Why the pensions of working pensioners stopped growing, what to do when working under a contract, how to find out the procedure for calculating your pension - we answer all these and many other questions in the final part of our series of materials with questions and answers on pensions in Russia.

Editor's note

Our editorial team receives dozens of questions on pension issues every day, and we try to answer each of them. We discussed a lot of problems in the comments to these articles: one, two, three, four. Today we decided to go even further and have prepared answers to almost any questions that you may have regarding the pension system of the Russian Federation.

This interview was published in 3 parts the third part is posted on the current page , the first part is available at the link, the second here. We strongly recommend that you subscribe to our EMAIL newsletters (sent no more than once every 2 weeks) and join our groups on social networks so as not to miss the release of new materials and have time to ask your question to the author.

Our expert, journalist for Banks Today, Artyom Vasiliev, answers the questions Do you have your own question for the author? Ask it in the comments to this article, he will certainly answer it.

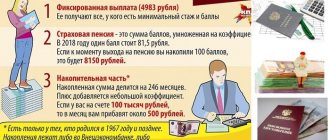

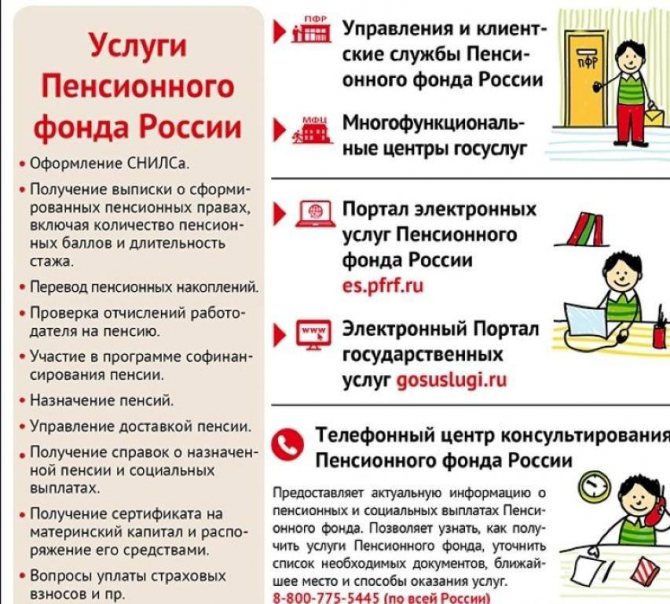

What services does the Pension Fund provide?

In 2020, significant changes were made to the list of functions that the fund can perform when citizens apply. According to the order dated July 12, 2018 No. 352r, the list was supplemented with services and sub-services.

Why make staffing arrangements? Find out by following the link.

Despite the fairly large list named in the document, it is not so difficult to understand the basic services provided to citizens.

Issuance of SNILS

The Pension Fund of the Russian Federation registers citizens in the compulsory pension insurance system, issues certificates and SNILS. A person receives a certificate from the moment of his birth.

To do this, the registry office sends information about the newborn to the Pension Fund offices that issue SNILS. If documents have been lost or any changes need to be made to them, then the citizen must submit an application to the Pension Fund.

Issuing a personal account statement

Providing data on a citizen’s account status is carried out through a personal application to the Pension Fund or an electronic request. After the claim has been reviewed, the fund issues a statement containing information important for calculating the pension.

The paper reflects the length of service a person has worked, as well as the amount of insurance contributions used to determine the amount of pension payments.

Assignment, recalculation and payment of pensions

The operation is carried out for various types of pension payments:

- insurance (for loss of a breadwinner, old age, disability), if there are contributions in the account and the required length of service;

- social, established when a citizen fails to fulfill the conditions necessary to receive insurance payments;

- state, assigned to certain categories of citizens: conscripts undergoing military service, pilots, persons exposed to radiation, astronauts;

- savings are paid if the citizen has savings that have not been transferred to the NPF.

Purpose of the federal surcharge

Such a pension supplement is due in the event that the amount of payments received by a citizen of the federal subsistence minimum (subsistence level) is not reached.

What can you get from the Pension Fund via the Internet?

Many believe that such a service is assigned to the social protection authorities of the constituent entities of the Russian Federation. In fact, regional structures establish an additional payment if the subject’s subsistence minimum exceeds the federal figure.

Providing additional financial security measures

In some cases, citizens can contact the Pension Fund to receive financial support related to:

- services to the Russian Federation;

- work at enterprises related to the coal industry;

- carrying out air transportation activities (civil aviation pilots).

Compensation for travel expenses to and from your vacation spot

Pensioners receive funds once every 2 years. In addition to the temporary limitation, the support measure is different in that it is provided to citizens permanently residing in the Far North.

Purpose of EDV

Preferential categories of citizens can receive payments. To do this, the applicant will be required to visit the Pension Fund and receive there a certificate about the social services they can count on. The indicated list can be replaced with compensation in cash.

Establishment of payments to persons caring for disabled citizens

This support measure is provided for persons caring for:

- disabled children;

- disabled people with group 1;

- elderly citizens who are unable to care for themselves.

Payments are accrued monthly.

Issuance of certificates for maternal capital

The powers to pay money to families recognized as low-income have also been exercised by the Pension Fund since 2020. Assistance is provided monthly from maternity capital.

Pension savings management

The Pension Fund provides a service to realize the rights of citizens who decide to refuse the formation of a funded pension.

When might production characterization be required? Read here.

When contacting the Pension Fund, funds can be transferred to non-state pension fund programs. To do this, pensioners will need to write an application with the corresponding requirement and send it to the authority for consideration.

Providing information support

This function is associated with the provision of information posted in information systems at the federal level, namely:

- register of disabled people;

- social security system

In addition, persons who sent a request to the authority can obtain information about the support measures provided to them at all levels of the budget system of the Russian Federation.

Such information is used by authorities to make decisions on establishing benefits for certain categories of citizens, for example, Labor Veterans, or on their abolition.

Questions about annual indexation

Pension is less than expected

- Good afternoon. According to the individual personal account statement, as of April 1, 2020, the IPC value is 111.509. If you calculate your pension using the formula SP = IPK * 87.24 + 5334.19 , then the pension should be 15,062 rubles . But in my personal account on the pension fund website I received a notification that the total amount of the insurance pension and the fixed payment to the insurance pension is 14,069.77 rubles . Why does the size of the real pension differ from that calculated using the formula?

Artyom Vasiliev

Most likely you are working. Pensions of working pensioners are not indexed

from 2020, this was done to reduce the budget deficit of the Russian Pension Fund.

If you retired in 2016 or earlier, then your pension would be calculated based on the value of pension points of 74.27 rubles. Most likely, you have been retired since 2018, so the cost of a pension point is 81.49 rubles, and the fixed payment is 4982.90 rubles.

If you quit your job, you will receive a full pension - 15,062 rubles in 2020, and another 6.6% more next year.

Is it worth working further?

– I have been retired since 2001. Work experience since 1957. Then vocational school, army, college, work in production. I continue to work today. Will my current job somehow affect the amount of my pension? Or is it enough to “hunch over”?

Artyom Vasiliev

Since you work, you are deprived of indexation to your insurance pension. In 2020, pensions were increased by an average of 1,000 rubles per month - you actually “lose” this amount.

But this is not the only loss. Although your employer pays insurance contributions in full for you (22% of your salary), you receive a maximum of 3 pension points per year

. For comparison, others with the maximum possible contributions receive 9.13 points (or 9.57 next year).

However, you receive a salary that is most likely more than what you lose due to work. Therefore, the choice - to work or not to work - is made by everyone for himself.

Instead of indexation – 200 rubles

– I retired in 2018, I continue to work now (the pension is not enough for anything). My pension was not increased, like everyone else, by 7% from the beginning of the year. And since September, 200 rubles more comes - is this all the well-deserved increase?

Artyom Vasiliev

Unfortunately, everything is correct. Working pensioners were deprived of annual indexation of pensions - their pensions were not increased by 7.05% in 2019 and will not be increased by 6.6% in 2020.

Working pensioners can receive an increase only in August, when pension points are recalculated

. However, they also had their maximum number of pension points reduced to 3. Others can receive up to 9.13 points for the current year.

3 points is about 83,132.53 rubles in contributions to compulsory health insurance per year, which corresponds to a salary of 31,500 rubles. That is, if you get more, you will receive less points due to legal restrictions.

But since 200 rubles is even less than 3 points, the restrictions on the number of points do not apply to you.

Indexation after dismissal from work

– I am a working pensioner, my pension has hardly been growing for the last few years (as I understand, indexation has been cancelled). If I quit now, will my pension increase immediately? And if in a month I go back to work, will it decrease again?

Artyom Vasiliev

According to the law, working pensioners receive a pension without taking into account annual indexation. But after dismissal, the pensioner begins to receive the full amount of the pension. This won't happen right away

: First the PF must obtain the relevant data from the employer. Up to 4-5 months pass, and the pension comes already increased (and with it additional payments for these months).

If you get a job again, your pension will not decrease. On the other hand, it will not grow again - after all, you will again be a working pensioner.

Indexation when working under a contract

- Hello! Please tell me, if a pensioner works for an individual entrepreneur under a service agreement, will his pension be indexed?

Artyom Vasiliev

According to the Rules for calculating and confirming the insurance period, periods of work under a civil law contract are counted towards the insurance period, since the employer still transfers insurance premiums for such employees.

And since there are contributions, the Pension Fund considers such a pensioner to be working

, and, accordingly, deprives the right to pension indexation. He is deprived of this right until the expiration of the contract, and if it is not defined, then until the end of the period of employment (that is, until the payment of insurance premiums stops).

NPFs have found an alternative to deposits and IIS

No bets placed

The Bank of Russia announced a reduction in the average maximum rate on ruble deposits in the 10 largest banks.

In the second ten days of September it was 4.4% versus 4.41% in the first ten days. Some financial institutions now have rates on bank deposits that do not even exceed 3.5%. The Bank of Russia's inflation target for this year is 4%. Analysts even believe that in fact annual inflation could reach 4.5%. In fact, bank deposits cease to fulfill their main function - to protect money from depreciation.

In general, in the next five years, due to low bank rates, about 3.4 trillion rubles will flow from the banking sector into alternative investment instruments, says Yuri Nogin, director of financial institution ratings at the National Rating Agency (NRA).

This, in turn, will lead to increased interest among Russians in various investment instruments.

Your own investor

Back in September, the head of the Central Bank, Elvira Nabiullina, noted that the regulator was recording a record flow of household funds from bank deposits to other forms of savings. This largely applies to stock market instruments. According to Moscow Exchange, Russians have opened more than 6.4 million brokerage accounts. Most often, private investors open special individual investment accounts (IIA) of the first type, which allow them to return personal income tax at 13% annually when replenishing the account in the amount of up to 400 thousand rubles.

However, IISs carry a lot of difficulties that a novice investor simply does not know about. Funds in any brokerage accounts are not protected in any way: firstly, the activities of the Deposit Insurance Agency (DIA) do not apply to them, unlike banks. Secondly, management companies do not provide guarantees on profitability. Any “subsidence” of the market will lead to losses of funds invested in IIS.

There is another objective problem. To work effectively with exchange instruments, the account holder must have certain knowledge of the laws of the stock market and understand what to invest in. He is required to constantly monitor events in the market and develop his own investment strategy.

“Exchange-traded instruments can bring much higher returns than deposits, but they also have significantly more risks. For investors who have never encountered this, such tools require additional analysis of risks, which not everyone will like,” notes Pavel Samiev, general director of the analytical agency “Business-drom”.

There is a good chance that people will look for conservative savings strategies that do not require specialized market knowledge. Mutual investment funds (UIFs) may be suitable for this purpose, where the investor does not need to understand the specifics of investing - he buys part of a ready-made portfolio consisting of different securities. But even here no one will guarantee the safety of money if the financial markets suddenly collapse.

The fund is a pension fund, and the plan is an investment

Against this background, new players are entering the market of bank deposits and trust management, seeking to fill an empty niche. Non-state pension funds (NPFs) have begun to offer their clients products that, in fact, have nothing to do with future pensions.

For example, in the fall of this year, NPF Safmar, which is part of the industrial group of the same name, launched two investment plans for a period of 4 years and 5 years with a guaranteed return in the first year of up to 7% per annum - this is higher than on deposits in some banks. If the market situation is favorable, the fund earns more, and then the profitability exceeds the one guaranteed in the contract.

This is an alternative to a bank deposit and an individual investment account at the same time, explains NPF Safmar. On the one hand, the client receives a guaranteed return, on the other hand, he does not bear investment risks, and, if necessary, can withdraw his contributions ahead of schedule without any commissions.

“The client by default has a minimum return on investment plans. At the same time, there is a chance to receive a higher rate of return based on investment results. There is no such fork in classic time deposits,” explains the organization’s general director Denis Sivachev. If the investor annually replenishes his account with additional contributions no less than the initial one, then the guaranteed income will increase by 1% per annum.

The main difference between fund investment plans and IIS, in addition to protection against losses when markets fall, is ease of use. the exchange several times a day

. You just need to transfer money to your account, and interaction with the fund takes place online. The fund's management company will invest the funds. The investment strategy for both investment plans is investing in highly liquid government and corporate bonds.

By law, an individual account with a non-state pension fund has a number of specific advantages available only to clients of pension funds. The money in the account is not divided between spouses during a divorce. In addition, they are not subject to legal penalties. Debts to pay for housing and communal services, unpaid taxes, fines, loan debt, etc. will not be written off from the account without warning. But funds in bank and brokerage accounts do not have this status. Individual pension plans with guaranteed returns are not very common among private pension funds: two or three large non-state pension funds have them, and information about the presence of a minimum rate is often hidden deep in the depths of their websites. Funds position such plans as long-term, that is, for saving for retirement, and not for medium-term savings. This is exactly how potential clients perceive them.

“NPF is still a specific financial institution aimed at long-term investment of pension funds,” recalls Yuri Nogin from the NRA. “This is a forced system for preserving pension capital: either entrust the management of funds to a morally outdated Pension Fund, or rely on the market instincts of the NPF,” noted Anna Bodrova, a senior analyst at the Alpari IAC, in a commentary to Gazeta.Ru.

Thus, NPF Safmar became the first of the private pension funds to offer citizens a medium-term savings product rather than a pension product. It is difficult to say how popular such tools will become in the near future. But it is possible that the main task of NPFs in the fight for clients will be the development of investment plans that differ from the notorious pension, which fewer and fewer Russians hope for over the years.

According to the head of the NPF association Sergei Belyakov, the pause that occurred with the introduction of the guaranteed pension plan (GPP) has led to the fact that it is difficult for funds to attract new clients, so it is not surprising that they are looking for new tools and relying not only on pension insurance products .

“Many funds invest in various assets on the market, and those of them who have the appropriate competencies may well offer citizens alternative ways to save and accumulate invested funds,” Sergei Belyakov told Gazeta.Ru.

Considering that funds are forced to compete not only with other types of structures, but also with each other, many of them will probably offer their clients shorter-term investment instruments in the near future. Indeed, in essence, this will allow Russian non-state pension funds to create an important foundation for the future: if now, with the help of a short-term investment product, they can win the trust of new clients, there is a high probability that the same clients will then turn to their funds for long-term products like the same pension plans .

System for Analysis of the Financial Condition of Russian Banks.

Our website is intended for both banking analysts and bank clients (for example, depositors and legal entities to assess the financial condition of the bank in which the account is opened).

The website presents in a convenient form processed analytical information collected from open sources (Bank of Russia, rating agencies, DIA and others).

Bank clients

will find information about the financial condition of their bank, which is easy to track every month immediately after the release of new bank reports.

We offer several models for assessing the reliability and financial stability of a bank. Particular attention is paid to indicative analysis of bank activities

for express diagnostics of the financial condition of banks, as well as

dynamic and comparative analysis based on ratings of banks

. If you are a client of several banks, then by adding them to your Favorites, you will be able to quickly receive data on the financial condition of credit institutions, as well as insider information.

Potential clients

can study all available information about a particular bank and choose a reliable bank. Bank ratings can be compiled based on any indicator. Ratings are updated monthly almost immediately after the publication of reports.

Banking analysts

We offer a tool for analysis: you can use both ready-made indicator formulas and specify calculations using your own custom formulas. All calculated indicators are displayed in the form of tables or graphs for any available period. Indicators are calculated on the basis of official reporting of banks (forms 101, 102, 123, 134, 135).

Find your bank

in the catalog of banks (alphabetically, by your city, by bank size) or in the BIC directory.

You are also provided with convenient options for quickly searching for banks: by letters from the bank name, by BIC or registration number. In the context of each bank, you can see the structure of the balance sheet (in three different groups), the structure of income and expenses, profitability indicators, assess the risks of liquidity, capital adequacy, credit and market risks. An analytical report is compiled for each bank to assess the financial and economic position of the bank, its stability and reliability

.

The range of reports based on various techniques is constantly expanding. Also, based on the most important economic indicators, a report is displayed on the bank’s positions in the ratings

, which allows you to track changes in these positions throughout the year.

Directory of banks and directory of BIC

banks is updated daily.

Bank statements

are downloaded monthly for analysis.

Analytical calculations

are carried out automatically on a monthly basis or at the request of users. Various lists of the Bank of Russia and bank ratings from rating agencies are also downloaded monthly.

In the Methods section

describes methods for analyzing the financial condition of banks. Descriptions of indicators and formulas for their calculation are specified there.

Bank ratings

can be compiled based on any indicator. To do this, select the methodology and indicator by which you want to build a rating (ranking). The composite rating of banks is used to generate tabular ratings for several indicators at once with the ability to select banks according to specified criteria.

Register on the site and you will have the opportunity to communicate on the forum, add banks to your Favorites, receive current information on selected banks, view descriptions and calculation formulas for indicators, and also use the bank comparison function.

Paid services

are provided according to two tariff plans:

- “Client”: Operational analysis of the bank’s financial condition. Viewing of all analytical reports and ratings is usually available within 30-60 minutes after the publication of reports by the Central Bank of Russia.

- “Analyst”: In addition to the capabilities of the “Client” tariff plan, you are offered the opportunity for a more in-depth professional analysis of the financial condition of banks using all available methods.

- Carrying out analytical calculations and research to order.

Read more about the scope of services provided...

Attention! From February 1, 2020, paid services will be provided in full! Until this moment, payment discounts apply. Go to the payment

Statistics on the analyzed data:

| Total number of credit institutions in the database: | 1162 |

| including: | |

| Organizations that consented to the disclosure of information: | 409 (as of September 1, 2020) |

| Operating banks: | 375 (as of October 16, 2020) |

| Operating non-bank credit organizations (NPOs): | 31 |

| Credit organizations with revoked license: | 651 |

The website collects and presents in a form convenient for analysis all available reporting from all banks:

| Reporting type: | Data downloaded for the period: |

| Bank Balance Sheets (Form 101). | from February 01, 2004 to September 01, 2020 |

| Income Statement (Form 102). | from January 01, 2004 to July 01, 2020 |

| Calculation of own funds (capital) (Form 123, until 02/01/2015 - Form 134). | from June 01, 2010 to September 01, 2020 |

| Information on mandatory standards (Form 135). | from June 01, 2010 to September 01, 2020 |

| Bank information updated as of date: | October 16, 2020 |

| Information on bank BICs has been updated as of the date: | October 16, 2020 |

Always up-to-date and only objective information about the financial condition of banks!