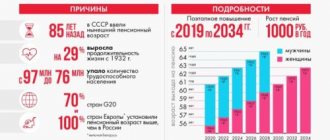

Many people, having barely reached fifty years of age, dream of taking a well-deserved retirement in old age, but every year the cherished milestone is constantly pushed back. Let’s try to understand what changes have occurred in the pension fund this year and what current and future pensioners can expect in a clear language.

A pension is a kind of compensation for the fact that a person, due to age, cannot work and receive a stable income. The age of a person to receive an old-age pension is set by the state. Starting this year, it has been increased for civil servants, but the indicated years will be added in stages: every year – for six months.

General provisions

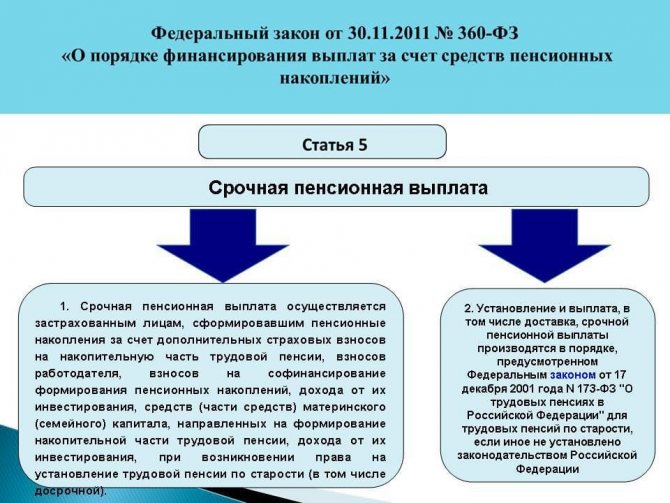

The formation and issuance of pensions is regulated by Federal Law No. 173-FZ of December 17, 2001, which spells out all the provisions regarding the establishment of volumes and amounts of payments, assignment and accrual to certain categories of citizens, as well as their implementation through authorized bodies.

Basic provisions of the law on pension insurance

The legislation provides for several types of pension payments depending on the type of accrual. These are labor, social and government. Each of them has subcategories depending on the reason for retirement: old age, disability, in case of loss of a breadwinner.

This article deals exclusively with the calculation of old-age pensions, i.e. labor in old age, social in old age, state in old age.

According to the pension reform, the beginning of which dates back to 1990 and is still being improved, a single payment in the amount of 22% of the monthly salary is divided into funded and insurance, the concepts of individual pension coefficient, pension points, etc. were introduced.

In addition to the basic definitions of the formation of pension payments, the legislation also regulates issues that relate to:

- Conditions for receiving pension accruals.

- The procedure for calculating pensions and delivery conditions.

- Calculation.

- Formation of pension payments (amounts).

The section of legislation on pensions consists of 7 chapters and 32 parts. In addition to the general provisions and mechanism for calculating pensions, it also provides for the concept of insurance length, the types of pension contributions that were mentioned earlier and the determining points for which categories of citizens are assigned this or that type of pension.

Basic concepts in legislation

The legislation of the Russian Federation provides for the following concepts:

- A labor pension is a monthly payment to persons who made contributions to a pension account during active work and retired due to old age or disability. (No. 213-FZ).

- Insurance experience is the total number of years worked on the basis of official employment or activities under an agreement/contract. During this period, pension contributions were made to the Pension Fund.

- Estimated pension capital is the total amount of pension contributions to the Pension Fund.

- Establishment of a labor pension - assignment, recalculation and adjustment of the amount of pension payments, transition from one type of pension to another. (No. 142-FZ).

- An individual personal account is a collection of information on pension contributions by the insured person (future pensioner). This provision is regulated by the Federal Law “On individual accounting in the pension insurance system” (No. 198-FZ). When registering a pension account, SNILS is assigned.

- A special part of an individual personal account is the formation of payments according to the division of accounts into compulsory pension insurance, the funded part of the pension, receiving interest on investments in both parts if the insured person agrees to the circulation of his funds, receiving income from Maternity capital if the funds were directed to the funded part of the pension (Law No. 256-FZ “On additional measures of state support for families with children”), and on payments made from the pension.

- Pension savings - all payments made and deductions from an individual pension account (No. 421-FZ).

- The expected period for payment of old-age labor pension payments is an indicator that determines payments for the insurance and funded part of the pension.

Insurance or savings?

Law No. 351-FZ introduced changes according to which the insured are given the right to choose.

Those born after 1967 until the beginning of 2020 had to make a choice:

- continue the formation of savings at a 6 percent tariff;

- refuse to continue paying savings contributions and completely switch to the insurance option.

In the period from 2014 to 2020, savings are not formed due to the moratorium of the Government of the Russian Federation. All contributions are credited to the insurance system, and they also form individual coefficients (points).

Everything that was accumulated before the specified period will continue to be invested by the same insurers in the mandatory provision system. They will be paid after regular maintenance has been completed.

If the insured person participated in the savings system, registration and payment of regular (insurance) social security occurs independently of it. To obtain the latter, you need to additionally contact your policyholder.

The situation with employers

It is often not profitable for an employer to employ an employee at a higher rate, since contributions to the state Pension Fund increase. In this situation, savings are better, since everything depends on the contributions of the citizen himself. The employer does not incur additional costs for contributions.

Comparison and benefits

The savings system differs favorably from the insurance system in that it makes it possible to manage money, as well as entrust funds to a selected fund that invests them, thereby creating the opportunity to receive additional income. For this purpose, the trusted agency forms an investment portfolio.

For other options, the above options are not provided. But the downside of savings is that investing may not bring income.

However, if you entrust money not to private licensed funds, but to state ones, a loss is unlikely, since most of them work with large strategic state-owned enterprises. The income will be slightly less, but the risks will also decrease.

In any case, if the investment does not generate income, the principal amount is guaranteed to remain untouched.

Accrual conditions

The conditions for calculating pension payments depend on the length of service, type of activity, and state of health of the person.

According to the law, the following types of pensions are distinguished:

- by old age;

- on disability;

- for the loss of a breadwinner.

These types are provided for in all forms of pension contributions.

A labor pension may consist of a funded and insurance component.

Labor

An old-age labor pension is assigned when a person reaches a certain age (55/60 years of age for women and men) and if he has at least 5 years of insurance experience.

A labor pension can be assigned for old age, disability and loss of a breadwinner.

This provision is regulated by the Law “On Labor Pensions in the Russian Federation”, Chapter I “General Provisions”, Art. 3.

Category of persons entitled to receive an insurance pension:

- Employees carrying out activities under an employment contract.

- Self-sufficient individuals (individual entrepreneurs, notaries, etc.).

- Employees who make their own contributions.

- Working abroad and paying contributions to the Pension Fund.

- Individuals who carry out work activities on the territory of Russia and are not its citizens, but have a pension account and contributions.

The following categories of citizens can receive early payments:

- Those with special experience, i.e. working under unfavorable working conditions.

- Having a certain total work experience (length of service, etc.).

These categories include citizens working on list 1 and list 2.

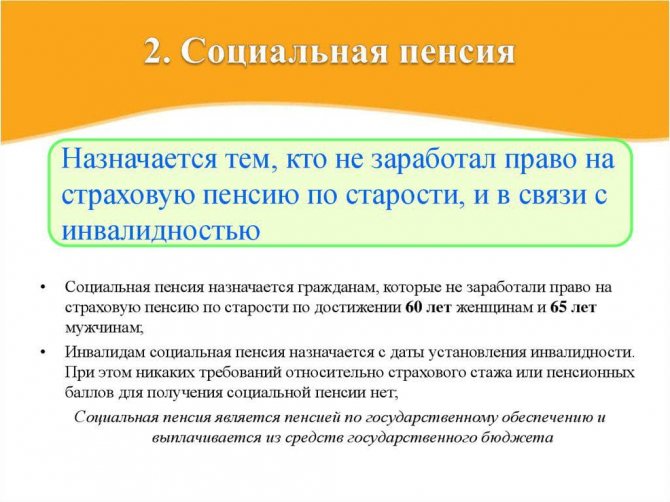

Social

There is also a social old age pension. Conditions for obtaining include permanent residence in the territory of the Russian Federation and belonging to the category of “disabled citizens”. Also, a social pension is issued to persons living in the Far North.

State

A state old-age pension is also awarded if a person is a participant in man-made and radiation disasters. State seniority is assigned to military personnel, government representatives, cosmonauts, and test pilots.

Social unemployment pension is paid if a person, due to reasons, does not have work (insurance) experience, and did not have any other benefits. In this case, he is paid a living wage.

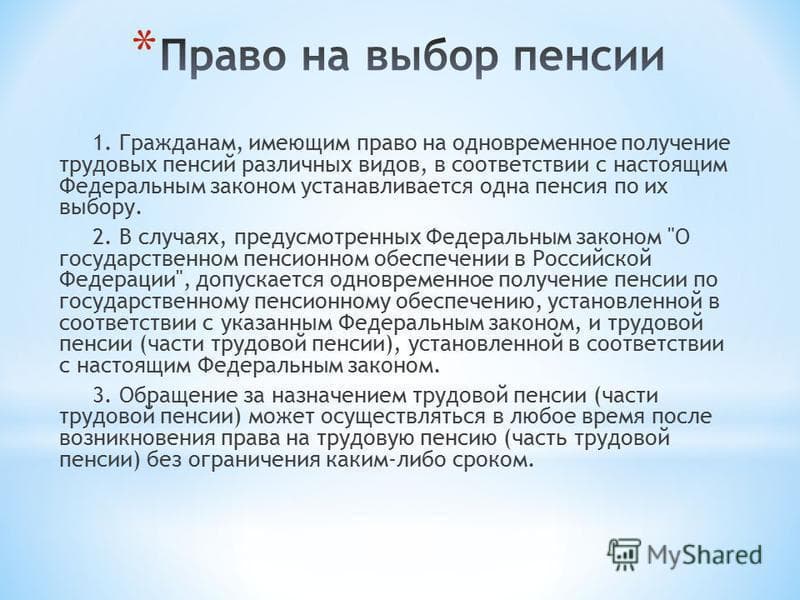

The right to choose pension provision

According to Russian legislation, today there are several types of pensions; they are assigned and paid to citizens who, depending on their life situation, cannot continue to work.

It is worth noting that citizens of the Russian Federation who deserve a reward for their services can also apply for a pension.

Please note that pension payments can be assigned even if a citizen of the Russian Federation has no work experience at all.

Some categories may be assigned 2 types of pensions at once, for example, disabled people.

Only a certain category of citizens can apply for and receive two pension benefits at once; its list is strictly regulated by law.

It is worth noting that since 2020, after the approval of the pension reform, citizens of the Russian Federation have the right to choose what type of pension they should form - only insurance or together with funded pensions.

Do you want to know what documents are required to receive property tax benefits for pensioners? To do this, you need to follow the link and read the article. You can read about how to apply for a pension for military families in the event of the loss of a breadwinner by following the link.

Right to choose a pension

According to Article 4 of the Law “On Labor Pensions”, a citizen of the Russian Federation can apply for a state pension in accordance with the Federal Law “On State Pensions in the Russian Federation” and a labor pension. This is allowed in the following cases:

- the size of the social benefit is small, it barely exceeds the minimum subsistence level, it is established by the state, while the size of the insurance pension depends on the person’s earnings and his length of service;

- social benefits are financed by the state, and the insurance pension is paid from the Pension Fund.

If these conditions are not met, then the person is obliged to choose the type of pension provision in accordance with the above-mentioned article of the law.

Some persons who have a special status may receive, in addition to old-age insurance payments, a long-service pension; these categories of citizens include:

- military personnel, with the exception of those who served as ordinary soldiers or sailors;

- test pilots;

- federal government employees;

- astronauts.

Regarding federal civil servants, it is necessary that they have at least 25 years of work experience and retire from this service, and if before retirement age they worked in the state civil service, then this period must be at least 7 years.

The long-service pension is paid together with disability or old-age insurance, which is assigned in accordance with the Federal Law “On Insurance Pensions”.

Some citizens may qualify for two pensions: social and insurance, both of these pensions are due:

- parents and widows (provided that they have not remarried) of military personnel who died during their service;

- participants of the Great Patriotic War;

- family members of deceased cosmonauts;

- those who received the distinction “Resident of besieged Leningrad”.

Pension Law of RussiaVictor Arakcheev, 2003

Introduction

Russia is a country where almost every fourth resident is a pensioner. For this reason alone, issues related to improving pension provision should rightfully be considered among the most significant national tasks, without the solution of which a state, whose Constitution stipulates that it is a social state, cannot be recognized as such. The problem of pension provision in our country is of a national nature also because the overwhelming majority of the current generation of pensioners, unlike modern youth and middle-aged people, worked exclusively for the state and its interests and lost earnings as the only source of livelihood for objective reasons: due to age, health status, loss of ability to perform certain types of professional work.

Therefore, the national task of providing pensions to citizens is at the same time the responsibility of the state, the implementation of which is not only moral, but also legal in nature. This obligation is also legal due to the fact that working citizens make deductions of insurance contributions for their future pension provision, and therefore the funds accumulated in the Pension Fund are nothing more than a debt obligation of the state to the insured persons.

The most obvious indicator of the quality of the state’s performance of this task-responsibility is the level of pension provision (pension amounts), which, as is known, for the majority of pensioners does not even rise to the level of the subsistence level and which, for some reason, is calculated at a low level compared to other age categories citizens indicators. In general, the financial situation of pensioners in our country can rightfully be characterized as extremely unsatisfactory, and it has been so for a long time. A pension for a person in Russia is given with great difficulty, and he is able to live on it with even greater difficulty. In this regard, it would be appropriate to give an assessment of pension provision in the USSR during the period of “developed socialism” given by G. R. Klimov based on a comparison with the social security of post-war defeated Germany, which paid huge sums to the victorious countries in the form of reparations and indemnities. “Later,” he writes, “when we became more closely acquainted with conditions in Germany, we became convinced that social security in Germany in the form of pensions or annuities, no matter how small it may seem, still ensures that people end their lives in decent human conditions. Old-age pensions in the USSR are an absolutely ephemeral concept. A person can only live by working to death or receiving help from his children. How can children help when they themselves have nothing!.. With pensions for the disabled, the story is the same as with old-age pensions. And if you don’t die, you won’t live...”[1] Let us add to this that the situation is no better with the size of pensions for members of a family that has lost a breadwinner, with the pension provision of a number of categories of employees artificially transferred by the state to the category of “hired” workers in the field of education and health care, which also reduced the level of guarantees of the rights of the corresponding categories of citizens for a decent pension. It should be added to what has been said that it began in the mid-80s of the 20th century. The restructuring of the socio-economic and political system, the state structure, the transition to a market economy, the scholastic privatization of the most important state-owned assets, which employed a significant part of the country's working population, further aggravated the situation of pensioners in our country. It can be stated with confidence that as a result of these transformations, the financial situation of only one category of pensioners has improved - former government employees at various levels, military personnel and persons equated to them under pension conditions.

However, the relatively successful pension provision of employees against the general background of the extremely low level of pensions for the vast majority of the country’s population does not, in principle, change the qualitative assessment of the pension system of modern Russia as a whole, which, of course, leads to the need to change it. And these changes were initially set out in three program documents of the Government of the Russian Federation, and then found their legal and regulatory support in the block of pension laws. With the adoption of new pension laws in Russia, a reform of its pension system has begun, the essence of which boils down to the transition from a distribution to a funded system, and the goal is to significantly increase the funds paid by employees and employers in the form of insurance contributions to the Pension Fund of the Russian Federation and recorded in their personal names. personal accounts.

As follows from the government’s program documents and the content of current pension laws, positive results of the reform should be obtained in the relatively distant future, i.e. only in the future, and at the moment the state only guarantees the preservation (through the conversion mechanism) of previously acquired rights, in connection However, the financial situation of the current generation of pensioners remains the same, moreover, it is gradually deteriorating due to the fact that the pension indexation mechanism laid down in the Law on Labor Pensions[2] is not able to neutralize the existing inflation rates. However, this generation of pensioners needs the present, otherwise it can hardly count on the future, especially decades distant. Indicative in this regard is the indexation of pensions by 6% (i.e. 30 rubles per month), carried out in March 2003, which was perceived by the majority of pensioners as insulting due to the fact that prices for utilities, including the cost of heating , increased by 30–50%. But if the indexation mechanism laid down in the Law (clause 6 of Article 17) does not neutralize the consequences of inflation in the present, then there is no guarantee of its effectiveness in the future.

Therefore, it can be stated that the ongoing reform of the pension system has not given the expected result in the present, i.e., it has not improved the financial situation of pensioners, but to some extent has worsened it compared to the previously effective legislation. Thus, according to the Law of November 20, 1990 “On State Pensions in the Russian Federation”[3], the legal significance for the assignment of pensions for age and disability, for long service (under certain additional conditions) was the total length of service, which included not only periods of work, but also other periods of socially significant behavior (socially useful activities), in addition, this length of service could be calculated in a preferential (multiple) manner. Currently, for the establishment of pensions, the insurance period is of legal significance, which includes, with minor exceptions (Article 11 of the Law on Labor Pensions), mainly periods of work during which insurance contributions were paid, and these periods are not subject to multiple (preferential) calculation. As a result, many people currently working in extreme conditions will be deprived of the opportunity to receive an early state pension, and the proposed introduction of the institution of professional pensions in the near future will not provide the level of state guarantees that were enshrined in the expired legislation.

Even from these given particular examples it follows that the authors of the pension reform are either far from sincere in their good wishes, or are not sufficiently “armed” with knowledge of the modern theory of pension law, do not have proper knowledge of its history, and for this reason were not able to predict the proper development of the relevant legal relations. There is enough evidence for the latter, and it is clearly visible even with a general review of the latest legislation. Thus, none of the regulations contains articles indicating the goals and objectives of pension provision, the principles on which it is based, or an article (with the exception of the Law on Compulsory Pension Insurance[4]) that would set out the fundamental rights in a concentrated form and the responsibilities of the subjects of direct pension legal relations, the basis for the responsibility of the state and the Pension Fund of the Russian Federation; The procedure for calculating pensions appears to be overly complicated and inaccessible to the understanding of ordinary pensioners, the structure of the relevant laws is not optimal, a socially unfair class approach to the conditions and level of pension provision for employees and hired workers is actually consolidated, the powers of the subjects of the Federation and municipalities in matters of pension provision are practically unlimited , which already leads to a clear disproportion in the size of pensions of federal civil servants and employees of lower rank. The new pension laws do not even have such a starting category as the basis for pension provision, as a result of which the impression is created that citizens of the Russian Federation do not have a basis, i.e., the right to a pension, because this right is given to them without reason, that the state is not burdened with the corresponding right duty.

The author of this work has made an attempt to analyze the state of the current pension legislation, including on the basis of its comparison with expired regulatory and legal sources, to evaluate innovations, makes proposals for eliminating certain gaps and conflicts, and therefore expresses the hope that this study can provide assistance and be useful for students, graduate students, researchers interested in problems of social security law, practitioners, as well as representatives of rule-making bodies.

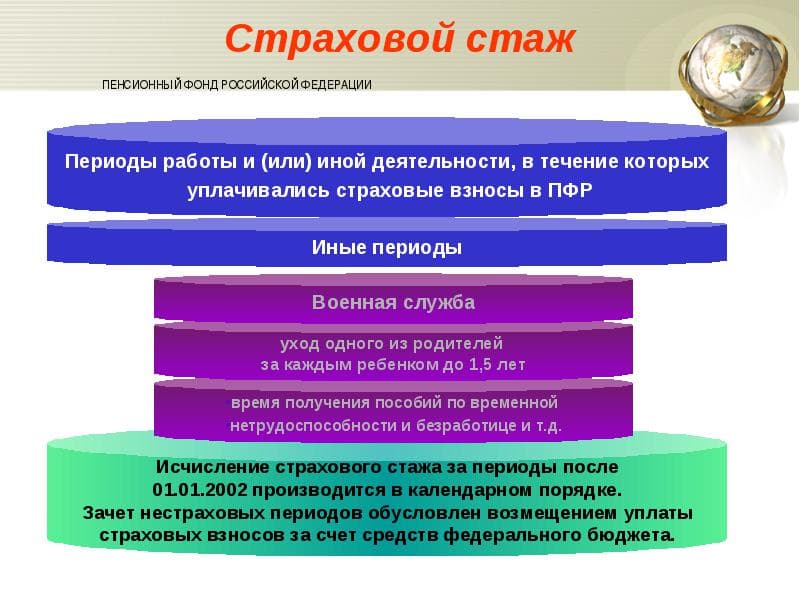

Insurance experience

The insurance period includes the period when a working person participates in state compulsory pension insurance, for which certain fees are paid monthly, the amount of which should not be less than the minimum insurance contributions. Confirmation that a person participates in such insurance is a document that can be obtained from the Pension Fund.

What does it include

The insurance period includes only the months for which insurance premiums were paid. When assigning a pension, only the citizen’s legal income is taken into account. And his work experience is confirmed by a documented work book, so it is worth carefully checking all the entries in it when moving from one job to another.

The rules for calculating work experience are described here.

It is worth considering one more nuance: if the contribution amount for one month was below the established minimum, then it is not taken into account in the length of service.

The length of service for calculating a pension includes time:

- work under an employment contract, in which case all state contributions must be collected;

- being on sick leave;

- voluntarily paid labor contributions;

- carried out during maternity age, caring for a baby under 3 years of age or a child under 6 years of age, if there are medical indicators for this.

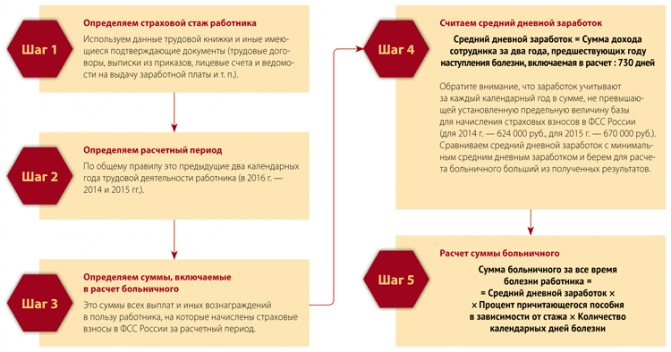

Calculation order

The insurance period greatly influences the calculation of the final pension. The fact is that pension payments grow annually by a certain percentage of earnings. There is not only a minimum size, but also a maximum. All citizens who have joined the compulsory pension system are considered insured by the country's Pension Fund.

To find out the amount of the insurance pension (SP), you can use the following formula:

SP = FV+IPK x SPK,

in it:

- FV - the size of the fixed payment;

- SPK - the cost of the personal coefficient;

- IPK - number of pension points.

The latter indicator is calculated for an individual year of work; it is influenced by the amount of insurance payments, as well as what type of pension a person has chosen for himself. Its maximum value is 10, and when calculating a funded pension it is now 6.25. There are some nuances when calculating it; the IPC can be charged in some cases, although citizens do not pay contributions; such exceptions include:

- care for young children and disabled children;

- Military service;

- looking after disabled people of group I.

To calculate this coefficient there is a special formula:

IPC = SV / SMV x 10

designation of the components of the formula:

- SMV – the amount of contributions from the maximum contributory part of the salary;

- SV - those contributions that were transferred to the pension.

When calculating the disability insurance pension, a slightly different approach is used; its minimum amount is set one and a half times higher than the minimum social payment in a certain region. The funded part of such benefits depends on deductions and length of service; it is calculated in the same way as for other segments of the population.

General information

Pension rights arise for a citizen from the moment of sufficient accumulation of pension points (for 2020, their minimum number is 11.4 points) and insurance experience (in 2020 - at least 8 years of experience). Knowing their size, the future pensioner will be able to calculate the exact amount of the expected pension, as well as obtain information about how many years are left to work to receive it.

You can find out about your rights yourself through:

- personal account on the official website of the Pension Fund;

- Pension Fund client service;

- State Services portal;

- bank.

Example. Not knowing the exact number of pension points, citizen Yu. contacted the Pension Fund client service. After 8 days, he received the requested information - for 17 years of experience, Yu earned 34 points and can now apply for a pension

In addition to this information, through these services you can find out:

- the number of insurance premiums and their amount;

- periods and places of work;

- personal account status.

Regulation of accrual, recalculation and indexation

New laws on pensions (Chapter 5, Articles 18-26 of the Law “On Labor Pensions”) have changed the previously recognized indicators. Now the minimum length of service for receiving an insurance pension will increase by a year, after each year, and the number of points will increase to 2.4 for the same period. When calculating a pension, you need to calculate all indicators at the time of its establishment.

Accrual

Insurance payments are calculated according to the above formula, but there are groups of people who receive it with an increased fixed surcharge:

- people over 80;

- disabled people of group I;

- citizens working or living in the North.

If you do not immediately apply for old-age benefits, their amount will increase and after five years it can increase by 36%.

The social pension depends on the cost of living, but it can change due to indexing. In 2020, the indexation coefficient is 1.5, and in 2020 the government plans to make it 1.2%.

If, as a result of calculations, the social payment turns out to be lower than the minimum, then the pensioner is charged an additional payment up to the established minimum.

If a pensioner supports dependents, then he is given an increase: for one person - 32%, for two - 64%, but for three or more - 100%.

When calculating a funded pension, income is divided into 240 months, and if you apply for it later, you will need to divide it into fewer months and the payments will be larger.

Recalculation

The state provides an increasing coefficient; it applies to working pensioners who should already be receiving an old-age pension, but are postponing receiving it; for a certain period of deferment, additional points and funds are calculated.

Also read about what valorization is and what kind of pension pensioners who completed their main service under the USSR can count on.

Indexing

They relate to the pension coefficient; every year its cash equivalent grows as the cost of living increases. Indexation of pensions is carried out only for non-working pensioners. From February 1, 2020, this figure is 4%.

What pension is due if there is no work experience?

Material support for people who work for private companies or entrepreneurs, and who do not have a record of this in their work books, is vital. The state provides for the payment of a minimum amount to citizens who do not have a sufficient number of years of work experience. The amount of such social benefits is minimal. Before the last indexation in April 2020, its amount was about 3.5 thousand rubles, and after indexation it increased to 8.6 thousand rubles .

Video review

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- 8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

By old age