- home

- Reference

- Experience

Work experience is of great importance for the formation of a pension in modern Russia. The larger it is, the more secure the citizen’s old age will be in the future.

The question of entering this period of military service remains relevant. The period of military service is included in it, however, with some features that will be discussed in the article.

What is experience

The concept of “work experience” was previously used exclusively in the context of the number of years of work of a citizen. This also included some other periods (for example, parental leave).

Also in Russia there is an insurance period - the period for which insurance premiums were paid for an employee (by the employer or by himself, in the case of entrepreneurial activity).

Separately, it is necessary to highlight preferential special experience, which should be understood as work in difficult, harmful and special conditions, for which the right to early retirement is provided.

Conscription in Canada

To join the Canadian Army, you must be 17 years old and have parental consent. To do this, you also need to be a citizen of the country and have completed at least 10th grade. In some cases, immigrants with Permanent Resident status are also accepted. If the foreign citizen's application is approved, then within a month he must undergo a medical examination, a criminal background check, aptitude testing and a screening interview. The entire preliminary campaign is free of charge. The army accepts not only men, but also women, who make up approximately 16% of the armed forces. Persons who are 16 years of age or older can enroll in the Canadian Reserve. They are recruited only for camp training, but if necessary they can also be accepted for regular service.

In what cases is military service included in the total length of service?

Until 2002, the main criterion determining the size of the pension was the total number of years worked. Now it does not have such practical significance as before, but is still used to calculate individual social payments. So does the period of being in the army coincide with the total time of work?

The Russian Federation provides for two forms of recruiting the Armed Forces:

- compulsory conscription of citizens liable for military service;

- conclusion of a contract.

For conscripted military personnel, the time spent in the army is fully counted.

Contract military personnel should include officers, as well as privates and non-commissioned officers from the persons who signed the relevant document. With a certain length of service, they have the right to count on a special military pension, and therefore the total length of service is not of fundamental importance for them. However, in case of insufficient length of service, they have the right to rely either on an old-age insurance pension, for the calculation of which they must have a minimum working period of 10 years in 2020.

Reference! Since 2019, citizens of pre-retirement age have the opportunity to retire early if they have worked for many years (37 years for women and 42 for men).

There are also a number of structures in which service is equivalent to army service:

- Troops of the Russian Guard;

- FSIN;

- Ministry of Internal Affairs;

- FSB;

- Ministry of Emergency Situations.

The procedure for serving foreign citizens in the armies of other countries

In foreign military formations created for the service of foreigners, a serviceman must be prepared for quite serious tests and demonstrate physical endurance, organizational, mental and personal abilities. Conscientious service under a contract in foreign countries implies career growth, the assignment of a title and an increase in salary.

Social and living conditions, food and clothing are the same as in the Russian army; there is no need to create illusions about ideal conditions. Maintaining an army requires serious funds, and each state approaches the issue from the point of view of reasonable economy, providing military personnel with only the most necessary things.

As in the Russian army, in foreign military units it is necessary to obey the daily routine and maintain the established order of service. You need to get up early in the morning, have breakfast, clean the area and do the morning chores. After a divorce, there is a second breakfast, then training, study and lunch. After lunch they perform official tasks. After dinner, employees are given personal time (about 3-4 hours), then lights out.

If a serviceman knows applied science, then there is a chance that he will be offered to do just that. Electrical engineers, mechanics, welders, cooks, telecom operators and junior medical personnel are in demand.

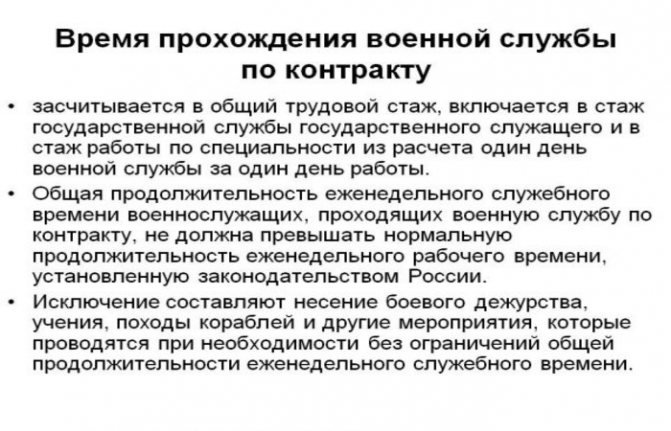

The principle of calculating the length of service of those who served in the army

As a general rule, service in the Armed Forces and structures equivalent to them is counted on the basis that 1 day of being there is equivalent to 1 day of work. In other words, it is taken into account depending on its duration in calendar days. However, there are exceptions. Thus, for conscripted military personnel, 1 day in the army or navy is equivalent to 2 days.

Example 1

The contract soldier served for less than 3 years, after which he left the army, subsequently working in civilian positions. Thus, he did not earn the right to a military pension, and the entire period of his stay in the army is equated to ordinary work. Accordingly, during the period he was in the army, he accumulated 3 years of work experience.

Example 2

A conscript soldier served the statutory period of 1 year and after demobilization worked in civilian life. Taking into account the increasing coefficient, the period of work experience accumulated during service is 2 years.

When applying for a pension, PFR specialists may request documents confirming that the citizen is in the army. These include:

- military ID;

- work book with a record of its owner being in the army;

- certificate from the military commissariat;

- certificates from military units and other places of service.

Insurance part: calculation features

The insurance period is more important, determining both the right to retire and its size.

For conscripted military personnel, being in the army is included in the insurance period only if, before this time or immediately after it, he had an official job (or was engaged in entrepreneurial activity) and contributions were made to the Pension Fund for him.

Important! The duration and nature of the work activity in this case does not matter at all; it is only important that it coincides in time with the period of being in the army.

If this condition is met, for each year that a citizen serves in the military, he is awarded 1.8 pension points.

For contract soldiers (including officers) who cannot qualify for a long-service pension, military service is included in the insurance period.

As for military pensioners who are going to apply for a second “civilian” pension, the time spent in the army, taken into account when calculating length of service, cannot be included in the insurance period.

Preferential length of service: nuances

As a rule, preferential service requires early retirement due to difficult and harmful working conditions. Staying in the army may be included in this period, provided that the citizen worked in hazardous work before being in the army or immediately after discharge and returning to civilian life. However, this applies to those workers who worked under special working conditions before January 1, 1992.

As for the special experience of health care and education workers, only compulsory military service before October 1, 1993 is included in it.

The situation is different during the period of contract service. It can be counted as special service provided that 1/3 of its citizen was in the army, and 2/3 worked in relevant positions in healthcare and educational institutions.

Military service in most cases is still of great importance for the formation of various types of length of service and, as a result, affects the size of future pension benefits, which, undoubtedly, is one of the incentives for completing it.

How to join the army of another country

If you decide to serve under a contract in another country, you are advised to consult with a lawyer. Military service abroad is available to citizens who applied to a military unit or recruiting station in a foreign country and received a referral for a medical examination. The examination procedure includes special psychological tests. Testing physical fitness and endurance (pull-ups on the bar, performing abdominal exercises, etc.) is considered mandatory.

Applicants for service abroad must undergo a document check and wait for an official response, then go to a military unit to undergo a professional aptitude test. If the candidate is suitable, a contract is concluded with him for a period of 5 years, which implies the citizen’s consent to serve where he will be sent.

Loyal requirements are put forward for recruits: age from 17 to 40 years, possession of a foreign passport and absence of health problems. Particular attention is paid to good memory and the ability to concentrate. The candidate must have healthy teeth, normal hearing and vision. Reasons for refusal may include jaundice, measles, or surgeries the candidate has undergone. Applicants who have suffered fractures or severe injuries also receive a negative answer.

Russian citizens need to know that they will not be sent to serve in places where there is domestic interest. Some recruits may have problems due to the legislation and national traditions of the state where the service is to take place. If you attend preparatory courses for recruits and treat your service responsibly, you can avoid trouble.

Registration of a Russian pension abroad: possible options

In order to use the government service of registering a Russian pension abroad, citizens of the Russian Federation must personally or through their authorized representative contact the Pension Fund.

The decision of the territorial body of the Pension Fund must be made within 10 working days from the date of receipt of the application (the date begins to count from the moment the full package of documents is submitted), and the applicant must be notified of the results of the consideration within 5 working days from the date of the decision.

The procedure for the Pension Fund to issue pensions to Russian citizens who permanently reside abroad depends on:

- depending on which country the Russian citizen moved to for permanent residence. If there are bilateral international agreements with the Russian Federation, the pension will be issued in accordance with the agreements;

- depending on when the move was made: that is, a citizen of the Russian Federation received a pension before leaving abroad or reached retirement age after the move.

There are several options for registering a pension, which you should familiarize yourself with in more detail.

New assignment of pension to a citizen living abroad

To assign a pension to a citizen of the Russian Federation who has gone abroad for permanent residence, he should submit to the Pension Fund an application for a pension (in two copies).

In addition, other documents must be attached to the application (the case will be considered only if they are available):

- application for pension delivery, completed in duplicate;

GDE Error: Error loading file - Turn off error checking if necessary (403:Forbidden) - a copy of SNILS (if available);

- confirmation of work experience - original or a clear, notarized copy of the work book, certificates of periods of work (originals);

- original salary certificate for any five years of service with the number and date of issue, seal and signature of the manager, indicating the basis for issuance, clearly stated full name of the certificate recipient. For certificates for the period from 1991 to 2001, data on contributions that were transferred to the Pension Fund is required;

- a copy of your military ID (if you don’t have one, a certificate from the military registration and enlistment office confirming your military service);

- certificate confirming permanent residence in a foreign country indicating the date of move from the Russian Federation. Such a certificate can be obtained from the diplomatic institutions of the Russian Federation in the country of residence.

a copy of the passport of a citizen of the Russian Federation;

In some cases, additional paperwork may be required:

- upon entry into/divorce of marriage and change of surname - a copy of the relevant document;

- if a woman has parental leave for up to one and a half (three) years, a copy of the child’s birth certificate;

- when changing the name of the enterprise or organization in which the applicant worked - a certificate of its renaming.

All copies must be certified by the Russian consulate.

What to do if your pension is suspended or terminated

The situation when pension payments may be suspended or terminated occurs quite often. The following may lead to a suspension of payments for 6 months:

- non-receipt of pension for 6 months;

- reaching the age of majority by a person receiving a survivor's pension, without confirmation of his full-time studies;

- receipt of documents by the Pension Fund on the departure of a pensioner outside Russia for permanent residence in the absence of his application for departure.

Termination of pension payment occurs when:

- establishing the death of a pensioner or recognizing him as deceased or missing in the prescribed manner;

- the expiration of 6 months from the date of suspension of the pension and failure to submit an application for its renewal;

- loss of the right to a pension: acquisition of working capacity, entry to work, expiration of the period of recognition as disabled.

Thus, there are two options for returning payments - renewal and restoration of the pension.

To resume pension payments, you must submit an application.

The following documents must be attached to it (depending on the reasons for termination of payments):

- confirmation of the applicant's full-time studies at an educational institution;

- confirmation that the applicant does not have the right to receive a pension in the state of residence (if there is an agreement with the Russian Federation);

- certificate of permanent residence;

- a certificate of performance/non-performance of paid work outside the Russian Federation (when paying a survivor's pension to a person caring for children under 14 years of age);

- document confirming that the applicant is in good health - a notarial deed, a document from the competent authority of the state of residence, a personal appearance certificate;

- a document from the diplomatic mission of the Russian Federation abroad or the territorial branch of the Pension Fund of the Russian Federation, which would confirm the termination of activities or work, during which pensions were not paid to those working abroad.

If the reason for stopping the payment was the receipt of documents on the citizen’s departure for permanent residence abroad, no additional documents are required - just an application is enough.

Pensioners whose pension payment was suspended due to a court declaring them dead or leaving for a new place of residence abroad must contact the Pension Fund and submit an application for the restoration of pension payment.

The application must be accompanied by:

- a document canceling a court decision declaring a citizen dead or missing;

- confirmation of full-time education of a disabled citizen at an educational institution (except for additional educational programs);

- confirmation of termination of work or a certificate stating that the applicant is not working;

- certificate of permanent residence abroad;

- a certificate of the applicant’s performance/non-performance of paid work in the host country (required for payment of a survivor’s pension to persons caring for children, brothers, sisters or grandchildren of the deceased breadwinner under 14 years of age);

- document confirming that the applicant is in good health - a notarial deed, a document from the competent authority of the state of residence, an act of personal appearance.

For pension restoration, the presence or absence of Russian citizenship does not matter. 12 months after the restoration of pension payments and thereafter, the applicant must annually submit to the Pension Fund a certificate of being alive.

A warning for future contractors

Military personnel in foreign armies face many difficulties. Moreover, difficulties may arise after returning to your homeland.

It should be immediately noted that if you are a Russian citizen, then you will not be sent to serve in points where there is domestic interest, that is, you should not be afraid that you will fight against your own.

Problems may arise due to ignorance of the national legislation and traditions of the country in which the service will take place. For this reason, careful attention should be paid to preparatory courses that teach recruits the rules of safe behavior with civilians.

As already mentioned, the Criminal Code of the Russian Federation provides for punishment for mercenarism. However, while in the service of another state, a serviceman cannot refuse to carry out the orders of the commander. If a situation arises in which your military unit is sent to a zone of armed military conflict, then there is a possibility of criminal prosecution in the Russian Federation.

This warning does not apply to UN peacekeeping missions.

Where to apply for pensions

Citizens have the opportunity to apply for a pension, regardless of the elapsed time from the moment the right to it arises (applying 30 days before retirement age is allowed) to the Pension Fund in person, through an authorized representative, or by post.

In the absence of permanent registration in the Russian Federation, all documents should be submitted directly to the Pension Fund - to the Department for Pension Provision of Persons Living Abroad: st. Academician Anokhin, 20, bldg. A, Moscow, Russian Federation. Or by mail to the address: 119991, st. Shabolovka, 4, GSP-1, Moscow, RF.

The Pension Fund of Russia will send the submitted documents to its territorial body at the citizen’s last place of stay/residence/work in the Russian Federation. If it is difficult to determine the territorial branch, the PFR branch for Moscow and the Moscow region will consider the application.

Submitting an application is also possible via the Internet. This can be done through the State Services portal or use your personal account on the official website of the Pension Fund. On the same website you can get online consultation on all issues of interest that fall within the competence of the Pension Fund, including familiarizing yourself with your personal data on the amounts paid: answers to questions will be sent to the sender’s mailbox.

When preparing a package of official papers, several documents, namely:

- act of personal appearance of a citizen;

- confirmation of the implementation/cessation of work outside the Russian Federation, during which the person is not subject to pension insurance;

- certificates of permanent residence and performance/non-performance of paid work in the country of residence;

- can be obtained from Russian diplomatic institutions at your place of residence abroad.

For greater convenience, you can use the portal for submitting applications for consular actions of the Consular Department of the Russian Ministry of Foreign Affairs.

Increase in subsidies transferred to military personnel

The time spent by conscripts during the period of fulfilling obligations to the country previously increased the size of preferences. However, according to the new mechanism, it only affects the increasing coefficient, which still needs to be accumulated.

Who is entitled to a pension supplement?

Changes in benefit calculations are made at the request of the beneficiary of the Pension Fund of Russia. To do this, the elderly must submit a request (free form) to the regional office of the fund.

Recalculation of preferences and reduction of surcharges

According to the current legislation, implemented during the reform of the pension system, the income of the elderly is indexed by a percentage exceeding the growth rate of inflation. Thus, in 2020 the increase was more than 7 percentage points. In monetary terms, this is equal to one thousand rubles.

Important! The higher a person’s pension rights, the more significant insurance support and bonus he will receive after annual indexation.

Additional payment after 80

The current legislation specifies groups of pensioners who can count on an increased fixed payment in the current year. By the way, it is 5334.19 rubles. So, these include the elderly:

- living and working in the Far North;

- having dependents;

- who have reached the age of eighty.

Point cost

Its price was equal to 81.49 rubles in 2020, and in the current period it increased to 87.24 rubles. From the above indicators it is clear that the cost increases every year taking into account the indexation of preferences.

Where should I go if I need to get preferences?

To apply for compensation for state support, anyone interested has the right to submit a request to the regional divisions of the Pension Fund of the Russian Federation or to centers that provide services to the population.

The procedure for obtaining a preference by visiting the MFC

State support is transferred to the citizen after he contacts the multifunctional center and completes all the actions specified in the procedure:

- Collecting a package of acts.

- Transfer of documentation to a specialist.

- Obtaining a result on the recalculation of the subsidy, the need to submit additional papers, or the refusal of the applicant’s request.

SOCIAL FACTOR

Questions related to the inclusion of the period of conscription service of citizens in the army in the general work experience began to be frequently asked after the publication of the new law on insurance pensions No. 400-FZ, which came into force at the beginning of 2020. But the whole point is that in the text of this law, information about this experience is somewhat veiled. Let's figure out how military conscription service will be included in the length of service after 2020.

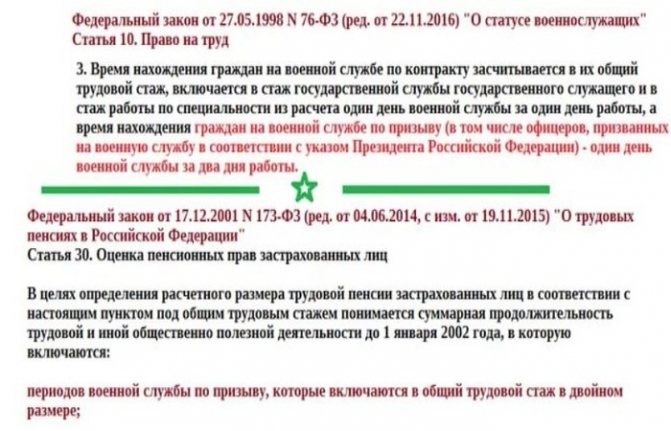

It should be recalled that for those citizens who served before January 1, 2002, the period of military service is included in the total length of service at double the rate. This is enshrined in paragraph 4 of Article 30 of the Federal Law “On Labor Pensions” No. 173-FZ, which states: The calculation of the duration of periods of labor and other socially useful activities before January 1, 2002, included in the total length of service in accordance with this paragraph, is carried out in calendar order according to their actual duration, with the exception of periods of conscription military service, which are included in the total length of service at double the rate.

A similar norm is established in paragraph 3 of Article 10 of the Law “On the Status of Military Personnel” No. 76-FZ: “the time spent by citizens in conscription military service is counted in their total length of service as one day of military service for two days of work.” So, citizens who served in active service before the beginning of 2002 are guaranteed to have the right to include in their total work experience the time they spent in military service under conscription with a coefficient of 2.

And for those citizens who served in military service as part of a limited contingent of Soviet troops in Afghanistan, in accordance with the resolution of the USSR Council of Ministers of January 17, 1983 No. 59-27, such a period will be taken into account in their length of service as 1 month of service for 3 months of work experience.

Starting from January 1, 2020, the Federal Law “On Labor Pensions” No. 173-FZ expired, and the Federal Law “On Insurance Pensions” No. 400-FZ will now apply. Now citizens of our country will accumulate their pension rights on the basis of this law, including citizens called up for compulsory military service.

Let's figure out how military conscription service will be included in the length of service for those conscripts who were called to serve their Motherland after 2020.

We open Federal Law No. 400-FZ, and find in paragraph 1 of part 1 of Article 12 of this law a rather laconic entry about the length of service of military personnel: “Other periods counted in the insurance period are the period of military service.” However, the law does not specify the nature of military service counted in the insurance period, but service can be both conscription and contract service.

This is important to know: Emergency service in Syria

The new pension law still contains a small clarification that sheds light on whether the legislator includes conscript military service in the “period of military service.” In paragraph 12 of Article 15 there is a single small clarification: “The coefficient for a full calendar year of another period counted towards the insurance period provided for in paragraphs 1 (the period of military service under conscription) is 1.8.”

This means that military service by conscription is included in the “period of military service” specified in paragraph 1 of part 1 of Article 12 and it will be included in the citizen’s insurance record, and for each year of such service 1.8 pension pensions will be taken into account on his personal account points.

List of countries for service abroad

There are many countries in the world that accept foreign contract soldiers into their army, but not in all countries military service is feasible for Russians and is well paid.

Main difficulties:

- the language barrier;

- difficult climatic conditions;

- the specifics of the tasks assigned to foreign military personnel.

To this should be added unusual food, medical features, and the difficulties of living far from family and native places.

The most attractive countries for Russians wishing to serve abroad are:

- France (French Foreign Legion);

- USA;

- Great Britain;

- Germany;

- Italy and so on.

Today, in almost all prosperous countries of Europe there is a shortage of national Armed Forces, so the shortage is filled by foreign contract soldiers.

Foreigners can also serve in the Israeli army. Military specialists are periodically required to serve in various UN military formations.

When choosing a country and format of service, you must remember that mercenarism (paid participation in armed conflicts) is a serious criminal offense for which you can receive a real prison sentence. For this reason, special care must be taken when choosing a military formation that recruits contract soldiers.

Legal Advice: Additional pay for service abroad or in hazardous conditions

The period spent in the army is confirmed by a military ID, a certificate of service, or a corresponding entry in the work book entered there on the basis of a document evidencing service in the army.

If the consultant says so, it is better to refuse the recalculation. To receive supplements for men who served in the army, 5 days are given to review the application.

There is also a special one: for those who took out an apartment or house on credit, the government awards at least 200 euros every month.

Useful information on the topic: “Recalculation of pensions for service in the Soviet army” from professionals with comments for people. Information on the topic is collected here, allowing it to be revealed from all sides.

Germany

Distinctive features of the German government's care for its soldiers and officers:

- No military service. Military service is voluntary, contractual.

- Military personnel have the right to receive civilian specialties. To do this, they are provided with preferential education at the universities of Hamburg or Munich for 3–4 years.

- Free.

- The allowance of military personnel consists of an official salary and various allowances.

- The pensioner retains the right to preferential payment of utility bills and compensation for expenses associated with renting a house.

- An employee who is transferred to the reserve or retirees receives 75% of his salary including allowances. The period for transferring such payments ranges from six months to 36 months.

- If a military man, transferred to the reserve or retired, has served for at least 10 years, he is entitled to a pension. Its size is 35% of the salary.

- Those who quit voluntarily are not entitled to a pension.

- Duration of service in Germany is 25 years.

- The pension consists of an apartment allowance, salary according to position, salary according to rank. So, a colonel receives 1,370 – 2,810 euros monthly.

The procedure for retirement from structures of the Ministry of Internal Affairs with mixed output

Such situations require the issuance of a pension at an early stage of life. The classification of employees of the Ministry of Internal Affairs includes two categories. The first includes civilian officials, and the second includes employees of the Ministry of Internal Affairs.

A mixed type benefit is provided subject to a number of conditions. So, these include the following:

- age from 45 years;

- total output for at least 25 years;

- Experience in the Ministry of Internal Affairs of 12.5 years.

Additional payment for special merits

Domestic legislation determines special merits by the presence of awards (orders, honorary titles, etc.) at the level of the Russian Federation. The process of acquiring regalia is clearly regulated by current legal acts. The system for awarding badges is constantly being improved. So today it includes 7 orders and 10 medals. For such achievements an increased salary is due.

The right to grant honorary statuses rests with the President of the state. To receive a bonus, you need to take a number of important steps. These include:

- Submitting a request to military structures with the provision of certificates.

- Visit to the Pension Fund for additional charges.

Important! If there is no money, you must send a request to the fund demanding a written response and explaining the situation. It is worth noting that other persons, even if they have family ties with the awardee, cannot receive an increase in security for him from the funds of the Russian Pension Fund.

Preferences related to combat services

The military's allowance increases due to privileges from the budget for performing feats during combat operations in conflict zones (Afghanistan, the Caucasus, Syria). Such additional payments are approved by the Russian Government.

The procedure for applying for a pension supplement for veterans who participated in conflicts

Additional support for BD veterans is one of the ways to support people who defended their homeland during difficult times. To receive subsidies you must acquire veteran status. Preferences are awarded only if there is an appropriate certificate obtained with the direct participation of a military personnel in local conflicts, regardless of the place of their occurrence.

Confirmation of special status is carried out by the social protection authorities at the place of registration. Without carrying out the necessary actions established by the regulatory legal acts, accruals are not carried out. At the same time, recalculation of the state benefit according to the point system is necessary only when it is more attractive than the privileges provided under the old system.

Let's sum it up

Today, Russian male pensioners have a real opportunity to receive a pleasant bonus to their pension accruals, due to the fact that back in the days of the Soviet Union they served in the army. This circumstance was not previously taken into account in the insurance part of the pension, however, it is now taken into account when forming payments, as socially significant.

The payment can be either insignificant in size or substantial. However, veterans should also remember that as a result of recalculation, payments, on the contrary, may decrease in size. But there is no need to worry, because each of them will be able to refuse such a recalculation, returning the previous pension amount.

Supplement to pension for service in the Soviet army

It should be said that even a citizen whose services to the Soviet army are officially recognized, falling into the category of pensioners, may, when applying to the Pension Fund of the Russian Federation, be refused an allowance. This happens for the following reason: according to the legislative act issued in our country on January 1, 2020, in order to receive an old-age pension, a specific person must:

- accumulate so-called pension points in the required amount – 11.4 points;

- gain 9 full years of work experience that meets the requirements.

If everything is clear with the general work experience, then citizens sometimes have questions regarding the determination of the amount of points they are entitled to.

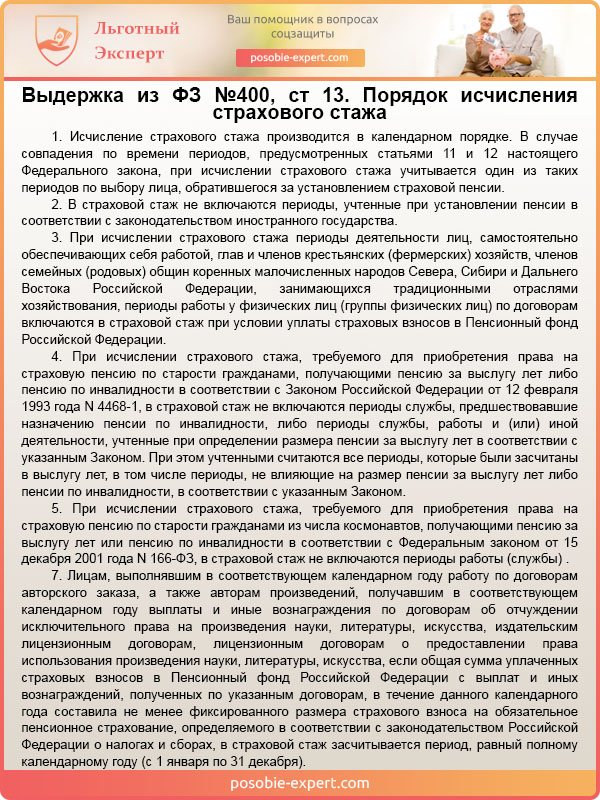

Excerpt from Federal Law No. 400, Article 13. The procedure for calculating insurance experience

So, the number of points available in your account at the current time is calculated using the following two values:

- the number of pension contributions you have made;

- full working experience as a citizen.

The greater the monetary value corresponding to the contributions made, the more points you will receive, which will ultimately determine whether you are entitled to a pension payment

Unfortunately, this system of counting and scoring as a whole today operates in a virtually experimental mode, since it is not so easy to adequately calculate the length of work experience of modern pensioners. After all, before the not-so-distant 1991, there was not a single computer base or general paper archive in the country that kept records of such things.

In addition, previously the accounting of the insurance category did not include coverage of the following socially significant phenomena:

- compulsory military service carried out in the army of the Soviet Union;

- leave taken to care for a child.

Please note: it is precisely in view of the above circumstances (not taking into account such significant phenomena as service in the USSR army and childcare leave) that residents of modern Russia have the opportunity to recalculate pension accruals.

What does state secret mean?

Cash salary, which depends on length of service and various bonuses. As for length of service, it is: for those who have the rank of “colonel” - “major” - 8 years, “captain” - 6 years, “lieutenant” - 4 years. At the legislative level, localities, enterprises and organizations are defined in which service or work time is counted according to a coefficient of 1.5 or higher.

But its accounting was based on other principles - this period was included in the insurance period and, therefore, also influenced the size of the pension.

So, if we single out categories of citizens who may benefit from accounting for military conscription service, then these are men who worked in hazardous and difficult working conditions, for whom the conversion of pension rights was carried out taking into account special length of service.