The salaries of pension fund workers in 2020 will increase by 15% - this became obvious back in 2020, when the amount of the state budget was announced. It must be taken into account that a pledged amount of such a value implies a significant excess of the average wages in Russia by 2 times.

Almost every Russian is aware of the fact of the budget deficit, which is reported annually by press services from bureaucratic offices.

To reduce the deficit, budget funds are being optimized, which affects every second citizen. Here's what the optimization is:

- the fact that some part of Russian pensioners do not have their pensions indexed;

- in the “freezing” of salaries and the temporary impossibility of increasing them;

- in staff reductions, which means layoffs.

In the process of the notorious optimization, budgetary funds are distributed unevenly: government funding often passes by those who needed it most. There is no need to talk about fairness in resolving such issues: there will always be those dissatisfied with the decision made.

Return to contents

Average salary in Russia

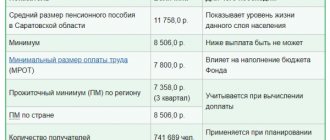

Table: wages in the Pension Fund of the Russian Federation in various regions in 2019-2020.

| Job title | Average salary (expressed in Russian rubles) |

| Omsk region | |

| Social work specialist | 16000 |

| HR Specialist | 20000 |

| Specialist | 18000 |

| Kalachinsk | |

| Leading Lawyer | 25000 |

| Specialist | 18000 |

| Amur region | |

| Specialist | 23000 |

| Inspector | 19000 |

| Labor safety engineer | 25000 |

| Bryansk region | |

| Leading Specialist | 15000 |

| Programmer | 18000 |

| Vladimir region | |

| Archivist | 15000 |

| Specialist | 18000 |

| Voronezh region | |

| Specialist | 13000 |

| Labor safety engineer | 17000 |

| Accountant | 21000 |

| Irkutsk region | |

| HR Specialist | 20000 |

| System Administrator | 27000 |

| Kirov region | |

| Leading Specialist | 22000 |

| Specialist | 17000 |

| Kurgan region | |

| Chief Legal Consultant | 19000 |

| Specialist | 18000 |

| Leningrad region | |

| Leading Specialist | 20000 |

| Chief Specialist | 21000 |

| Group Head of the Division for Comprehensive Information Security | 22000 |

| Saint Petersburg | |

| Leading Specialist | 18000 |

| Chief Specialist | 22000 |

| Leading specialist expert | 35000 |

| Moscow | |

| Chief specialist-expert of the internal financial control organization department | 31000 |

| Leading specialist of the methodology department | 27000 |

| Chief specialist-expert of the department of functional design of information systems | 32000 |

| Chief Specialist-Expert of the Project Technical Support Department | 32000 |

| Leading specialist-expert of the HR department | 28000 |

| Chief specialist-expert of the production and technical department | 30000 |

| Chief Specialist | 28000 |

| Chief specialist-expert of the property relations department | 30000 |

| Chief specialist-expert of the social payments subsystem department | 30000 |

| Chief specialist-expert of the department for consideration of appeals | 32000 |

| Murmansk region | |

| Pension consultant | 18000 |

| Nizhny Novgorod Region | |

| Leading Specialist | 22000 |

| Specialist | 19000 |

| Chief Accountant | 23000 |

| Orenburg region | |

| Leading Specialist | 14000 |

| Chief Specialist | 18000 |

| Inspector | 15000 |

| Head of Department | 20000 |

| Lawyer | 18000 |

| Rostov region | |

| Leading Specialist | 20000 |

| Specialist | 17000 |

| Senior Specialist | 18000 |

| Ryazan Oblast | |

| Specialist | 20000 |

| Inspector | 16000 |

| Saratov region | |

| Specialist | 17000 |

| Tomsk region | |

| Chief Specialist | 24000 |

| Information Technology Specialist | 32000 |

| Chief Legal Consultant | 33000 |

| Yaroslavl region | |

| Leading Specialist | 20000 |

| Specialist | 18000 |

| Inspector | 16000 |

| Chelyabinsk region | |

| Leading Specialist | 20000 |

| Specialist | 19000 |

The salary of employees of the Pension Fund of the Russian Federation, according to them, does not exceed 27 thousand rubles per month on average.

This information differs from that announced by representatives of financial departments involved in planning the state budget. It is necessary to understand the following questions:

- what is the salary of Pension Fund employees;

- how much does it actually cost the state to maintain Pension Fund specialists (in numbers);

- how costs are rising.

Return to contents

Professional responsibilities and work characteristics

The responsibility of the pension fund is not only to pay insurance pensions and benefits, but also to maintain a unified database that allows obtaining information on social security at various budget levels.

The Resolution of the Board of the Pension Fund of the Russian Federation fixed the list of duties and positions of employees, including the composition of the apparatus, which includes:

- PF management;

- Apparatus under management;

- Executive Directorate;

- Audit committee;

- Territorial administration bodies;

- Departments and departments of the fund;

- Centers for accounting and information support.

Departments include departments:

- financial - economic;

- legal;

- social benefits department;

- Human Resources Department.

When selecting employees, the pension fund pays great attention to the work experience and personal qualities of the applicant; standards have been developed that are applicable both when certifying employees and when assessing applicants.

Job descriptions have been developed in accordance with the requirements. In addition to performing skills, such personality characteristics as resistance to stress, competent speech, the ability to clearly explain and negotiate, possession of the gift of persuasion and the ability to resolve conflict situations will be in demand.

An employee of the management team of the Russian Pension Fund receives a pension in the amount of 100,000 rubles Source: pfrf.ru

Working in a pension fund requires a clear understanding that the working day is not standardized. Acceptance of such nuances will have a positive impact on the attitude towards the employee and on what the career growth will be, the responsibility assigned and, accordingly, what the salary will be.

Four main professional standards of the Pension Fund have been adopted. The list of qualification and education requirements includes a description of the employee’s responsibilities, as well as skills, abilities and experience.

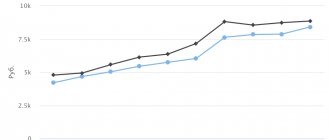

Increase in expenses for Pension Fund employees

The stated plans of the Pension Fund include increasing the costs of maintaining its specialists. In numbers it looks like this: from 78.7 billion rubles in 2020 to 83 billion in 2020. The increase in expenses for the Pension Fund apparatus looks strange, especially against the background that the state is acutely short of funds for indexation of pensions.

Journalists from well-known media calculated:

- If we assume that 12 thousand rubles is the average pension, then the salary increase for employees of the pension department will cost 358 (!) thousand pensions.

- The calculated amount could allow supporting more than 30 thousand pensioners. And this number does not take into account the fact that many receive a pension much less than the average.

- Full indexation of pensions by increasing funding for pension fund workers is impossible, but fairness to those in greater need would be more likely.

On our website you can find out about the amount of pensions in countries around the world and in European countries.

Trends in salary increases for PF employees look like this:

- The average salary increase should be closer to 5.5%.

- The real increase in income is much higher, since the Pension Fund apparatus is threatened with numerous cuts: about 10% of employees will be laid off.

- The cost of maintaining an ordinary PF employee should be about 57 thousand rubles (before staff reductions). In 2020, the expense was slightly lower - 54 thousand rubles monthly. Where does the difference go if ordinary specialists claim that their salary is 27 thousand rubles? Unanswered question.

- In the event of a one-time staff reduction, the maintenance of 1 PF specialist will reach almost 63 thousand rubles.

Return to contents

What else is included in the maintenance of employees of the Pension Fund

Such large expenses imply not only the salary (in total, it is about 40 billion rubles) that employees receive, but also the following points:

- Formation of insurance premiums that the Pension Fund pays for its subordinates to insurance funds. It follows from this that the state not only provides income to employees, but also their future pensions, which the Pension Fund itself will then pay to its employees of retirement age. The amount of these insurance contributions is 30% of the salary, which is about 8 thousand rubles (based on the average salary of 27 thousand rubles). Thus, the formation of pensions for Pension Fund employees additionally takes 11.5 billion rubles from the state.

- The remaining 30 billion, requested from the state budget by the department, disappears in an unknown direction, since the specific necessary expenses have not been presented. Perhaps it’s because of high bonuses or expensive business trips, which department heads do not disdain. An analysis by Life.ru journalists of travel statements of PF employees demonstrated that even middle-level management employees consider it normal to buy tickets costing 100-200 thousand rubles at the expense of the fund.

- Some more expenses of the Pension Fund in numbers:

- outreach activities - 185 million rubles;

- construction purchases, acquisition and rental of real estate - more than 14 billion rubles, in many cases (50%) the amounts were greatly exaggerated.

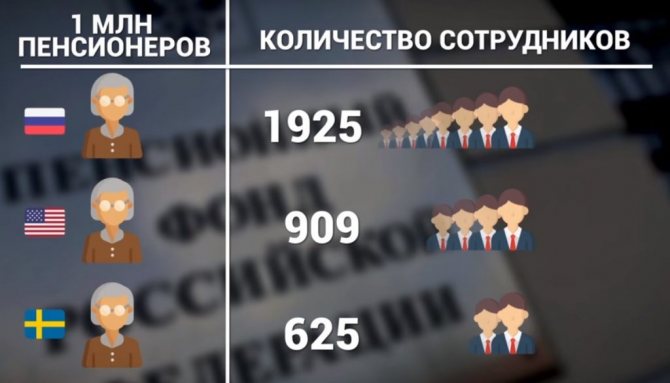

Number of Pension Fund employees per 1 million pensioners in Russia, USA and Sweden

Return to contents

Pension provision in the Pension Fund of the Russian Federation

It is difficult for an ordinary employee, upon reaching retirement age, to count on any large amounts of insurance pension, since calculations are based on the amount of contributions and the employee’s length of service.

Today, the pension assigned to an ordinary employee is minimal and amounts to no more than 8,726 rubles. The pension of management employees will vary from 100,000 rubles.

You can calculate the approximate amount of your future pension using a “pension calculator” located on Internet resources; you just need to enter your data.

You can calculate your pension on the official website of the Pension Fund using a calculator Source: Pixabay.com

For example: with a salary at the subsistence level of 12,130, the pension will be approximately 9,080 rubles, if there is 1 child and 30 years of work experience.

How are pension fund expenses growing?

It is important to note that in Russia the ban on increasing the salaries of officials has not yet been lifted and even extended. How does this fit in with the above? The question is rhetorical.

A few more interesting facts about the Pension Fund: the Pension Fund has the status of an extra-budgetary institution, and therefore its employees are not formally officials, which means that the moratorium on salary increases has nothing to do with their salaries.

Pay attention to the video: the salary level of Pension Fund officials.

The department must be self-sufficient and autonomous, and also support its employees at its own expense.

- The money that the Pension Fund generates independently, which is about 3.5 trillion rubles, is not even enough to pay the necessary pensions.

- Due to the fact that the Fund is not able to ensure its own self-sufficiency, 40% of all expenses of the pension department in the amount of 3.2 trillion are borne by the state. The mistake is in ineffective spending of the funds that he can generate on his own. And pensioners who are deprived of indexation pay for these mistakes.

- The wages of ordinary employees of the pension department are set and, accordingly, increased at the level of all federal structures to which the ban on salary increases applies. Therefore, the salaries of employees in the Pension Fund will remain the same as last year 2020, despite the fact that more than enough additional funds have been allocated. This is a paradox in Russian.

Return to contents

Where will businessmen submit their reports?

One of the advantages of the updated Tax Code is that the burden on entrepreneurs in terms of the number of inspectors will be reduced. They will not need to withstand regular audits by the Pension Fund, but will only need to report to the tax authorities.

On the one hand, resolving issues regarding contributions using the one-stop-shop principle at the Federal Tax Service is a positive thing. On the other hand, business representatives fear that the timing of inspections will now be significantly increased. Previously, representatives of the Pension Fund of Russia carried out a desk audit within up to ten days, while tax officials worked with documents for a month. This significantly complicated the work of Russian companies.

Deputies respond to the concerns of businessmen that the reduction of employees of the Pension Fund and the delegation of their responsibilities to the tax service will be carried out as unnoticed as possible for business. There will be more specialists at the Federal Tax Service, so an increase in data processing time is not expected. Additionally, over the next three years, new reporting forms (simpler) and programs for data processing will be introduced.

Businessmen should be wary of the introduction of more severe measures for late payment of fees. The Ministry of Justice has already prepared a package of amendments to the Criminal Code, which are developed similarly to the clauses on tax evasion.

Salary increase

Some senators and representatives of the Union of Pensioners of Russia believe that increasing the salaries of Pension Fund employees in 2020 would be completely justified, since the burden on the Fund’s employees is constantly growing: despite the fact that control of social contributions is no longer their prerogative, they continue to administer a lot of other payments (in addition to pensions).

An example of spending the budget of the Russian Pension Fund on its own needs

For example, voluntary contributions to insurance and funded pensions, social benefits, maternity capital. It would be fair if increased expenses for the Pension Fund also meant an increase in employee salaries - this is the opinion of many interviewed by Life.ru journalists.