .

The principles of the OPS are based on the introduced system of individual registration of citizens and allow:

- take into account the receipt of insurance payments in the personal account of each insured person;

- record data about his place of work and duration of work;

- determine the number of accumulated pension points to calculate a future pension.

Payments in the OPS system are made upon the occurrence of an insured event , i.e. reaching retirement age, loss of ability to work due to disability, loss of a breadwinner.

The key participants in the OPS system are the insured persons themselves, policyholders and insurers.

Policyholders are the direct payers of insurance premiums. The role of such participants in the OPS may include:

- organizations;

- individual entrepreneurs (IP);

- individuals paying contributions for themselves and for others;

- self-employed population (notaries, lawyers, etc.)

As for insurers , their role may be:

- in terms of insurance pension: Pension Fund of the Russian Federation;

- in terms of funded pensions: various non-state pension funds (NPFs).

The main administrator here, of course, is the Pension Fund, since it manages all pension funds in the compulsory pension system.

Contributions to OPS - what are they?

All funds received by the Federal Tax Service (until 2020 - by the Pension Fund of Russia) are recorded on individual personal accounts of citizens in accordance with the current system of individual (personalized) accounting by insurance certificate number (green laminated card).

Insurance premiums for compulsory health insurance are amounts accrued from all payments and other remunerations in favor of the employee and paid by the employer in accordance with the law. These contributions represent the future pensions of these employees and constitute the pension benefits of current beneficiaries.

The distribution of contributions is carried out in accordance with current regulations and the pension option chosen by the citizen.

Direct transfer of funds is carried out by the policyholder , who performs two important functions:

- payment of contributions for their employees ;

- own payments for yourself .

As for citizens - insured persons who have received an insurance certificate of compulsory pension insurance, these include:

- citizens of the Russian Federation;

- foreigners permanently or temporarily residing in our country;

- stateless persons.

Summary

Important conclusions regarding the current pension insurance system in Russia:

- Insurance upon reaching retirement age is mandatory for all residents of the country. Following the requirement of Federal Law No. 167Z, insurers pay special contributions to the compulsory health insurance account for all working employees to their individual personal account.

- The country's main insurer is the Pension Fund (PFR). It records all incoming money in the personal accounts of registered citizens, according to the established tariffs.

- Payments under compulsory health insurance are “included” when the insured citizen reaches certain conditions. The most common type of payment is an old-age insurance pension. Such a pension is assigned to a person when he reaches the age of retirement.

Video files

Who pays the employee's contributions?

Employers pay monthly insurance premiums from their employees' salaries. However, not everyone clearly understands two main points: they are accrued from the employee’s payroll before deduction of all taxes, and are transferred directly by the policyholder from his own funds .

Payers of contributions for their employees are:

- organizations that have employees;

- individual entrepreneurs (IP), including heads of farms with employees under their command;

- persons who are not individual entrepreneurs, but pay remuneration to individuals.

Most of the insured persons for whom policyholders pay premiums work under an employment contract or a civil law contract.

If the policyholder belongs to several categories, then he makes transfers of payments for several reasons.

How is the pension payment fund formed?

Pensions were paid to Russian citizens before, but the pension payment fund was formed from the state budget. Contributions to social insurance, including pensions, were made by enterprises and were very small, but a significant share of enterprise profits was transferred to the state budget.

Contributions were not taken from employees at all, because our older generation received salaries from the state, since they worked for it; there were no commercial structures. Therefore, there was no point in the state withholding pension contributions. Everything was included in the budget; when assigning a pension, salary and length of service were taken into account.

Now, taking into account the fact that a person can work both in a commercial structure and in the civil service, the employer transfers contributions to the Pension Fund.

It is the employer from the Payroll Fund, and not you personally from your salary, that is the answer to the remark “I’ve been crying all my life!”

Insurance contributions for compulsory pension insurance in 2020

When calculating contributions to compulsory pension insurance, it is important to determine the maximum salary amount at which payment occurs. If income exceeds this value, then another 10% tariff is provided. The maximum level of the contribution base is determined by the government every year; in 2020 it is equal to 1,292,000 rubles .

The tariffs depend on the following parameters:

- categories of the insured;

- employee age;

- from the amount of income accrued to the employee during the year.

Special rates are provided for policyholders who have preferential jobs. When calculating payments at an additional tariff if such places are available, the limitation on the maximum base does not apply.

For some categories of payers, reduced insurance premium rates apply, and some are completely exempt from paying for a number of reasons.

Amount (tariff) of insurance contribution for compulsory pension insurance

Each of us, being an insured person, forms our pension rights and our future pension. To achieve this, our employers transfer 22% of our salary monthly to our individual accounts.

This tariff can be distributed in two ways depending on the chosen pension option:

- In the first case, the individual tariff of 16% will go entirely to the formation of the insurance pension, and the solidary tariff of 6% will ensure the payment of a fixed part of the pension to its current recipients.

- Another case applies to citizens born in 1967 and younger, who could choose a pension option with a funded payment before 2020, and young employees who have the right to such a choice during the first five years of their working career. For all of them, the individual rate will be 10% for the formation of an insurance payment and 6% for a cumulative payment, while the joint rate remains unchanged.

This basic tariff in the OPS system is provided for payers using the general taxation system.

Additional contributions to the Pension Fund (in case of hazardous working conditions)

Since 2013, additional tariffs have been introduced for employers with workplaces that are harmful and dangerous to life and health. They apply to all payments in favor of insured persons engaged in such types of work.

According to Law No. 426-FZ “On Special Assessment of Working Conditions,” the employer conducts such an assessment with the involvement of the relevant organization in order to:

- ensure the safety of the employee during work;

- establish a certain class of working conditions to provide guarantees and compensation to employees.

The choice of the tariff for the additional contribution depends in this case on the fact of the special assessment.

- in the presence of a special assessment additional. the insurance premium rate will be set based on the accepted hazard class, and the more dangerous the working conditions (the most dangerous is class 4, the optimal is class 1), the higher the payment rate;

- in the absence of a special assessment, the contribution rate is 9% for work on List 1 and 6% for List 2 and “small” lists.

An assessment of working conditions is carried out by the employer at least once every five years.

Reduced insurance premium rates

The insurance premium rate below the generally established 22% applies to the following categories of payers:

| Reduced tariff | Payer categories |

| 20% |

|

| 14% | organizations participating in the Skolkovo project |

| 8% |

|

| 6% |

|

Payers of such preferential categories are exempt from paying contributions if the contribution base is exceeded.

Insurance premiums in 2020 for individual entrepreneurs for themselves

Policyholders registered as individual entrepreneurs receive income from their activities without paying themselves a salary. In this regard, a special procedure is provided for their payment of insurance premiums, regardless of the availability of income from the activities undertaken in the current year.

The payment amount is set in accordance with the entrepreneur’s income level for the year:

- if it is below 300 thousand rubles , then a fixed amount of 32,448 rubles is applied;

- if it is above 300 thousand rubles , then it will be necessary to pay an additional 1% on the amount of excess income to the fixed amount.

When are they exempt from paying?

In addition to a special procedure for calculating insurance payments under compulsory insurance for individual entrepreneurs for themselves, they are provided with an exemption from paying contributions for certain periods during which entrepreneurs did not carry out the relevant activities . This measure is also provided for the self-employed population.

Grace periods include:

- military service upon conscription;

- caring for a child until he reaches the age of one and a half years, but not more than six years in total;

- caring for a disabled person of group I, a disabled child or an 80-year-old citizen;

- living with a military spouse for no more than 5 years in places where there is no employment opportunity;

- living abroad for no more than 5 years with a spouse who is an employee of the diplomatic mission of the Russian Federation.

The listed periods are counted in the insurance period along with the periods during which contributions were paid.

Pension Fund requirements

One of the main difficulties when filling out personalized accounting information is filling out the amounts of accrued and paid contributions* for each insured person in forms SZV-6-2 and SZV-6-1.

Note:

* Since the principles for filling out the amounts of contributions to finance the insurance and funded parts of a pension are the same, in the material, contributions mean both the insurance part and the funded part.

According to paragraphs 71, 72 of the Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p (hereinafter referred to as Resolution No. 192p), in the forms in the “accrued” field the “amount of accrued insurance premiums ... for the last three months ... of the reporting period ...”* is indicated, subject to “the presence of during the reporting period of information."

Note:

* At the same time, “for payers of insurance premiums who make payments and other remuneration in favor of crew members of ships registered in the Russian International Register of Ships, in relation to crew members of ships, the amount of insurance premiums is indicated corresponding to the amount of insurance premiums to finance the insurance/funded part of the labor pension under basic tariff."

The “paid” field indicates “the amount of insurance premiums paid... in the last three months... of the reporting period...”, while “the amount of overpaid (collected) insurance premiums is not taken into account in this detail.” The field is filled in “if during the reporting period there is information or payment for the insured person of debt for previous reporting periods, including those dismissed.”

In addition, Resolution No. 192p contains a requirement to indicate the amount of insurance premiums “in the amount calculated from the base for calculating insurance premiums, but not more than the maximum taxable amount.”

If there are usually no problems with determining the contributions accrued for each person (since contributions are calculated separately for each person), then determining the contributions paid for each person may cause certain difficulties. At the time of payment of contributions, it is impossible to indicate (record) for whom exactly these contributions are paid and even for what period (month) they are paid - such information is not entered into payment documents. Only the total amount of contributions paid and the date of payment are known.

Federal Law No. 212-FZ of July 24, 2009 obliges the policyholder to “keep records of the amounts of accrued payments and other remunerations, the amounts of insurance premiums relating to them in relation to each individual...”, while the “type of movement of contributions” (accrued or paid) not specified. The recommended Pension Fund for the fulfillment of this obligation “card for individual recording of the amounts of accrued payments and the amounts of accrued insurance premiums” does not imply maintaining individual records of the amounts of paid contributions.

Note:

* Letter of the Pension Fund of the Russian Federation dated January 26, 2010 No. AD-30-24/691.

In this regard, it is advisable to determine the amount of insurance premiums paid for each person at the stage of filling out reports. No official recommendations have been published by the FIU on how such distributions should be made. However, the main requirement for distribution results follows from Resolution No. 192p. Analyzing its provisions, we can conclude that when filling out personalized accounting information, paid contributions must be indicated in such an amount that for each person there is no overpayment (excess of paid contributions over accrued) taking into account all the information already available in the Pension Fund for previous reporting periods. In this case, accrued contributions must be indicated minus the amounts of contributions accrued from income exceeding the maximum taxable base (if any).

The legislation does not contain any other requirements regarding the distribution of paid contributions among individuals. For example, it does not contain such a rule that some persons have priority over others in the distribution of paid contributions and that for some the amounts paid should be indicated in a relatively larger amount than for all, and for others, on the contrary, in a relatively smaller amount than for all. The most fair and obvious seems to be the distribution of the total amount of contributions paid “equally” to everyone, in proportion to the amounts of accrued contributions. The fact that the distribution of paid contributions to individual personal accounts of insured persons was carried out by the Pension Fund of the Russian Federation in exactly this way is indicated by paragraph 3 of clause 7 of the Rules for accounting for insurance contributions included in the estimated pension capital, approved by Decree of the Government of the Russian Federation of June 12, 2002 No. 407.

Figure 1 shows a schematic representation of the principle of such distribution.

Reporting period

Rice. 1

The amount of contributions paid in the reporting period*, indicated in the diagram as P, is distributed to pay off the debt at the beginning of the reporting period (d1+d2+d3), for all employees equally (both for the previously dismissed Guseva and for the rest of the employees); the balance of the amount is for the payment of contributions accrued for the current reporting period (a1+a2+a3), also for all employees equally (both for Egorov, who was dismissed in the reporting period, and for Zemtsov, who was hired at the end of the period and has been working throughout Gorin period).

Note:

* The “reporting period” in the material means the last three months, and not the entire period from the beginning of the calendar year.

However, in some exceptional situations (for example, if an employee is assigned a pension, and its amount depends on the contributions paid for this particular employee), it may be necessary to “close” the payment for a specific person, i.e. indicate the payment amount is relatively larger , than others.

In "1C: Accounting 8", ed. 3.0. Automatic filling of the amounts of paid contributions for each person in personalized accounting information has been implemented. The filling algorithm is based on the principle of distributing the total amount of paid contributions in proportion to the amounts of contributions accrued for each person. The results of distribution according to this algorithm satisfy all the requirements of current legislation and pass all checks required by the Pension Fund of Russia. If necessary, information about contributions paid for any persons can be edited manually, and contributions paid for other persons can be automatically redistributed taking into account these manual changes.

Let's consider the procedure for distributing the amounts of paid contributions using the example of "1C: Accounting 8", ed. 3.0. The order of reflection in other application solutions may differ slightly.

When automatically filling in the Paid field in personalized accounting information, the following data is used:

1. The total amount of payment (which must be distributed among all persons).

The payment amount generally consists of two components:

— amounts of insurance premiums directly paid to the Pension Fund in the reporting period.

These are amounts that are recorded in the program by documents Debiting from a current account with dates included in the reporting period.

Please note that contributions paid to finance the insurance part of the pension are not divided into contributions from amounts not exceeding the maximum taxable base and contributions from amounts exceeding this amount. All contributions paid in the current period are used for distribution in personalized accounting information.

- the amount of overpayment of contributions, if any, at the beginning of the reporting period.

If in previous reporting periods a part of the paid insurance premiums during distribution was undistributed (i.e., in general, for all periods of contributions more was actually paid than accrued), then this part is used for distribution in the current reporting period.

2. The amount of debt at the beginning of the reporting period.

In previous reporting periods, accrued contributions may not have been paid in full, i.e., in previously submitted personalized accounting information, the amount of paid contributions may be less than the amount accrued. In order for the information of the current period to be “matched” in the Pension Fund with the information of previous periods already available there, when distributing payments in the current reporting period, it is necessary first of all to “close” the debt of previous periods. To do this, it is necessary to know both the total amount of such debt and the amount of debt for each person - in order to distribute the payment proportionally to everyone (if the payment amount is not enough to cover the entire debt). These amounts are determined on the basis of sets of information from previous periods available in 1C: Accounting 8. Only information from sets with the status Set information posted to personal accounts is taken into account. If information from past periods was generated in another program, then it must be downloaded from files that were sent and accepted to the Pension Fund of Russia, or this information must be entered manually (for more details, see the material https://its.1c.ru/db/staff1c# content:34431:1).

In practice, a situation may arise when the Pension Fund independently changes information, for example, about contributions paid by individuals, in previously accepted batches. In this case, the data located in the policyholder’s database (or in the files of submitted reports) will differ from those that are actually available in the Pension Fund of Russia database, and therefore the distribution of paid contributions may be made inadequately. For example, when connecting, an overpayment is created for some persons, which is not acceptable.

It is also possible that a situation may arise where information from previous periods, despite the fact that it leads to an overpayment, was accepted by the Pension Fund. Such information from the past period is not acceptable and must be adjusted (instead, corrective information is issued).

3. The amount of accrued contributions for the reporting period.

If insurance premiums were accrued in the current reporting period, then when distributing the paid contributions by person, it is analyzed how many contributions were accrued (the accrued contributions are shown in the personalized accounting information for the current period), both in total and by person.

Therefore, before the Paid field is filled in in the personalized accounting information of the current reporting period, the Accrued field must be filled in. The Accrued field is filled in automatically based on the data on income and contributions registered in the Payroll document.

Please note that accrued contributions in personalized accounting information are indicated minus the amounts of contributions accrued from income exceeding the maximum taxable base.

Let us now consider the principle of payment distribution itself.

The amount of payment for each person generally consists of the amount of payment of debt and the amount of payment of current accruals (contributions shown as accrued in the information of the current reporting period) and is determined as follows.

1. If there is a debt for previous reporting periods, then it is “repaid” first:

- if the total amount of payment is less than the total amount of debt (i.e., the amount of payment is not enough to cover the entire debt), then it is distributed to all persons evenly (with the same coefficient). The debt repayment ratio is defined as the ratio of the total payment amount to the total debt amount. The amount paid for each person includes the amount of debt on it, multiplied by this coefficient. There are no more funds left to pay off current accruals, and these amounts will be the final amounts in the Paid field;

- if the total amount of payment is greater than the total amount of debt or equal to it (i.e., the amount of payment is enough to cover the entire debt), then the amount of payment in the amount of the debt for this person is included in the amount paid for each person.

After the debt is repaid, some portion of the total payment remains (if the payment is strictly more than the debt). This part can then be used for distribution to pay current charges, if they are present in the information of the current period.

2. If the information for the current period contains the amounts of accrued contributions, and there is a remainder of the total payment amount after repayment of the debt (or there was no debt at all, and then the payment amount remained in full), then this payment amount is used to pay current accruals:

- if the amount of the remaining payment is less than the total amount of current charges (i.e. the payment amount is not enough to “cover” all current charges), then it is distributed to all persons evenly (with the same coefficient). The payment ratio of the current period is defined as the ratio of the remaining total payment amount to the total amount of current charges. In the amount paid for each person, the amount of his current accruals, multiplied by this coefficient, is entered (or added, if the amount of debt payment had already been previously entered);

- if the amount of the remaining payment is greater than the total amount of current accruals or equal to it (i.e., the amount of payment is enough to “cover” all current accruals), then an amount equal to the amount of current accruals is entered (or added) to the amount paid for each person, but nothing more. The amount of payment for each person cannot exceed the amount of debt on it plus the amount of accruals from current information.

Thus, in the information of the current period for a specific person, the amount “paid” may be greater than the amount “accrued” only if the debt of the previous period is repaid.

Please note that monitoring the compliance of the amounts of accruals and payments received in personalized accounting information with the amounts received in the RSV-1 should not be done “by eye”, but with a check built into “1C: Accounting 8” or with the PFR verification programs, since control the relations are not trivial enough, for example*:

“The value of the indicator “Accrued” in ... ADV 6-2, reduced by the values of the corresponding indicators of the line with the category code of the insured person “CHES”, “VZhES” and “VPES”, should be equal (within the value equal to 1.5 kopecks, multiplied by the number of insured persons) the value of the indicator of line 114 in column 3 ... RSV-1 reduced by the sum of the values of columns 4, 5 and 6 of line 252 (if there are several Sections 2 of RSV-1, the values of columns 4, 5 and 6 of line 252 of each section are involved )".

“If there are sections in the DAM-1 calculation with tariff codes “51”, or “52”, or “53”

the value of the “Paid” indicator in ... ADV 6-2 must be less than or equal to, within 1 ruble, the value obtained using the following formula:

- for the 1st quarter, line 140 ... in column 3 ... RSV-1 minus line 150 ... in column 3 with a sign (-) overpayment in absolute value plus line 100 ... in column 3 with a sign (-) overpayment in absolute value.

- for the second and subsequent quarters, instead of line 100 in the formula for calculating the RSV-1 payment for reconciliation, you must use the expression: (page 110 - page 114) - (page 140 - page 144 - page 100).

The values of line indicators 150 and 100 with the sign (+) debt are not included in the calculation.”

Note:

* From the verification rules published at https://www.pfrf.ru/userdata/rabotodatelyam/persuchet/otchet_per/pravila_proverki_3.doc

Let's look at specific examples of how the total amount of premiums paid is automatically distributed (using the insurance part as an example).

Example 1. No debt or overpayment

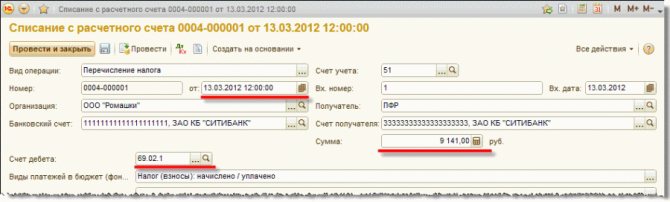

| Debt and overpayment may be absent if, for example, the organization has just started its activities, or accruals from previous periods have been neatly “closed” - exactly as many contributions have been paid as accrued. Let's assume that the organization Romashki LLC began its activities in the 1st quarter. 2012 (we will omit the year from now on). The organization pays contributions at the “basic” rate. In February, the first payment of salaries and, accordingly, contributions to three employees was made (see Fig. 2).

Rice. 2 At the beginning of March, these contributions were fully paid (Fig. 3).

Rice. 3 In March, the fourth employee was hired, salaries and contributions were calculated (Fig. 4).

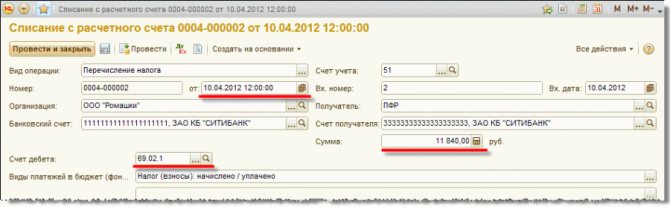

Rice. 4 These contributions were paid at the beginning of the next quarter - in April (Fig. 5).

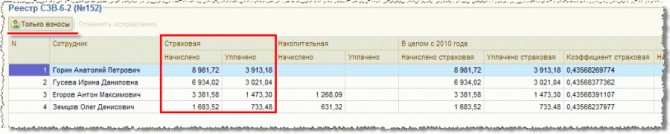

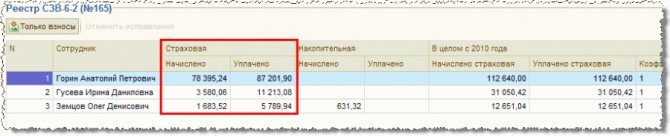

Rice. 5 When generating personalized reporting for the 1st quarter, the accrued and paid contributions for each employee were automatically filled in as follows (Figure 6 shows a fragment of the workplace for preparing PFR quarterly reporting in the Contributions Only mode).

Rice. 6 The distribution of contributions was made according to the algorithm described above: - the total amount of payment that needs to be distributed has been determined - 9,141 rubles. contributions paid on March 13. Contributions paid on April 10 (RUB 11,840) are not taken into account, since they were paid already in the next reporting period (Q2). There is no overpayment of contributions at the beginning of the reporting period (contributions were not previously accrued or paid); - the amount of debt was determined at the beginning of the reporting period - it is equal to zero, since the organization did not previously conduct activities, which is indicated for all previous periods (the state was established: No operating activities were carried out); - the amount of contributions accrued for each person was determined and placed in the Accrued information field, and the total amount of contributions accrued for the reporting period was determined - RUB 20,980.84: Employee

Since there is no debt, the entire distributed payment amount is 9,141 rubles. is used to pay off current accruals. Current accruals are greater than the payment amount, therefore the payment ratio of the current period is determined: 9 141 / 20 980,84 ~ 0,4356832234 Finally, the payment amount for each employee is determined by multiplying current accruals by the payment coefficient:

| |||||||||||||||||||||||||||||||||||||||||

Example 2. Having debt

| After the information for the 1st quarter was accepted by the Pension Fund and the set status was set to Information from the set was posted to personal accounts, information about the debt that arose in the information for this reporting period appeared in the database. The debt in the information was formed as a result of the fact that the paid contributions were shown to be less than the accrued contributions. This debt must be taken into account when generating information for the 2nd quarter. For each month of the 2nd quarter, salaries and contributions were calculated (Fig. 7).

Rice. 7 Contributions were paid in full in the 2nd quarter - for April at the beginning of May, for May at the beginning of June, and for June at the end of June, and at the end of June more contributions were paid than required (Fig. 8).

Rice. 8 When generating personalized reporting for the 2nd quarter, the accrued and paid contributions for each employee were automatically filled in as follows (Fig. 9).

Rice. 9 Let's consider the process of generating this information: - the total amount of payment that needs to be distributed has been determined - 55,120 rubles. In addition to RUB 43,280. 11,840 rubles paid on April 10 “for the 1st quarter” are also taken into account. There is no overpayment of contributions at the beginning of the reporting period. - the amount of debt was determined at the beginning of the reporting period based on data from the information for the 1st quarter, both for each person and the total - 11,839.84 rubles. Employee

- the amount of contributions accrued for each person is determined and placed in the Accrued information field, and the total amount of contributions accrued for the reporting period is determined - 35,120 rubles.

Since there is a debt, it is repaid first. The total amount of payment is 55,120 rubles. RUB 11,839.84 is enough to fully repay the debt. (i.e. the debt repayment ratio is 1). The repaid debt is entered into payment for the current period:

After repayment of the debt, 43,280.16 rubles remain from the total payment amount. (55,120 - 11,839.84). This amount is used to pay current charges, which amount to 35,120 rubles. The remaining payment is enough to completely “close” the current accruals, i.e., the payment coefficient for the current period is also equal to 1. Payment of accruals is added to the payment of debt:

|

Example 3. Presence of overpayment, “manual closing” of contributions for a dismissed employee about to retire

After the Pension Fund of Russia accepted the information for the 2nd quarter, according to the data from the sets of previous periods, there is no debt - on an accrual basis from the 1st quarter, the amount of payment indicated in the information is equal to the amount of accruals. However, in fact, more contributions were paid than were accrued. This overpayment must be taken into account when distributing payments for the 3rd quarter.

For each of the months of the 3rd quarter, salaries and contributions were calculated. At the same time, employee Egorov quit in the 3rd quarter (Fig. 10).

Rice. 10

No contributions were paid in the 3rd quarter (Fig. 11).

Rice. eleven

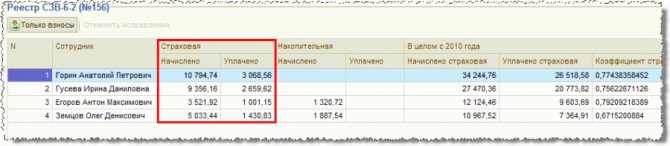

When generating personalized reporting for the 3rd quarter, the accrued and paid contributions for each employee were automatically filled in as follows (Fig. 12).

Rice. 12

Let's consider the process of generating this information:

- the total amount of payment that needs to be distributed has been determined - 8,160.16 rubles. This is exclusively the amount of overpayment at the beginning of the reporting period, the amount of payment in the period itself is zero;

- the amount of debt was determined at the beginning of the reporting period - it is also equal to zero, according to the data of the sets for the 1st and 2nd quarter. the amount of contributions paid is equal to the amount accrued;

- the amount of contributions accrued for each person was determined and placed in the Accrued information field, and the total amount of contributions accrued for the reporting period was determined - RUB 28,706.26:

| Employee | Accrued |

| Gorin | 10 794,74 |

| Gusev | 9 356,16 |

| Egorov | 3 521,92 |

| Zemtsov | 5 033,44 |

| Total | 28 706,26 |

Since there is no debt, the entire distributed payment amount is RUB 8,160.16. is used to pay off current accruals. Current accruals are greater than the payment amount, therefore the payment ratio of the current period is determined:

8 160,16 / 28 706,26 ~ 0,2842641291

Next, the payment amount for each employee is determined by multiplying current accruals by the payment coefficient:

| Employee | Accrued | Paid |

| Gorin | 10 794,74 | 3 068,56 |

| Gusev | 9 356,16 | 2 659,62 |

| Egorov | 3 521,92 | 1 001,15 |

| Zemtsov | 5 033,44 | 1 430,83 |

| Total | 28 706,26 | 8 160,16 |

Let’s assume that a request has been received to “close” the payment for Egorov, who resigned, i.e., if possible, to distribute the payment first to pay off the debt and accruals on it, and the rest to the remaining employees.

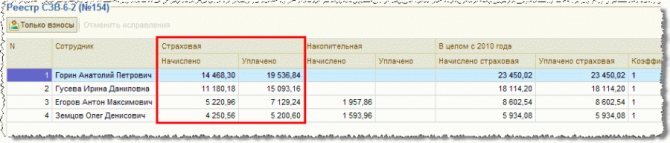

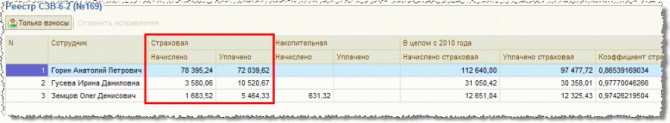

In the example under consideration, there was no debt on it at the beginning of the period; however, in the general case, it is necessary not only to equate the payment to the accruals of the current period, but also to take into account the presence of debt from previous periods. To do this, you can analyze special auxiliary data in the columns Overall since 2010 (Fig. 13):

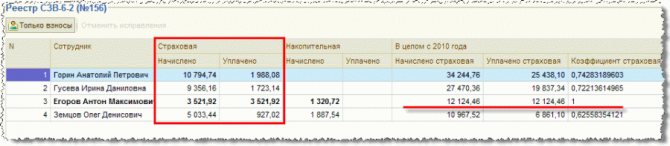

Rice. 13

After determining the amount that is necessary to “close” the payment for the employee, it must be manually entered into the Paid field. After this, payments to the remaining employees will be redistributed automatically taking into account this change (you may need to run the Update Contributions command) (Fig. 14).

Rice. 14

When redistributing contributions, taking into account manual editing of payments for one employee, contributions were redistributed among the rest as follows:

— distributed payment amount 8,160.16 rubles. is reduced by the manually entered amount of 3,521.92 rubles. and now amounts to 4,638.24 rubles;

— during the distribution, only accruals of employees for whom the payment has not been edited are taken into account

| Employee | Accrued |

| Gorin | 10 794,74 |

| Gusev | 9 356,16 |

| Zemtsov | 5 033,44 |

| Total | 25 184,34 |

— a new payment ratio for the current period is determined:

4 638,24 / 25 184,34 ~ 0,1841715923

— the amount of payment for each employee is determined by multiplying current accruals by this payment coefficient:

| Employee | Accrued | Paid |

| Gorin | 10 794,74 | 1 988,08 |

| Gusev | 9 356,16 | 1 723,14 |

| Zemtsov | 5 033,44 | 927,02 |

| Total | 25 184,34 | 4 638,24 |

Please note that contributions should be edited manually within acceptable limits. For example, if in the example under consideration we completely “close” the payment for Gorin (RUB 10,794.74) when there are 8,160.16 RUB available for distribution, for the remaining employees the payment will not be completed at all, but when such information is reconciled with the RSV-1 a payment discrepancy error will be detected.

<end of example>

Example 4. Availability of contributions accrued from amounts exceeding the maximum value of the taxable base

Since 2012, the “basic” tariff provides for the payment of an additional 10% of contributions to finance the insurance part of the pension from amounts exceeding the maximum taxable base (in 2012 - 512,000 rubles). This part of accrued contributions should not be shown in personalized accounting information. However, when paying contributions (to finance the insurance part of the pension), it is impossible to indicate which part of them is paid - accrued on the amounts before the excess or the amounts after the excess. The entire amount of contributions is paid per BCC.

In the examples discussed earlier, Gorin was accrued a total of 155,658 rubles over 9 months. taxable income. Suppose that in the 4th quarter Gorin was accrued 400,000 rubles, as a result, the total amount of accruals on him exceeded the maximum taxable base of 512,000 rubles. Contributions from income in the amount of RUB 356,342. calculated at the basic tariff (22%) and amounted to 78,395.24 rubles, and contributions from amounts exceeding this value, i.e. from 43,658 rubles, were calculated at a 10% tariff and amounted to 4,365.8 rubles. That is, in total, in the 4th quarter, Gorin accrued 82,761.04 rubles. contributions. Contributions accrued for other employees are shown in Figure 15.

Rice. 15

At the beginning of the 4th quarter there was arrears in payment of contributions in the amount of RUB 20,546.10. and 88,024.62 rubles. accrued for the 4th quarter. Let's assume that all these fees are paid in the 4th quarter (Figure 16).

Rice. 16

When generating personalized reporting for the 4th quarter, the accrued and paid contributions for each employee were automatically filled in as follows (Fig. 17):

Rice. 17

The amount of contributions “from excess” was not included in the contributions assessed for Gorin. The payment completely “closed” the debt for all employees in the amount of RUB 20,546.10. and current accruals in the amount of RUB 83,658.82. and in total amounted to 104,114.92 rubles. In the next reporting period, undistributed 4,365.8 rubles. will not be considered an overpayment and will not be distributed.

Let us assume that contributions in the 4th quarter were not paid in full, but, for example, in the amount of 88,024.62 rubles. (Fig. 18):

Rice. 18

Then, when generating personalized reporting for the 4th quarter, the accrued and paid contributions for each employee would be automatically filled in as follows (Fig. 19):

Rice. 19

The amount paid would be enough to completely “close” the debt in the amount of 20,546.10 rubles, and the remaining amount is 67,478.54 rubles. would be distributed to pay current charges with a coefficient of 0.806592... (67,478.54 / 83,658.82).

That is, in this case it cannot be said that of the 88,024.62 rubles paid. part in the amount of 4,365.8 rubles. is a payment of contributions “from excess” and that it cannot be distributed towards the payment of arrears or current accruals for other employees.

Procedure and terms of payment of funds to the Pension Fund

Payments are transferred every month. Insurance contributions for compulsory pension insurance for the previous month must be paid:

- no later than the 15th in case of submitting documents in paper form;

- no later than the 20th in case of electronic document management .

If the last day of such a period falls on a weekend or holiday, then payment can be made on the next business day.

For entrepreneurs paying contributions for themselves, it is possible to choose the frequency of payment transfers once a quarter or at the end of the financial year.

It should be remembered that accrued but not paid on time insurance premiums for compulsory health insurance are subject to collection as arrears.

The base for calculating payments is determined for each employee at the end of each calendar month on an accrual basis from the beginning of the year . For employees who joined the organization during the calendar year, the base is determined from the month of hiring.

Direct payment of contributions is carried out by sending a settlement document to the bank, where the corresponding budget classification codes (BCC) must be indicated. Contributions to compulsory pension insurance are paid without dividing into insurance and savings parts.

Individuals can also pay contributions free of charge through post offices.

It is worth noting that according to the rule introduced in 2020, the amount calculated for transfer must be determined exactly in rubles and kopecks .

4 014

Program period

The co-financing program is valid for a ten-year period. During this period, each participant who has made at least one payment as a voluntary contribution has the right to stop and resume payment of contributions at any time. From the end of the ten-year period, a citizen also has the right to replenish his account, but without government support, so the amounts will not be doubled.

Conclusion: the intention of the program of co-financing by the state of voluntary contributions of its participants is to increase the size of citizens’ pensions. Under the terms of this program, the amounts contributed by participants will be doubled, as a result of which the funded part of the pension should increase. State co-financing will cease for the participant after a 10-year period has passed from the date the citizen submitted his application to participate in the program.

Comments (6)

Showing 6 of 6

- Vasily 01/16/2017 at 22:45

Good afternoon At the moment, my wife is unemployed and is raising our children. Accordingly, due to the absence of an employer, insurance premiums for her future pension are not paid. Can I voluntarily transfer money to her personal account to form a pension payment?answer

- Julia 01/17/2017 at 12:14

According to Art. 29 Federal Law No. 167 of December 15, 2001 “On compulsory pension insurance in the Russian Federation” both working citizens and the unemployed can voluntarily pay insurance premiums not only for themselves, but also for other persons for whom payments are not made by the policyholder. The minimum possible payment in this case is equal to twice the minimum wage established at the beginning of the reporting year, the maximum corresponds to eight times the minimum wage. At the same time, the periods during which contributions are transferred are counted toward the citizen’s insurance length, provided that the duration of such periods is no more than half of the length of service required to establish his pension payment. Thus, based on current legislation, you can transfer a voluntary insurance contribution to your wife’s individual account in the amount established by law in order to increase her future pension.

answer

- Alexander 09/04/2018 at 21:35

Julia. Tell me, is it possible to make a contribution to a voluntary pension in an amount equal not to two times the minimum wage established at the beginning of the reporting year, but to three times the minimum wage established at the beginning of the reporting year? Or is only 4, 6, 8 multiples allowed?

answer

According to Trudovaya K., the length of service until 1992 (including ’92) was 3 years 10 months 18 days, according to IP - 2 years and 3 months 18 days, it turns out to be a total of 6 years, probably. I will turn 55 years old in September 2022, it’s clear that I don’t have enough experience and points. If I now pay contributions to the Pension Fund for 4 years until 2022, will this be enough for me? Should I pay at least 3200 per month or will it no longer work? And if I pay for 4 years, and they tell me that there is not enough, will the money be returned to me? Or the money will disappear and there will be no pension at 55 years old. Or should we wait for the social one?

answer

Julia 04/12/2017 at 17:20

Lyudmila, by 2022 you will need to have 13 years of insurance coverage - this is an integral condition for receiving an insurance pension, which, unfortunately, you will no longer have time to fulfill. At the same time, are you going to deposit funds “3200 per month” without having an official income? Or does this take into account that you will carry out official work with a salary of 20,000 rubles (3,200 is 16% of the specified salary)? This (at a minimum) will seem strange to the tax service, since it is they who are now administering insurance premiums (if we understood everything correctly, of course).

The situation is not entirely clear. Most likely, you will only be entitled to a Social Security pension when you reach age 60. In any case, it is better to take your passport and SNILS to the Pension Fund office according to your place of residence for advice.