The purpose and objectives of the Pension Fund of the Russian Federation

The pension system is the basis of the social policy of any state, providing basic social guarantees for the stable development of society. The pension system is one of the components of the social protection system, where the most important role is played by the Pension Fund , whose main task is to ensure a decent standard of living for the population. Pension funds are the largest of those whose funds are aimed at achieving social goals. In developed countries, they reach up to 70% of all funds allocated for social purposes, and the Russian Pension Fund accounts for almost 75% of the funds from extra-budgetary social funds. Currently, in a mixed economy, the Pension Fund is designed to ensure the maximum possible realization of individual rights to a dignified old age.

The need to expand the state's sources of financing for socio-economic needs has led to the emergence of extra-budgetary funds, to which revenue sources are assigned and the funds of which are used for strictly predetermined purposes. One of these funds was the Pension Fund of the Russian Federation, the main goal of which, according to V.A. Kriulina, is to ensure the payment of monthly benefits and pensions to people who cannot provide their living due to certain circumstances. The Pension Fund of the Russian Federation is a fund of funds formed outside the federal budget.

The Pension Fund of the Russian Federation is a state social extra-budgetary fund, it and its monetary resources are in the state ownership of the Russian Federation, while these funds are not included in other funds and budgets, cannot be used for other purposes and cannot be withdrawn from him.

The main goal of the Russian Pension Fund is to ensure the level of life benefits earned by a person through the accumulation and redistribution of funds, therefore this fund has an undoubted impact on the country’s economy.

The pension fund is a state non-budgetary organization whose main purpose is to manage the funds that make up the budget of the pension system. In addition to the main goal, the creation of the Pension Fund was necessary to perform the following tasks :

— ensuring, together with the tax authorities, targeted collection and accumulation of insurance premiums;

— financing of expenses;

— capitalization of own funds, attraction of additional sources of financing and investors;

— organizing and maintaining individual (personalized) records of insured persons in the compulsory pension insurance system;

— work to collect pension funds from citizens and employers in order to ensure disability payments as a result of injuries at work;

— jointly with the tax authorities, monitoring the completeness of incoming insurance contributions from employers and the correctness of their spending, etc.

Read also: Development of pension provision in Russia

NPFs received 60 billion rubles at the end of the year. rewards

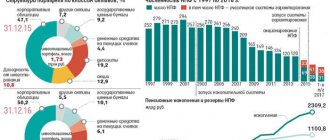

At the end of last year, the remuneration of non-state pension funds (NPFs) for managing citizens’ pension savings reached 60 billion rubles, doubling the 2020 figure. At the same time, the funds distributed a little more than 200 billion rubles to client accounts. The funds' remuneration for mandatory investment insurance is one of the highest in the trust management market, which does not correspond to the status of a mandatory and conservative investment product, experts point out.

At the end of 2020, for the management of pension savings, the variable part of the remuneration (success fee) of the NPF amounted to 31.3 billion rubles, the constant part of the remuneration (management fee) - 28.3 billion rubles. This is evidenced by data from the Bank of Russia. In 2020, the total income of NPFs for managing funds within the framework of compulsory pension insurance (OPI) was almost two times less: success fee - 12.6 billion rubles, and management fee - 20.5 billion rubles. (see “Kommersant” dated May 17, 2020).

On March 18, 2020, new rules for collecting NPF fees came into effect. Previously, the funds received only 15% of the earned investment income on pension savings. Now they have received the right to a management fee, which is up to 0.75% of the average annual net asset value (NAV) according to OPS. From these funds, NPFs, in particular, pay for the services of management companies and special depositories. The management fee also includes contributions to the reserve for compulsory insurance and the Deposit Insurance Agency (0.149% of NAV).

In 2020, it was possible to increase remuneration, primarily the success fee, due to the fact that all non-state pension funds showed profitability that was ahead of inflation, the Central Bank notes. The size of the management fee, according to the regulator’s representative, increased against the backdrop of an increase in NAV (the volume of pension savings for the year increased by 263 billion rubles, to 2.86 trillion rubles), “and also due to differences in the basis for calculation: in 2019 The remuneration calculation was carried out for the full 12 months, while in 2020 it was calculated for the period from March to December.” At the same time, 59.6 billion rubles taken by the funds in the form of remuneration. were extremely close to the maximum allowed for non-state pension funds (see “Kommersant” on February 28). According to Kommersant’s calculations, the NPF’s profitability from investment to payment of remuneration in 2020 was about 10.5% per annum. According to NPF data, at the end of last year the funds distributed a total of 205.8 billion rubles to the accounts of insured persons. That is, their weighted average profitability accrued to customer accounts amounted to 8.2% per annum (see Kommersant on April 16). As a result, for the management of pension funds entrusted to them by citizens, the funds withdrew about 2.3 percentage points of the received investment income from clients.

Sergei Shvetsov, First Deputy Chairman of the Central Bank, January 31, 2020

The planned return of 5% (for investments in OFZ. - “Kommersant”) is just chocolate for a pension fund that wants to get results for clients without much effort

The main external expenses of NPFs from the remuneration they receive are on the services of management companies and special depositaries. According to Kommersant’s assessment, based on the funds’ reports, the total costs of trust management at the end of last year slightly exceeded 10 billion rubles. Moreover, more than 80-90% of the funds received, according to the funds themselves and independent analysts, came from management companies associated with non-state pension funds (see Kommersant on April 30). The services of special depots cost less than 2 billion rubles. The remaining general and administrative expenses of non-state pension funds involved in compulsory public insurance were also slightly above 10 billion rubles.

“Within the trust management market, the NPF’s remuneration for OPS is one of the largest, comparable to mutual funds, which are considered the most expensive instrument for clients,” says Managing Director of Expert RA Pavel Mitrofanov. According to InvestFunds, the average management fee for most bond funds is 1.7% of NAV, while for mixed investment funds it is 3.6%. At the same time, according to him, a pension product, especially not a voluntary, but a mandatory one, performs a social function, which means that its remuneration should be “much more modest.” The expert emphasizes that the funds themselves are unlikely to impose restrictions on the remuneration charged, continuing to use to the maximum the limits that the regulator has set for them.

Ilya Usov

Guaranteed contributions

In addition to the management fee in the amount of 0.75% of the net asset value (NAV), which goes to the fund’s capital, mandatory contributions are made from pension savings to the reserve for mandatory pension insurance (ROPS).

Since last year, they have amounted to 0.125% of the NAV of pension savings, excluding the funds of the reserve itself. In 2020, NPFs invested RUB 4.6 billion in ROPS. As a result, due to investment income, as well as the loss of pension savings by citizens as a result of the early change of insurers, and the failure of legal successors of citizens to claim the money of deceased insured persons, these NPF reserves at the beginning of the second quarter exceeded 87 billion rubles. (See “Kommersant” dated May 8). In addition, NPFs make contributions to the pension savings guarantee fund of the Deposit Insurance Agency. Until 2023, the rate of such contributions is set at 0.025% of the NAV of pension savings, excluding ROPS. At the end of last year, non-state pension funds paid 0.6 billion rubles to this fund. In the amount of 28.3 billion rubles. permanent part of remuneration RUB 5.2 billion. made contributions to the guarantee system. Ilya Usov

Levels of the Pension Fund of the Russian Federation

The Russian Pension Fund carries out its executive activities through regional and local branches of the pension fund, thus the Russian Pension Fund is a multi-level system with centralized management. The pension system in Russia, from the point of view of executive management bodies, includes four main levels :

- federal level , at which the board of the Russian Pension Fund, the executive directorate, as well as the management of the structural divisions of the fund are located;

— federal districts of the Russian Federation, at this level there are structural divisions of the Russian Pension Fund for federal districts;

— the level of the constituent entities of the Russian Federation, at which the territorial governing bodies of the Russian Pension Fund are located by region;

— local and municipal level of government, at which the governing bodies of the Russian Pension Fund in districts and cities are located.

Real numbers and salary calculations

Last year, the average salary of pension fund employees increased by 15%. In other words, the income of workers in this area has become significantly higher than the average throughout the country. But in real life, the salary does not exceed 27,000 rubles.

Today, the highest paid position in the entire Pension Fund is the head of the customer service department. His salary is 28,300 rubles. A salary of 25,000 is provided for such positions as deputy head of the department, specialist - expert of the economic department, lawyer, chief specialist - expert and head of the department.

There is a small difference between their salaries, which does not exceed 200 - 300 rubles. A leading specialist - an expert, an inspector and a programmer - receives up to 16,000 rubles. A salary of 19,000 rubles is provided for a senior specialist and an expert specialist.

A specialist and a leading specialist receive the minimum wage. At this time it is only 14,000 rubles. But the system does not intend to stop at such income. The Pension Fund of the Russian Federation has immediate plans to increase benefits for its employees.

The amount of allocated funds should be about 83 billion rubles. To calculate the average income of an employee in this field of activity, you need to add the amount of income for the previous and previous years, then divide the total by 731 days (calendar days for both years).

Structure of the Pension Fund of the Russian Federation

The structure of the Pension Fund (Figure 3) includes 84 Pension Fund Branches in the constituent entities of the Russian Federation, including the OPFR in Baikonur (Kazakhstan), as well as 2,460 client services in the territorial bodies of the Pension Fund. The Pension Fund system employs more than 100,000 specialists.

Structure of the Pension Fund of the Russian Federation

The vertical organizational structure of the Foundation consists of three levels, and is subordinate to the central apparatus. The central apparatus (first level) includes:

— Board, represented by the Chairman and his deputies;

— an information center dealing with personalized accounting and administration of deductions;

- audit committee.

Read also: Structure of the pension system of the Russian Federation

Territorial divisions are managed by the Executive Directorate. The structural units of the Pension Fund are:

— second level: eight district departments, according to the number of federal districts;

— third level: 84 branches, according to the number of subjects of the Russian Federation, plus a branch in Baikonur;

— 2460 client units included in the territorial branches.

Functions of the Pension Fund of the Russian Federation

The socially significant functions of the Pension Fund of the Russian Federation include:

— assignment and payment of pensions;

— keeping records of funds received into accounts;

— assignment and implementation of social payments to certain categories of citizens: disabled people, Heroes of the Soviet Union, Heroes of the Russian Federation, veterans, etc.

— interaction with policyholders and employers;

— collection of arrears on pension contributions;

— registration and issuance of maternal certificates;

— payment of maternity capital funds;

— management of money accumulated in the system with the help of a state management company;

— establishment of federal social supplements to bring total income to the subsistence level;

— implementation of state programs for joint financing of pensions for the population.

For the full development of the pension industry, the state needs not only to concentrate on what is happening within its territories, but also to have an idea of similar activities in other countries. It is for this purpose that the Pension Fund, within its competence, partners with numerous foreign organizations.

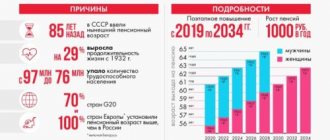

Discussion about raising the retirement age

In the spring of 2020, plans were discussed to reduce the fund’s budget deficit by raising the retirement age, canceling payments to working pensioners, and other methods. On January 29, 2020, the head of the Ministry of Economic Development, Alexey Ulyukaev, announced that he considers it possible, as part of the reform of the pension system, to begin a gradual increase in the retirement age. On February 13, at a meeting with economic experts, Russian President Vladimir Putin proposed studying and considering this issue. On April 14, Finance Minister Anton Siluanov said that he was in favor of urgently raising the retirement age. At the same time, during the “direct line” on April 16, Vladimir Putin said that, in his opinion, Russia is currently not ready for a sharp increase in the retirement age, but this is possible in the future “with an open and active dialogue with society,” and should not concern people of pre-retirement age.

Two points are touching: the first concerns the phrase: “with an open and active dialogue with society.” Do you believe that this dialogue will take place at all? Usually in Russia, no one is interested in the opinion of the population, all decisions are simply made by the State Duma, and deputies, in principle, do not care about the population, since they live by their own laws, and they set their own pensions long ago. And the size of this pension is many times higher than that of the ordinary population. Or do any of you really believe that one day there will be a call from the Kremlin like: “Hello, is this Ivan Ivanovich Ivanov? Here in the government we are deciding the issue of increasing the retirement age, and your opinion on this issue is very important to us. We have already called 144.3 million people, only you remain. Are you against raising the retirement age?”

And the second point is that the very issue of raising the retirement age from the point of view of discussion with society is rhetorical. For some reason it seems to me that most of the population will be against raising the retirement age, doesn’t it?